Investors continued to contend with climbing interest rates in 2023, although the recession that many anticipated didn’t materialize. Amid this turbulence, some mutual fund families did very well.

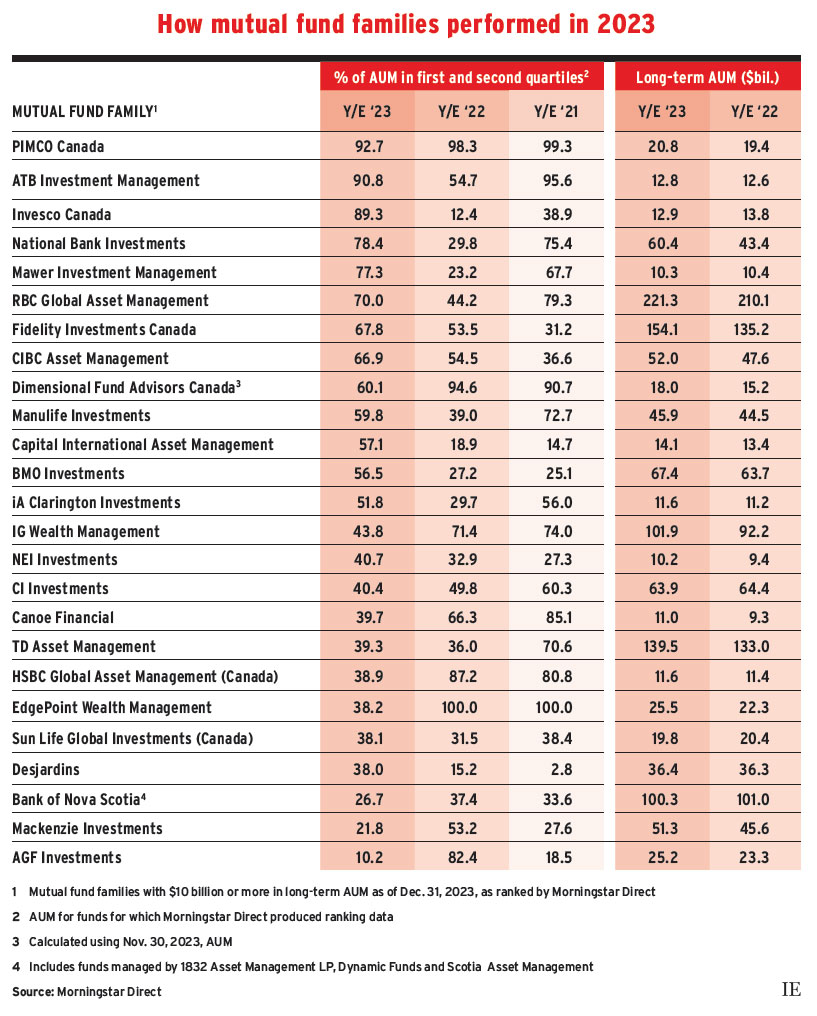

The best performer among the 25 Canadian mutual fund families with long-term assets under management (AUM) of $10 billion or more at the end of 2023 was PIMCO Canada Corp. with 92.7% of long-term AUM in funds ranked in the first or second quartile for the year ended Dec. 31, 2023, according to Chicago-based Morningstar Direct. (All firms based in Toronto unless otherwise noted.)

ATB Investment Management Inc. in Edmonton and Invesco Canada Ltd. weren’t far behind, with 90.8% and 89.3% of long-term AUM ranked in the first or second quartile, respectively. Montreal-based National Bank Investments Inc. and Calgary-based Mawer Investment Management Ltd. came next with percentages in the high 70s.

These results were achieved in different ways. PIMCO is a fixed-income specialist currently relying on U.S. mortgages and inflation-protected securities. ATB is a top-down asset allocator. Invesco had great success with stock picking, as did Mawer.

Meanwhile, National Bank offers a traditional variety of funds. It wasn’t the only bank with a broad lineup to do well: both RBC Global Asset Management Inc. and CIBC Asset Management Inc. had around 70% of long-term AUM in the top two quartiles.

Other fund families struggled. AGF Management Ltd. was barely above 10%. Mackenzie Financial Corp. and Bank of Nova Scotia (which owns Dynamic Funds and 1832 Asset Management LP, and offers its own fund family), were under 30%.

Here’s a look at some mutual fund families in more detail:

PIMCO Canada

Last year, PIMCO added agency mortgage-backed securities to its funds, which now account for a quarter of AUM. Murata cautions that availability may shrink if banks, which currently aren’t buying the securities, begin purchasing them.

Murata said PIMCO also is investing in inflation-protected securities because the firm forecasts inflation will be around 2.75% at the end of this year rather than the 2% anticipated by financial markets.

ATB Investment Management

The firm is primarily a top-down asset allocator and uses ETFs and other passive investments to help achieve its desired asset mix. Ian Filderman, who became president in November, said individual security selection also is important.

“Asset allocation was underweight fixed income earlier in 2023, which turned out to be very helpful,” Filderman said. Earlier in the year, ATB’s funds also were overweight equities in general. U.S. stocks were a major contributor, as the “Magnificent Seven” tech companies — Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., Nvidia Corp., Meta Platforms Inc. and Tesla Inc. — did very well. Later in the year, managers shifted to overweighting fixed income and slightly underweighting U.S. equities.

Invesco Canada Ltd

Individual stock selection primarily drove outperformance, with some of the best-performing names coming from technology, consumer discretionary and communication services, said Jason MacKay, head of wealth management intermediaries. “In a high interest-rate environment, we believe quality, cash-generating and growing businesses are best positioned to win,” he said.

In the fixed-income space, “we viewed the U.S. and Canada as fundamentally the strongest and most attractive investment-grade credit regions to be invested in 2023,” MacKay said. The fund family experienced bumps in March as U.S. regional banks collapsed, but he said Invesco’s funds managed that by adding “high-quality money-centre and regional banks that were fundamentally strong” with attractive valuations. He noted that banking was one of Invesco’s larger overweights.

Mawer Investment Management

This asset manager is known as a strong stock picker and has a long-term discipline aimed at eight- to 10-year returns. Occasional weak years are not a problem. “We look for wealth-creating companies with excellent management that we can buy at a discount,” said Christian Deckart, deputy chief investment officer.

Deckart, who will become chief investment officer in June, pointed to three stocks that did particularly well in 2023: Denmark-based Novo Nordisk A/S, up by 51%; Laval, Que.-based Alimentation Couche-Tard Inc., up by 29%; and U.S. travel firm Bookings Holdings Inc., which operates booking.com and was up by 74%.

Novo Nordisk got a boost from the popularity of diabetes drug Ozempic, while Alimentation Couche-Tard is the second-largest convenience-store firm in the world. Booking.com is the No. 1 online travel agent for hotels and short-term vacation rentals, with US$20 billion in revenue.

Fidelity Investments Canada ULC

Kelly Creelman, senior vice-president, products and marketing, said Fidelity’s fund managers “resisted the urge to be very defensive” in the face of rising interest rates and recession worries. Instead, the managers upgraded their portfolios with stocks in which they have “the highest convictions — and that really paid off.”

Stock picking is central to Fidelity’s approach. Fund manager Mark Schmehl has “incredible conviction” about the long-term trend of artificial intelligence, Creelman said, and increased exposure to Meta and Nvidia last year as those two members of the Magnificent Seven took off.

Picks in the private equity and pharmaceuticals spaces also paid off. Creelman said private equity can be an alternative for traditional banks and pointed to the strong returns for Onex Corp., which was up by 39%. U.S. pharmaceutical giant Eli Lilly and Co., maker of Ozempic competitor Mounjaro, was up by 59%.

AGF Management Ltd

David Stonehouse, senior vice-president and head of North American and specialty investments, said the fund family’s performance over three and five years “remained solid, slipping only a little” after a relatively weak 2023.

A major factor in the family’s weakness was the narrow equities market in the first half of 2023. AGF’s funds held some Magnificent Seven stocks, but not as many as their peers. Stonehouse noted that equities performance improved in the second half as the market broadened. Another factor pulling down performance was a “more defensive position in balanced solutions,” he said.

Nonetheless, some funds in the family did well, such as AGF’s Canadian funds — particularly Canadian dividend funds. Stonehouse attributed that to “sectoral positions and idiosyncratic investments.”

Click image for full-size chart

This article appears in the February issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.