Insurance Advisor Report: How we did it

Through a new web survey, insurance advisors across Canada shared their working experiences

Through a new web survey, insurance advisors across Canada shared their working experiences

Report casts doubt on regulator’s independence

Rising interest rates and reduced regulation may create options for U.S. banks that exploit niche markets and M&A strategies

It’s tougher to trade bonds these days. Liquidity has dried up, the result of reforms that began in the fall-out of the 2008-09 global financial…

Interest rates reflect many things, but, generally, in the bond world, they frame risks of inflation and default. With the perceived risk of higher rates…

Rising interest rates and a friendly regime in Washington could set the stage for healthy profits at many U.S. banks

The near-term prospects for a significant rise in inflation, which would push bond yields upward, are dim. But if inflation rises before real-return bonds (RRB)…

A building boom could fuel steel stocks. But producers may find ramping up capacity that may not be needed could be costly

A big market shock could trigger a rush for cash as happened in the crisis of 2008

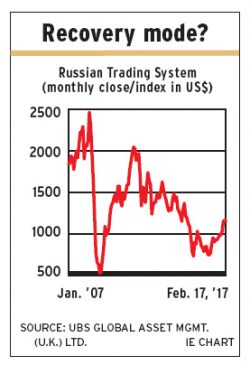

Russia has been battling low oil prices and political sanctions, but may be heading into more positive territory

The pharmaceutical industry is enjoying growth from new meds for aging populations, but regulations could present headwinds

The path is risky, but rising interest rates and more liquidity in bond markets could see bonds delivering more "normal" returns

While some stock indices are rising, Canadian corporate profits have been dropping in the past five years, with resources the hardest-hit sector

Synthetic stock positions can be a useful way to invest in U.S. banks without taking on all the risks of unfavourable exchange rates and Canadian…

Times have changed and investors now have to accept that market risk is critical when assessing specific asset classes

The Trump presidency is likely to mean rising bond yields as spending rises and taxes decline

Various strategies are available for building an investment portfolio that is sensitive to the environment

Bond investing strategies are changing as the U.S. and Canadian central banks head in opposite directions

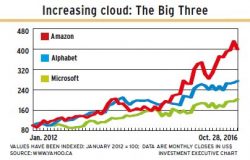

Three tech giants jockey for position in a sector that's characterized by rapid growth and rising revenue

How a bank's total assets or earnings have grown is good to know, but what counts more is each share's portion of earnings, as a…

An increase in interest rates would mark the end of the 34-year bond bull market and hit long government bonds especially hard

Recent reforms designed to contain corruption and limit government spending could set the stage for further gains this year

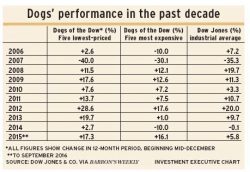

This decades-old strategy may seem counterintuitive, but it has outperformed the S&P 500 almost every year since 2008