When you have 193 ETFs to your name, you begin to think more about what you’re trying to accomplish with your 194th.

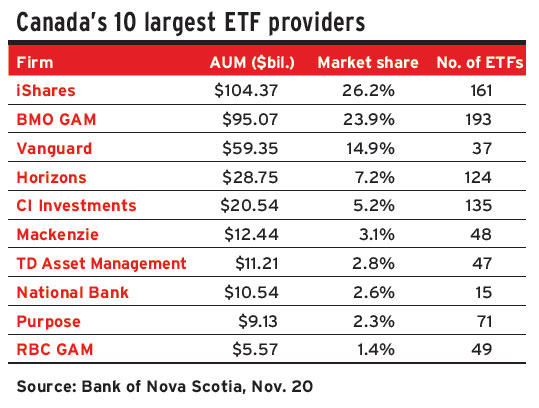

That’s the position in which BMO Global Asset Management finds itself. After launching its first ETFs in 2009, BMO GAM has gathered more than $95 billion in ETF assets under management (AUM), good for almost one-quarter of the Canadian market and a close second to BlackRock Inc.’s and RBC Global Asset Management Inc.’s iShares products.

But, as more than 1,300 products crowd the Canadian ETF space, BMO is leaning into its capital markets business as it looks for its next phase of growth. Sara Petrcich, formerly managing director and head of synthetic asset management, has been brought in to lead the effort.

“The industry as a whole is at a real inflection point,” Petrcich said. “Where does the growth come from? We are actually seeing it over the long haul coming from the structured solutions side, which is why we wanted to bring the two together.”

Petrcich was appointed head of the ETF and structured solutions team in August, replacing long-time head of ETFs Kevin Gopaul. As part of the change, the firm combined its ETF business with its synthetic asset management business, which Petrcich had been leading for a year. The move follows the 2022 appointment of Bill Bamber, another capital markets veteran with experience in derivatives and structured products, as BMO GAM’s chief executive.

Petrcich joined BMO Capital Markets in 2021 as global head of risk strategy and management after more than two decades working in derivatives and structured products with Bank of Nova Scotia and RBC Capital Markets.

She said the structured solutions team brings more tools to the ETF business.

“It’s a team of subject-matter experts in derivatives,” she said. “We’ve had capital markets backgrounds of varying capacities, and we built products in capital markets. And now we want to make them available in asset management.”

The first indication of what the firm is working on came in October, when BMO GAM released its buffer and accelerator ETFs. The funds use options contracts to try to define investor outcomes over set periods.

Petrcich expects these products will appeal to investors seeking downside protection — a feature of the buffer ETFs — a known monthly distribution and a target yield.

She cited the current inflationary environment in which asset managers are competing with GIC rates above 5%, as well as the growth of covered-call products over the past two years, as evidence of investors’ appetite for income.

“In my past life in capital markets as a structured-products trader, we actually created structured notes that are buffers and accelerators,” she said. “So, we’re just bringing this concept now into an exchange-traded fund.”

The next step could be a structured product for fixed income. With uncertainty around central bank policy, Petrcich said, investors are looking for tactical solutions.

She noted the Office of the Superintendent of Financial Institutions’ decision in October to tighten banks’ liquidity requirements for high-interest savings account ETFs. That change is likely to lower the rates ETF providers can offer on the immensely popular products, and further open the door to competing fixed-income products, she said.

BMO GAM has the luxury of patience in product development. Demand for its existing lineup of ETFs allows the firm to focus on quality for new releases, Petrcich said. She’s looking at product development with a 10-year horizon.

“Having a suite of different types of products that generate income is our long-term goal in terms of the structured solutions piece,” she said.

Petrcich studied mathematics and economics at the University of Ottawa, where she also played varsity volleyball for a year. Growing up in Ottawa, she remembers watching Wall Street Week with Louis Rukeyser on PBS with her father. She decided then: “That’s what I want to do.”

She added: “Having parents who came from Croatia, it was always drilled into us to be economically sound, [be] fiscally responsible, save your money, be financially independent.”

She got a summer internship with RBC while she was at university and was accepted into a rotation program upon graduation. After she landed on the derivatives trading desk when the bank was bringing structured products to market for the first time, Petrcich decided that’s where she wanted to remain.

“I love math and the problem-solving component of it,” she said. “We can be extremely creative, but we still have to use the facts and have a viable solution.”

Petrcich worked in over-the-counter derivatives for almost 23 years at RBC and then at Scotiabank before being seconded at the latter to the chief financial officer and treasurer, taking the concept of managing risk through derivatives to the bank’s broader balance sheet.

“Now I get to do it for clients in asset management, which is really what I love,” she said.

Petrcich is also BMO GAM’s executive sponsor for diversity, equity and inclusion. She said increasing women’s representation at the firm is important because her experience has shown that men and women tend to think differently.

“I think the asset management industry is a little bit behind the capital markets side that I came from,” she said, “so I’m hoping that I can bring it a few steps ahead with the help of all the other great women leaders out there.”

Click image for full-size chart

This article appears in the December issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.