This article appears in the March 2023 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The scenario: Carol, 45, received a $10-million inheritance and later an unexpected $10,000 employment bonus. She is seeking balanced growth over the long term, which she defines as 10 or more years.

The philosophy: Manara invests in businesses with a high probability of producing a consistent rate of return over time with a low amount of risk, regardless of the market environment. These businesses also must provide an essential good or service that allows each company to have strong pricing power. Other characteristics Manara looks for are high returns on capital; ability to operate and fund growth without needing to take on new debt or issue more shares; and a low capital intensity ratio.

Avenue Investment Management also employs a hedging strategy that aims to protect the portfolio against major tail events or stock market crashes.

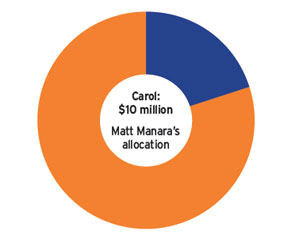

The allocation: $10-million inheritance

20% to bonds

“The bulk of the strategy would be to own high-quality, short-term corporate bonds, providing the ability to mature bonds and reinvest at higher rates if rates continue to increase,” Manara said. Among the bonds he suggested are:

- Manitoba Telecom Services Inc., with a 4% coupon, maturing on May 27, 2024

- Province of Alberta, 2.05%, June 1, 2030

- Telus Corp., 3.75%, Jan. 17, 2025

- Alimentation Couche-Tard Inc., 3.056%, July 26, 2024

- Cenovus Energy Inc., 3.6%, March 10, 2027

- Province of British Columbia, 4.3%, June 18, 2042

- First Capital REIT, 3.9%, Oct. 30, 2023

80% to equities, such as:

- Alimentation Couche-Tard (TSX: ATD)

- Gibson Energy Inc. (TSX: GEI), an energy infrastructure company

- Wheaton Precious Metals Corp. (TSX: WPM)

- Andlauer Healthcare Group Inc. (TSX: AND), a supply-chain management company serving the health-care sector

- National Bank of Canada (TSX: NA)

- AutoZone Inc. (NYSE: AZO), a leading U.S. automotive parts retailer

- Atkore Inc. (NYSE: ATKR), a manufacutrer and distributor of electrical components

- Home Depot Inc. (NYSE: HD)

- CACI International Inc. (NYSE: CACI), an information solutions and services provider

Tail hedge strategy:

- 2% of the equities portfolio is used to implement a tail-hedging strategy that uses derivatives to hedge against large declines in the stock market. “Having this protection within the portfolio allows clients more flexibility to be weighted to equities and stay invested during an entire market cycle,” Manara said.

The allocation: $10,000 bonus

100% to cash for liquidity

The philosophy: Stayropoulos uses value screens to select widely held securities. These value screens analyze a company’s cash flow, competitive advantages, future earnings potential, share price and ability to create capital appreciation for shareholders. Her firm uses ETFs to maximize efficiency and exposure to opportunities when a diversified selection of individual securities does not meet asset-allocation objectives.

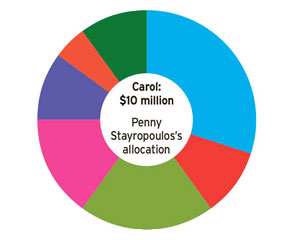

The allocation: $10-million inheritance

30% to fixed income

“With fixed income, we assume that the inherent income produced isn’t required; rather, we take advantage of the rate environment to capture a total return in price and yield differentials without lowering our investment-grade standards,” Stayropoulos said.

Among the bonds she recommended are:

- Government of Canada, with a 1.25% coupon, maturing on March 1, 2025

- Government of Canada, 0.50%, Sept. 1, 2025

- Hydro One Ltd. 2.54%, Apr. 5, 2024

- Fairfax Financial Holdings Ltd., 4.70%, Dec. 16, 2026

- Bank of Montreal, 1.758%, March 10, 2026

- Telus Corp., 3.625%, March 1, 2028

10% to cash, held in the NBI Altamira CashPerformer account to preserve capital and to take advantage of quality names selling at a discount.

20% to Canadian equities, such as:

- Canadian National Railway (TSX: CNR)

- Canadian Tire Corp. Class A (TSX: CTC.A)

- BCE Inc. (TSX: BCE)

- Telus Corp. (TSX: T)

- Bank of Nova Scotia (TSX: BNS)

- Open Text Corp. (TSX: OTEX), an information management software provider

- Lightspeed Commerce Inc. (TSX: LSPD), an e-commerce company

15% to U.S. equities, such as:

- Adobe Inc. (NASDAQ: ADBE)

- The Coca-Cola Co. (NYSE: KO)

- Constellation Brands Inc. (NYSE: STZ), an alcoholic beverage manufacturer

- The Scotts Miracle-Gro Co. (NYSE: SMG)

- Tractor Supply Co. (NASDAQ: TSCO)

- Pfizer Inc. (NYSE: PFE)

- Microsoft Corp. (NASDAQ: MSFT)

10% to international equities, such as:

- Siemens AG (FRA: SIE)

- Nestle SA (SIX: NESN)

- Novo Nordisk A/S (NYSE: NVO), a Denmark-based multinational pharmaceutical company

- Diageo PLC (NYSE: DEO), a British multinational alcoholic beverage company

- Medtronic PLC (NYSE: MDT), an Ireland-based medical device company with international operations

- Yamaha Corp. (FRA: YHA), a Japan-based multinational conglomerate

5% to infrastructure, held in the iShares U.S. Infrastructure ETF (Cboe BZX: IFRA)

10% to private assets:

- 1% in angel investments

- 2.5% in secondary limited partnership opportunities

- 6.5% in real estate

The allocation: $10,000 bonus

100% to the NBI Altamira CashPerformer account