This article appears in the June 2023 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

Few things in investment management divide opinions as sharply as the 60/40 portfolio. Sneered at as a relic or held up as the holy grail, the balanced portfolio’s obituary has been written countless times. Then came 2022.

Soaring inflation hurt both stocks and bonds, leading to “an apocalyptically bad return for a slice of your portfolio that should be ballast,” said Daniel Straus, director, ETFs and financial products research with National Bank of Canada in Toronto.

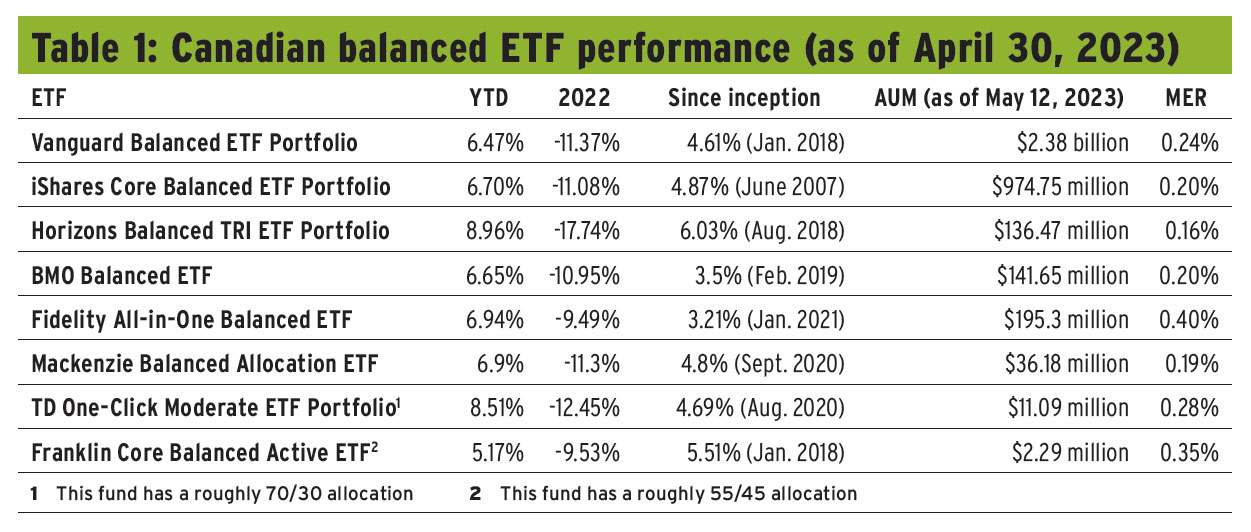

By the end of 2022, a standard 60/40 portfolio was down by about 16%. In Canada, where a home bias was an advantage, most balanced ETFs were down by about 11% on average. (See Table 1.)

Straus said the death of the 60/40 portfolio has been called since the global financial crisis of 2008, as many managers argued that fixed-income allocations made little sense in a time of low yields and overvalued equities.

“That was the refrain that echoed for many years. It took a long time, but [in 2022] it turned out to be right — just that one year,” he said.

With bonds once again offering healthy yields and equities off their pandemic highs, detractors of the 60/40 portfolio now point to persistent inflation breaking the inverse correlation that stocks and bonds enjoyed until last year.

In April, New York-based BlackRock Inc.’s investment institute released a paper stating that the “traditional” balanced approach of broad public indexes isn’t suited to a new investing regime.

“We don’t see the return of a joint stock/bond bull market like we saw in the Great Moderation,” the authors state. “That was a decades-long period of largely stable activity and inflation, when most assets rallied and bonds provided diversification when stocks slumped.”

Allocations based on these “old assumptions” won’t fare well when central banks are “hiking interest rates into recession” and won’t rescue markets with cuts, the report said. Instead, BlackRock recommends active stock selection in sectors such as energy and health care, and allocations to private assets.

Many other market analysts have warned the conditions that allowed broad index funds to thrive over the past decade — low inflation and easy money, cheap labour and global supply chains — no longer exist.

That doesn’t mean life is easier for long-suffering stock pickers. S&P Global Inc. found more than half of Canadian equity funds beat their benchmarks in the first six months of 2022, marking the industry’s best performance since 2013.

But that active advantage evaporated by the end of 2022, with 52% of active Canadian equity funds underperforming the S&P/TSX composite. Only in the Canadian dividend and income equity category did a majority of funds beat their index for the full year.

Still, many contend the end of the Great Moderation will give active managers an edge.

Andrew Clee, vice-president of product with Toronto-based Fidelity Investments Canada ULC, said the rising tide of easy credit lifted all boats over the past decade, but dispersion among companies within sectors will be more pronounced in a higher-rate environment.

“Security selection is probably one of the most important tools in your tool kit in 2023, and we expect that to continue,” Clee said.

The Fidelity All-in-One Balanced ETF invests in a dozen factor-based ETFs on the equity side. The four U.S. ETFs, for example, begin with a universe of 1,000 companies of which about 10% are selected based on a factor: low volatility, value, high quality or momentum.

“A lot of the alpha on the equity side comes down to what we do not own,” Clee said.

The fixed-income side of the Fidelity ETF invests in a factor-based Canadian bond ETF and an active global bond ETF. The Fidelity ETF also has a 2% bitcoin allocation.

As for the 60/40 allocation generally, Clee said, there have been signs since early March that the negative stock/bond correlation is back. Performance for balanced portfolios has rebounded nicely, buoying the argument that last year was an aberration.

“I think investors recognize that 2022 was a uniquely bad year for this entire concept, and there are new opportunities on the ground,” Straus said.

From 1976 through 2022, the 60/40 portfolio was negative only 14% of the time on a rolling one-year basis, said Sal D’Angelo, head of product with Vanguard Investments Canada Inc. Over rolling five-year periods, it was negative just 0.6% of the time.

The correlation benefits are premised on low to moderate inflation, D’Angelo said. The extremely high inflation we saw last year was painful, but he doesn’t expect that to continue.

“We could see higher than normal inflation: maybe it’s not 1%–2% like we’ve seen over the past decade, but nothing in the range that would concern us and negate the correlation benefits,” he said.

Even including last year’s catastrophe, the U.S. version of Vanguard’s balanced ETF returned more than 6% annualized over the 10 years to the end of 2022. (The Canadian version launched in 2018.) D’Angelo projects the same trend over the coming decade.

“Bond yields have moved up materially higher, so the fixed-income component of the portfolio is generally about 200 basis points higher than it was at the end of 2021,” D’Angelo said. The passive funds’ low fees will help them beat active funds over time, he added.

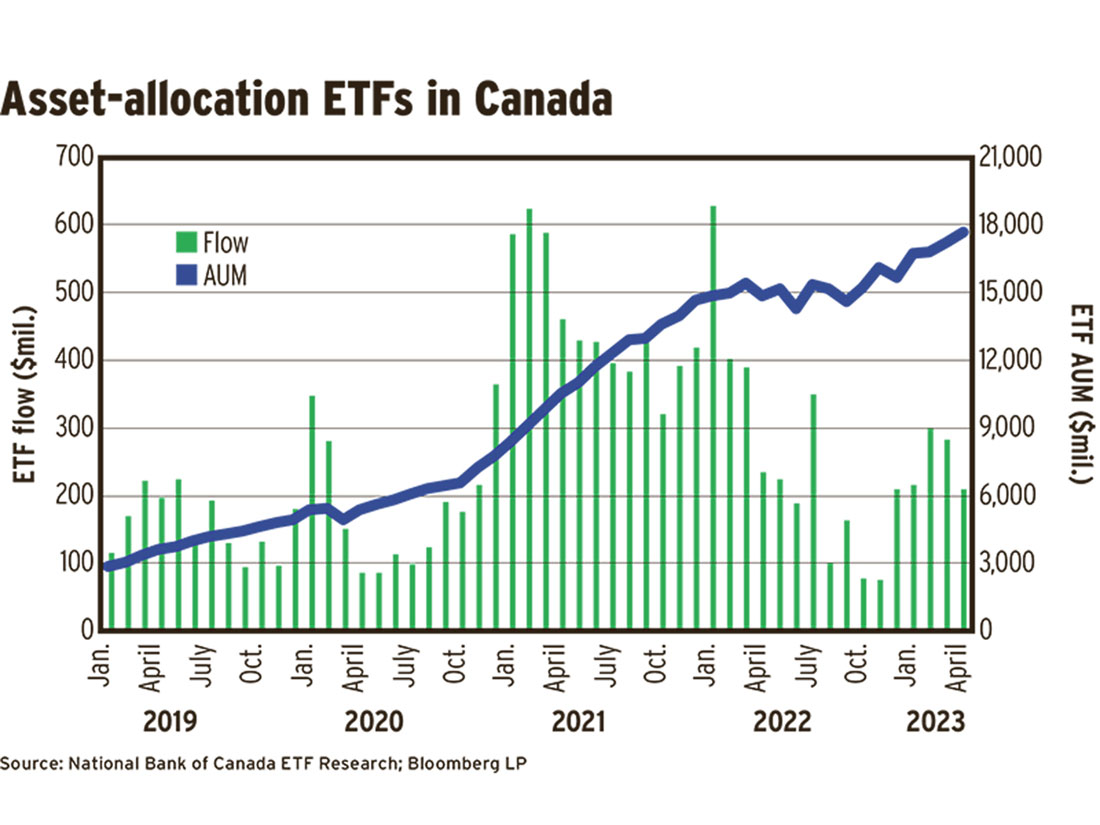

There also may be a behavioural benefit to balanced funds. Straus noted that investment into asset-allocation ETFs remained steady last year despite their poor performance, and Clee noted balanced funds have some of the lowest redemption rates among Fidelity funds.

“We tend to see a lot of flows chase the flavour of the month on stand-alone funds, whereas balanced is very consistent,” Clee said, which suggests investors are comfortable using them for dollar-cost averaging.

D’Angelo said there’s been more dealer appetite to put balanced funds on shelves to help reduce the dispersion of returns.

“They don’t want advisors all doing their own thing: one [year] knocking it out of the park and then next year losing a lot of money,” he said. “They want to have more of a normal distribution: market-like returns, with potential for outperformance, using either their own models or high-conviction funds on their recommended list.”

Click image for full-size chart

Click image for full-size chart