This article appears in the Mid-November 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

For Canadian financial advisors, exposure to the U.S. dollar via investment funds is a source of currency risk for clients. But that exposure also can be a welcome source of diversification and opportunity, as investors have seen this year.

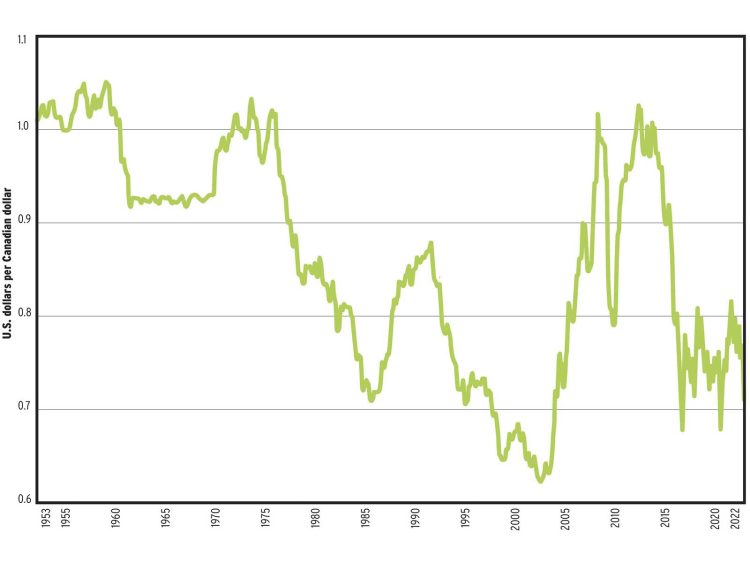

The U.S. dollar has surged ahead of other major currencies this year. Although the Canadian dollar has been more resilient than most, it too has weakened. Since starting this year at 78.9¢ U.S., the loonie had lost more than 5¢ by Oct. 31, or about 7%.

As a result, mutual funds and ETFs that employ currency hedging have lagged far behind their unhedged counterparts. Among the largest ETFs, the iShares Core S&P 500 Index ETF (CAD-Hedged) had lost 19.2% in the year to Oct. 31, much worse than the 12.1% loss of the unhedged iShares Core S&P 500 Index ETF.

The same trend prevails in other foreign equity and foreign income categories. Fidelity Investments Canada ULC, for example, offers both hedged and unhedged versions of multiple mandates. Among its currency-neutral choices is its floating-rate strategy, which invests primarily in non-investment-grade debt of issuers based in the U.S. or that have debt denominated in U.S. dollars.

The recent difference in performance of two funds mirrors the slump in the Canadian dollar. As of Oct. 31, series F of the Fidelity Floating Rate High Income Currency Neutral Fund had lost 2.3% year to date. Its unhedged counterpart, the Fidelity Floating Rate High Income Fund, was up by 5.5% over the same period.

Steep market declines tend to be bullish for the U.S. dollar, which is viewed as a source of safety and liquidity. That’s been the case this year, just as happened during the Covid-19 emergency in 2020 and the global financial crisis of 2008.

“There’s always a search for U.S. dollars whenever you have a selloff,” said Alfred Lee, director, portfolio manager and investment strategist, BMO ETFs, with Toronto-based BMO Asset Management Inc. — one of many firms to offer hedged and unhedged funds. “From a long-term portfolio construction perspective, it’s always good to have that U.S. dollar to hedge out some of that equity market risk.”

With the Canadian stock market heavily weighted in financial services and natural resources, obtaining adequate sector diversification requires investors to look to the U.S. and other foreign markets.

The question for financial advisors and their clients is how much exchange-rate risk to take on when investing outside Canada. Fund companies typically view their role as offering choice.

“Very often, you could have returns in an asset class that are eroded by returns in the currency,” Lee said. “So we want to give the option to the investor to have the unhedged version and also the currency-hedged version.”

TD Economics’ latest quarterly forecast suggested that the worst of the loonie’s depreciation might be over: “The Canadian dollar may see some appreciation versus the U.S. dollar over the coming months if the risk-off move in financial markets eases and the Canadian economy can maintain its outperformance on the GDP front.”

By comparison, the report stated, the euro and the pound sterling both appear to have further downside in store because of the threat posed by the Ukraine-Russia war on natural gas supplies and economic weakness in Europe.

At the Canadian dollar’s current depressed level of about 74.3¢ U.S., the case for currency hedging has become more compelling. Although the loonie’s all-time low is 61.8¢ U.S., the U.S. dollar is still at its higher end historically. “With the U.S. dollar getting up there,” Lee said, “if you want to be tactical, I think having that hedged version is a good opportunity at this point.”

Canadian-U.S. dollar exchange rate, Jan. 1, 1953, to Oct. 31, 2022

Click image for full-size chart