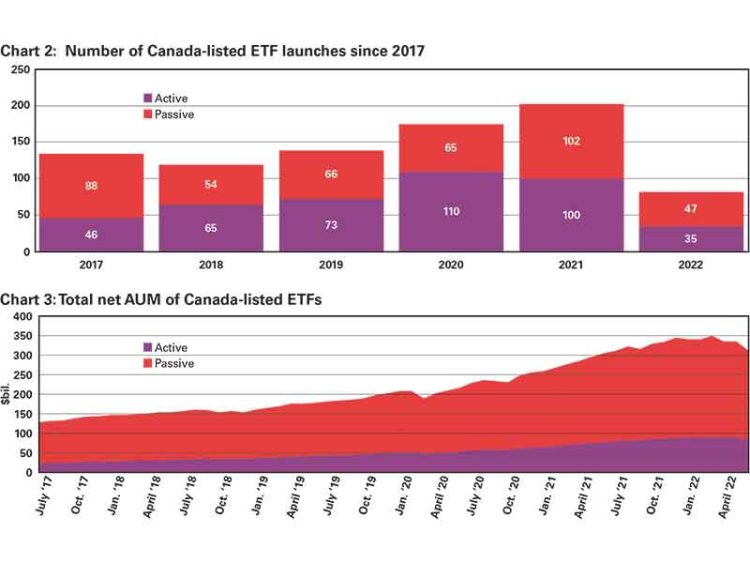

The first two years of the pandemic represented a high-water mark for launches of actively managed ETFs in Canada. In 2020, active ETF launches topped 100 for the first time, and launches remained robust the following year. More active ETFs have launched than passive in four calendar years: 2015, 2018, 2019 and 2020.

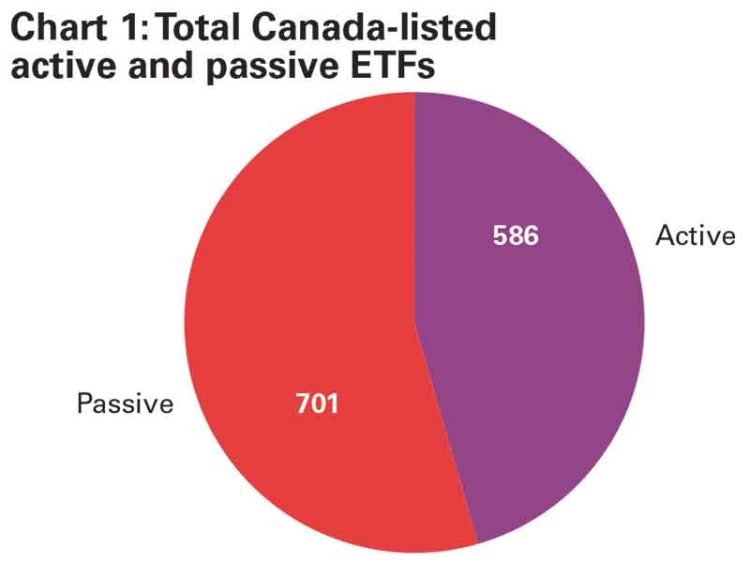

But while active ETFs now comprise nearly 46% of ETFs listed in Canada, their assets under management (AUM) remain far lower than for passive ETFs. Active ETF AUM as of June 30 was $85 billion (27%) compared to $227 billion (73%) for passively managed ETFs, according to Morningstar Direct.