This year’s Advisors’ Report Card — a summary report that consolidates the average results of the four main Investment Executive (IE) Report Cards compiled each year — indicated that many surveyed advisors were crafting more financial plans for clients.

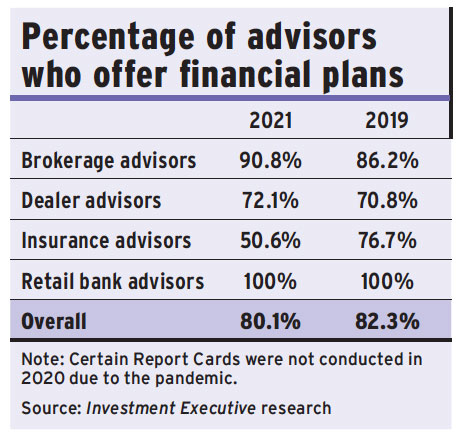

While the average percentage of advisors who offer financial plans across all segments slipped to 80.1% from 82.3% in 2019 (see box, below), 18 of the 34 firms assessed on how many advisors craft financial plans showed an increase in the number of advisors who said they offer such plans. In contrast, only six firms saw a dip in the percentage of advisors offering financial plans to clients.

And a greater proportion of clients across all segments have financial plans this year: 63.1% on average, up by more than five percentage points from 2019 and by more than eight points from 2017.

Over the past few years, firms across several segments have begun tying compensation to financial planning (as discussed in this year’s Brokerage Report Card and Report Card on Banks), which could also be driving the increase in the number of client plans being crafted.

This year’s Report Cards also saw an increase in advisor satisfaction regarding “Support for developing a financial plan for clients.” The industry-wide performance average for the category rose 0.3 points to 8.3, compared with 2019.

Advisors with banks’ retail branches gave the highest rating for this category (8.6, unchanged from 2019), partially as a result of those firms investing in software upgrades.

“There’s been so much education around [our] new planning tool,” said a retail bank advisor in Ontario with CIBC Imperial Service. “We have a dedicated line of specialists that are experts on the tool and can walk you through it.”

CIBC implemented GoalPlanner in November 2020, and many of the bank’s advisors were satisfied. Another CIBC advisor in Ontario said, “If you don’t have that support, you can’t do your planning properly.”

Bank of Nova Scotia also has worked on planning support improvements, with advisors saying they’ve seen a big push to implement financial planning in their practices. An advisor with Scotiabank in Quebec said, “The bank invested enormously in their wealth platform and that’s where we see a big difference. [We’ve received] only positive feedback from clients.”

Advisors with dealer firms, as well as those with insurance agencies, gave significantly higher ratings for financial planning support in 2021. Both industry segments saw their performance averages for the category rise significantly (by 0.5 or more) to 8.0 from 7.5 in 2019.

“[Planning support] is getting better each year, with what we have access to and the technology that is coming in,” said an advisor in Alberta with dealer firm Assante Wealth Management (Canada) Ltd.

An advisor in B.C. with dealer firm IG Wealth Management said the support they received has been “top of the line. Great software [and] great planning tools.”

In the insurance channel, dedicated sales agencies such as Sun Life Financial Distributors (Canada) Inc. (SLFD) are focusing on the ways advisors can strengthen their financial planning relationships with clients — a main goal being a higher percentage of advisors offering “holistic” plans.

“There’s been a paradigm shift in the past three years. They’ve tried to provide more holistic planning to clients,” said an insurance advisor in Alberta with SLFD.

In the brokerage space, advisors similarly highlighted the importance of incorporating more financial planning into their practices, but found technology glitches could be a barrier at times. Advisors in that channel gave a performance rating of 8.4 in the financial planning category, the same as in 2019.

“There’s no actual human to talk to. There’s also not good software in-house, but they’re working on it,” said an advisor in Ontario with brokerage firm iA Private Wealth. Another advisor with that firm, in Quebec, said they didn’t have all the tools expected from large firms. (In an emailed statement to IE, iA said it is evaluating its current tools and looking to “advance” support for advisors.)

An advisor in Ontario with bank-owned brokerage National Bank Financial Inc. (NBF) — a firm that had mixed advisor sentiment — said planning support was good but that “[the] infrastructure could use some work. There’s longer-than-expected turnaround times due to lack of staff.” Other NBF advisors noted the brokerage had upgraded its technology within the past year, which clients appreciated.

In an emailed statement, NBF told IE a tool called Advice Suite will soon replace its old software. The tool had its beta launch in 2020, currently has 600 users and will be fully ready by the end of 2021.

Despite the challenges, advisors across all industry segments indicated that they are placing greater emphasis on financial planning. As an advisor in Ontario with dealer firm Manulife Securities said, “[Financial planning] is something I’ve integrated a lot recently. It’s become so important to my practice.”