As Russia’s economy emerges from a deep recession, the country should be fertile ground for exploring investment opportunities. However, investors must be cautious, given the country’s problems with corruption, government intervention, weak property rights and poor corporate governance.

Indeed, there are many Russian stocks that portfolio managers won’t even consider due to these types of risks. However, there are some companies with good prospects.

“We like Russia and are adding to our holdings,” says Christine Tan, chief investment officer at Excel Investment Counsel Inc. in Mississauga, Ont., and portfolio manager of Excel Emerging Markets Fund. However, she notes, the fund is not overweighted in Russia because of sanctions imposed by the U.S. and the European Union after Russia’s annexation of Crimea in 2014.

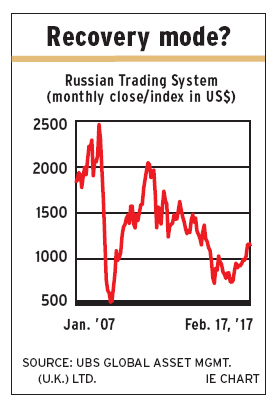

Charles Burbeck, managing director for global equities at UBS Global Asset Management (U.K.) Ltd. in London, also is “pretty” positive: “We’re likely to see some positive economic growth. Quite a few companies’ shares are quite cheap [but] investor sentiment is changing.” He notes that a lot of institutional investors are underweighted in Russia and, if that changes, share prices should rise.

Russia’s economy is expected to grow by 0.8% this year and by 1% in 2018, according to the Organisation for Economic Co-operation and Development. That follows declines in real gross domestic product (GDP) of 0.8% in 2016 and 3.7% in 2015.

The recession was caused by the plunge in oil prices and trade sanctions, both of which began in 2014. Further exacerbating the situation was a drop in the ruble, which resulted in high inflation and caused the Russian Central Bank (CBR) to push up interest rates substantially.

The economic recovery is coming from the rise in oil prices to around US$50 from US$30 in January 2016 and the accompanying rise in the ruble. Government revenue has risen due to higher revenue from taxation of oil companies; inflation has dropped as the price of imports declines in step with the recovering ruble and CBR cutting its key interest rate to 10%. (That rate peaked at 17% in late 2014.)

The trade sanctions remain, but there is some possibility that U.S. President Donald Trump might remove them, which would provide a further boost to Russia’s real GDP.

Still, Russia carries many risks, and that’s what tempers the enthusiasm of Richard Farrell, associate portfolio manager, on the London-based emerging markets equities team at RBC Global Asset Management Inc. and the team’s expert on Russia.

Farrell is positive about the short-term outlook, but less enthusiastic for the longer term because of Russia’s sensitivity to commodity prices and the lack of governance reforms. He notes that the country doesn’t have robust property rights or “judicial independence” and also has a large public sector and high taxes.

Adam Kutas, portfolio manager, emerging and frontier equities, with Fidelity Management and Research Co. in London, agrees. Kutas, manager of Fidelity Frontier Emerging Markets Fund, believes that the unattractive business environment will dampen increases in stock prices: “It’s unlikely that Russian stocks will trade at a large premium,” he says.

Kutas is doing more selling than buying of Russian equities. He entered the market in late 2014 and the Fidelity fund’s portfolio has done very well. He says there are still opportunities, but he doesn’t expect another bull market.

Some investment opportunities:

– Lukoil Pjsc. This is the second-largest integrated oil and gas firm in Russia and among the largest globally. Both Burbeck and Tan say Lukoil is a well-run company that is a low-cost producer with no government ownership.

“Even when oil prices were at their lowest levels in 2015, the company still made money and had a return on invested capital of around 2%,” Tan says. She notes that Russia’s taxation of oil companies varies widely by region and most of Lukoil’s fields are in low-tax regions.

– Magnit Pao. This company is the largest food retailer in Russia, with big-box hypermarkets, supermarkets, convenience stores and a chain of cosmetic stores. Magnit began operations in eastern Russia in small cities and towns and has been moving west and into large population centres.

Burbeck and Farrell both favor Magnit. However, Tan, whose Excel fund has owned Magnit shares in the past, finds the sector “challenged” these days. The decline in the ruble pushed up the cost of many foods in Russia that are imported. The ruble has recovered, but it’s still well below pre-recession levels. As well, retailers find that passing along the full price increases is difficult.

Kutas also cautions that Magnit’s efforts to penetrate dense urban markets, such as Moscow, are likely to be expensive, given high costs and lots of competition.

– Mail.ru Group Ltd. This is one of Burbeck’s picks. He describes the company as “the Facebook [Inc.] of Russia.” He says social media is “quite big” in Russia as a means of self-expression and a refuge during the long winters. Mail.ru, like Facebook (the expansion of which the Russian government has curtailed), has monetized its business through advertisements and has a big online gaming operation.

– Sberbank Rossii Pao. This bank is Russia’s largest. There is some government ownership, but, Tan says, the bank “seems to be able to manage its business well despite its government ties.” She describes Sberbank as a “traditional retail bank that is resilient through volatile times.” She adds that the bank will benefit from more loan growth as the economy recovers and also from a gradual reduction in its work force.

Burbeck adds that Sberbank is a well-capitalized bank that has benefited from consolidation in the sector, as many small banks struggled in the recession.

© 2017 Investment Executive. All rights reserved.