This article appears in the November 2020 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

With interest rates at historical lows and markets potentially on the brink of further volatility, retirees may be wondering where to turn for reliable income.

A September report from Boston-based Natixis Investment Managers paints a bleak picture, noting that retirement security around the globe was already “on shaky ground” before 2020 — a year that has delivered “some of the greatest threats to public health and the global economy in more than a century.”

Given investors’ mounting challenges, Investment Executive asked two experts to present sample portfolios focused on generating retirement income.

Traditional, with a twist

Despite low interest rates and economic uncertainty, Ben Felix, portfolio manager with Montreal-based PWL Capital Inc. in Ottawa, says he hasn’t resorted to “exotic asset allocation” in his portfolios.

“Seeking returns in alternative asset classes, like high-yield bonds, preferred shares, private equity or private credit, results in repackaged versions of the risks available through public stocks and bonds,” Felix says.

Some clients may believe high-yield bonds and dividend-paying stocks don’t carry much risk, but investors who rely heavily on these assets may be taking on “substantially more risk than they realize,” Felix says. He adds that many of these investment vehicles can have “unattractive risk-adjusted returns.”

Felix suggests retirees invest in funds that hold traditional stocks and bonds and account for volatility, such as the Dimensional Global 60EQ-40FI Portfolio, an asset-allocation fund managed by Vancouver-based Dimensional Fund Advisors Canada ULC. (See Product Watch for more examples of asset-allocation funds.)

The Dimensional fund, which invests predominantly in other mutual funds, uses a custom benchmark and offers “a bit of a twist,” Felix says. The fund is similar to a total market index fund and offers a traditional 60/40 split between equities and fixed income, but “deviates” from other index funds in weighting methodology.

“Dimensional begins with market-cap weights and then increases the weight of securities with higher expected returns, while decreasing the weight of securities with lower expected returns,” Felix says.

The Dimensional fund favours small-cap value stocks “with robust profitability that invest conservatively,” Felix says. This is “one of the best times in history to be diversified away from large-cap growth,” he says, given the high valuations of the U.S. market — which have led to lower expected returns — and the wide valuation spread between large-cap growth and small-cap value.

As of June 30, the Dimensional fund’s equities exposure is divided among the U.S. (22.4% of the entire portfolio), Canada (18.8%) and international (15.8%), with some exposure to the DFA Global Real Estate Securities Fund (2.3%).

The Dimensional fund seeks exposure to bonds with varying maturity dates for its fixed-income allocation. “Dimensional varies the term of the [bond] portfolio based on the shape of the yield curve,” Felix says. “In countries with an upward-sloping yield curve, Dimensional takes more term risk.”

The Dimensional fund’s highest allocation to fixed income (16.2% of the entire portfolio) is the DFA Five-Year Global Fixed Income Fund, which tracks the FTSE world government bond index (hedged to the Canadian dollar), followed by a DFA global investment-grade fund (14.2%) and a DFA targeted credit fund (10.2%) — both of which are exposed primarily to U.S. bonds.

Overall, the Dimensional portfolio is “simple and cost-efficient,” says Felix, who adds that he likes Dimensional’s use of hedged funds to “eliminate currency risk and take advantage of covered interest rate parity.”

Strategy for a retired couple

An alternative to mutual funds and ETFs is a separately managed account (SMA) that directly owns individual stocks and bonds, says Sean Lasko, senior investment counsellor with Manulife Private Wealth in Toronto.

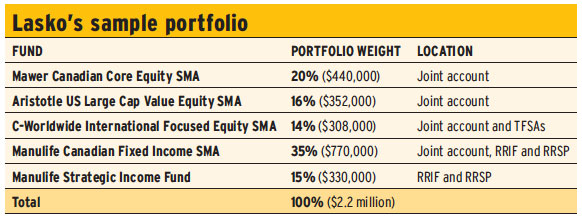

Lasko gives the example of John (age 72) and Jane (age 67), who together require $100,000 in income per year, indexed to inflation. The couple has $2.2 million in liquid assets to be invested across a joint account, John’s RRIF, Jane’s RRSP and each of their TFSAs.

Lasko suggests a 50% equities/50% fixed-income portfolio consisting primarily of SMAs with a target expected return of 5%. (See table, left.) He says this type of portfolio would work for clients like John and Jane regardless of market conditions. “Typically, we’d advise clients with this kind of portfolio that if we’re going through some kind of bear market, they have to be willing to tolerate short-term declines of 12% to 15% without jumping out. You’re always going to have volatility.”

Lasko says he recommends SMAs because they’re “inherently more tax-efficient than mutual funds, as there are no ‘pregnant’ capital gains that a new investor inherits.” Any capital gains that do arise can be handled through tax-loss harvesting at year-end.

The total holdings in each SMA vary: the C-Worldwide International Focused Equity SMA holds 25 to 30 names, while the Mawer Canadian Core Equity SMA holds approximately 40 names. Lasko says each SMA focuses on quality names.

The Mawer SMA focuses on large-cap, blue-chip names. The top five holdings as of June 30 consisted mainly of financials.

Meanwhile, the SMA offered by Los Angeles-based Aristotle Capital Management LLC has a portfolio of no more than 45 high-quality businesses that are trading at a discount.

Lasko concedes that the Aristotle SMA has underperformed the S&P 500 index in the past few years due to “value-style investment management being out of favour,” but he expects that to change: “I think we’re due for a reversion to the mean and could see value-style investing post better numbers moving forward.”

Lasko notes that there’s greater focus on domestic and global equities than on U.S. holdings in his sample portfolio: “We’re less bullish on the U.S. market going forward, and the allocation is less than it would have been a year and a half ago.”

In the fixed-income component of the portfolio, government and corporate bonds are the main focus. Lasko says the Manulife Canadian Fixed Income SMA, which holds a mix of domestic government bonds (65%) and corporate debt (35%; most of which is A-rated), can “act as the stabilizing force or shock absorber during periods of market volatility.”

Meanwhile, the Manulife Strategic Income Fund, a mutual fund, holds global government and corporate bonds, with some emerging market and high-yield exposure. This fund includes “multiple sectors and currencies,” Lasko says, which the portfolio managers believe increases the potential for added value.

Lasko cautions that allocation to the Manulife fund should be kept to 15% due to the product being “more aggressive,” as the portfolio managers seek additional return to counter interest rates being at historical lows.