One of the most influential technological innovations in recent years is cloud computing, which reduces or eliminates the need for many companies to have their own technology platforms and staff.

“The cloud is very dynamic and really important because it allows smaller companies to scale up quickly and provides a more flexible operating structure for larger firms,” says Michael Graham, managing director and senior equities analyst, Internet with New York-based Canaccord Genuity Inc. “This lets customers keep up with technology while focusing on their core business.”

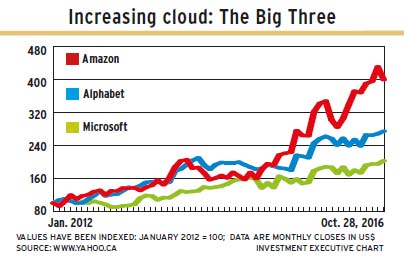

Cloud revenue has been growing fast, with both Graham and Eugene Profis, vice president, investment management, of the global equities and income team, and a portfolio manager with Mackenzie Financial Corp. in Toronto, expecting growth of about 20% a year.

The leader in cloud services is Seattle-based Amazon.com Inc. The company came up with the idea when management realized that the huge computing capacity the firm had for peak selling periods was underused during the rest of the year.

Amazon Web Services (AWS), started up in 2006, now is the dominant player in this space and is expected to continue in that position. “[AWS] has the lowest price, widest selection and greatest convenience,” says Sandy Sanders, senior managing director and senior portfolio manager with Manulife Asset Management (U.S.) LLC in Boston.

“AWS’s cloud business is 10 times the size of [Redmond, Wash.-based] Microsoft Corp.‘s, and I believe it will continue to have the lead,” says Profis. He foresees AWS taking over as the IT department for many firms and being used from Day 1 by startup companies.

Google Cloud Platform, which launched in 2008, is not a major priority for its parent, Mountain View, Calif.-based Alphabet Inc., the main focus of which is generating advertising revenue on the Google search and YouTube websites.

Although Microsoft’s Azure service was not started up until 2010, it is believed to be the second-biggest cloud provider, albeit much smaller than AWS. However, Azure has the advantage of a large base of customers who already use Microsoft products. Those users tend to be bigger firms and more sophisticated users who are less price-sensitive than AWS’s customers, says Troy Crandall, vice president and senior research analyst with Toronto-based Raymond James Ltd. in Montreal.

Here’s a look at the three companies in more detail:

> Alphabet Inc. Graham believes the company could succeed in the cloud “if it put its head to it,” but he doubts the firm will do so.

The company’s big strength is its search engine, Google, which is dominant because it offers the best product and reinvestment in it by the firm continues. Graham notes that Alphabet efficiently monetizes that advantage through auctioning advertising space.

Alphabet’s key challenge is protecting its market share on mobile devices, which is why the firm is pushing its smartphone. Alphabet’s other plus is YouTube, through which the firm is beginning to tap revenue from advertising, which also is auctioned.

Graham’s one-year price target is US$950; the analysts in San Francisco who cover all three companies for Raymond James have a target of US$920. The 698 million outstanding shares closed at US$795.37 on Oct. 28.

> Amazon.com Inc. Although best known for its online retailing, those retail margins are low. As a result, AWS represents 60% of the value of Amazon and that proportion is likely to rise, says Profis. He believes AWS’s revenue will triple to about US$50 billion by 2021.

Amazon’s e-commerce also is growing strongly, mainly because of third-party sales – products offered on Amazon’s website by other companies – which have been rising very fast. Amazon takes 14% off the selling price to fulfill orders. These sales now account for about 50% of Amazon’s e-commerce revenue; Profis believes that proportion could rise to 80%.

E-commerce accounts for about 10% of all U.S. retail sales, of which Amazon has about a 28% share. Profis expects e-commerce to double by 2021, with Amazon’s share of e-commerce to rise to around 50% in the next decade.

Both Canaccord and Raymond James have price targets of US$900 for Amazon. The 475 million outstanding shares closed at US$776.32 on Oct. 28.

> Microsoft Corp. Microsoft’s board of directors view Azure as the firm’s future, according to Crandall, who says the service is getting “better and better.” He notes that Satya Nadella, the new CEO, in his previous job, led the creation of Azure.

But while Profis believes Azure will be a significant player, he notes the long-term threat to Microsoft is its software. Those products have been dominant and a major source of revenue, but other cloud providers offer free software.

Microsoft has “huge amounts of cost-cutting potential,”says Charles Burbeck, co-head of global equity portfolios with UBS Global Asset Management (U.K.) Ltd. in London, U.K., adding that this is beginning to materialize as it’s a focus of the company’s new management team.

Raymond James has a “strong buy” rating on the stock, with a one-year price target of US$69. The 7.7 billion shares closed at US$59.87 on Oct. 28.

However, Richard Davis, Graham’s colleague in Boston who covers Microsoft, rates it a “hold” with a price target of US$60.

© 2016 Investment Executive. All rights reserved.