The strong demand among consumers for smartphones, tablets and other small wireless devices, combined with the need for large enterprise networks and servers, has different implications for multinational semiconductor chipmakers. This demand favours Cambridge, England-based ARM Holdings PLC but presents challenges for Santa Clara, Calif.-based Intel Corp.

ARM’s reduced instruction set computing (RISC) architecture is ideal for wireless devices. The firm also develops microprocessor chips large enough to be used in enterprise networks and servers.

In contrast, Intel hasn’t yet been successful in designing a low-power consumption chip compatible with its X86 architecture that can be used in wireless devices. Furthermore, demand for PCs, Intel’s main market, is stagnant.

Nevertheless, the current slowdown in the rate of growth for smartphones and tablets leads some securities analysts to prefer Intel as a short-term holding.

Further clouding the picture is that it isn’t certain that ARM will be able to take much market share from Intel in servers and networks, a market Intel has long dominated. As well, it’s quite possible that Intel will gain traction with its development for a low-power consumption chip in the near future.

A major difference between the two companies is that ARM just develops the architecture, then licenses the production of its semiconductors to other firms; Intel both develops the architecture and manufacturers all the microchips. This makes Intel a very strong company, considered the best microchip manufacturer in the world. Intel recently decided to offer excess capacity to other microchip manufacturers, which could produce a good injection into revenue for Intel.

Nevertheless, ARM remains in an excellent position. Not only is there still more growth to come in smartphones and tablets, but ARM’s chips are being used in what’s known as the “Internet of things” (IoT). This involves anything connected to the Internet, which is expected to include home appliances as well as medical diagnostics, manufacturing assembly, truck fleets and so on. This market is in its early stages.

Here is a look at the two companies in more detail:

– Arm holdings plc. Although demand for smartphones and tablets is expected to continue to be strong, there has been some slowing in this market’s rate of growth.

However, both Matthew Ramsay, analyst with Vancouver-based Canaccord Genuity Group Inc. in Minneapolis, and Hans Mosesmann, analyst with Raymond James & Associates Inc. in St. Petersburg, Fla., think the slowdown is temporary. They have a “buy” or “outperform” recommendation on the stock.

A recent report from Ramsay says: “We maintain our belief ARM is well positioned for strong sales and earnings growth driven by expanding royalty rates in ARM’s key mobile markets and by market share gains in underpenetrated markets, including enterprise networking, server, embedded and IoT.”

As for Mosesmann, his report states: “ARM’s technology will become increasingly pervasive in most areas of computing for years to come.”

Analysts with J.P. Morgan Securities LLC (JPM) in London are less enthusiastic about ARM’s near-term prospects and rate the stock as “neutral” because of concerns about the slowing growth in the smartphone market and, to a lesser extent, in tablets. Nevertheless, their report says, this stock is a good longer-term hold because they like ARM’s business model and believe the company will report robust earnings growth over the mid- to long term.

Net income in the 12 months ended March 31 was £115.2 million ($180 million) on revenue of £741.2 million ($1.2 billion). That’s down from £175.2 million ($280 million) on revenue of £604.5 million ($1 billion) in the same period a year earlier. The drop in earnings was due to a one-time charge related to a customer’s decision not to pursue a licensing program.

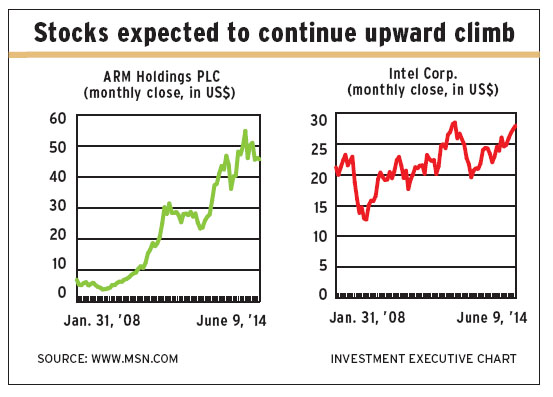

Ramsay’s target price for ARM’s stock is $60 a share; Mosesmann’s is lower, at $53. The 472.2 million outstanding shares closed at $45.59 on June 9. (All figures are in U.S. dollars unless stated otherwise.)

– Intel corp. is a strong company, but the softness in its major market, PCs, has resulted in declining revenue and excess capacity. Intel plans to increase revenue by using its excess capacity to manufacture microchips for other companies while continuing to work at developing a chip suitable for wireless applications.

A recent report from analysts with JPM in New York has an “overweight” rating on the stock: “We believe the PC market will remain relatively stable in 2014 – and we believe Intel’s new CEO will continue to provide realistic guidance and focus on areas in which Intel has an advantage, thereby improving margins and returns.”

One factor the JPM analysts expect will increase demand for PCs is the end of Microsoft Corp.’s support for Windows XP as of this past April. With higher margins and returns, the JPM analysts expect the stock’s price to increase to 14 times earnings from around 12.5 times.

However, Mosesmann’s report has an “underperform” rating on Intel’s stock. He believes the PC market is “a modest to no-growth segment,” noting that data centre demand has slowed and that ARM and its partners will “make a dent” in that market this year.

Sales for the data centre segment rose in the fiscal quarter ended March 31 by only about 20% relative to the corresponding period a year earlier; the quarter ended March 31, 2013, had an increase of more than 40% vs the same quarter a year earlier.

Net income in the 12 months ended March 29 was $9.5 billion on revenue of $52.9 billion. That compares with net income of $10.3 billion on revenue of $53 billion in the corresponding period a year earlier.

JPM’s price target is $30 vs the $27.91 that the 5.1 billion shares closed at on June 9. Raymond James’ analysts don’t provide price targets for stocks rated as “underperform.”

© 2014 Investment Executive. All rights reserved.