As you’ve probably noticed, the ESG space has been undergoing a wave of disruption. Former insiders like Desiree Fixler and Tariq Fancy have been blowing the whistle on their past employers for real or perceived greenwashing, leading to fines and even raids by authorities in some cases.

In response to growing scrutiny, industry bodies such as the International Sustainability Standards Board (ISSB) and CFA Institute are developing voluntary ESG reporting standards to strengthen market confidence.

While industry-led standards play a vital role in developing the sustainable finance market, they only go so far in serving the public interest due to their voluntary nature. As such, securities regulators are developing new rules for the ESG disclosures of companies and asset managers alike.

The impending wave of disclosure rules foreshadows a new era of transparency that will transform the market by enabling investors to see ESG risks and evaluate sustainability leadership like never before.

The coming tidal wave

The forthcoming tidal wave of ESG disclosure rules will land in North America this April when the U.S. Securities and Exchange Commission (SEC) publishes the first of several new ESG-related regulations in its pipeline.

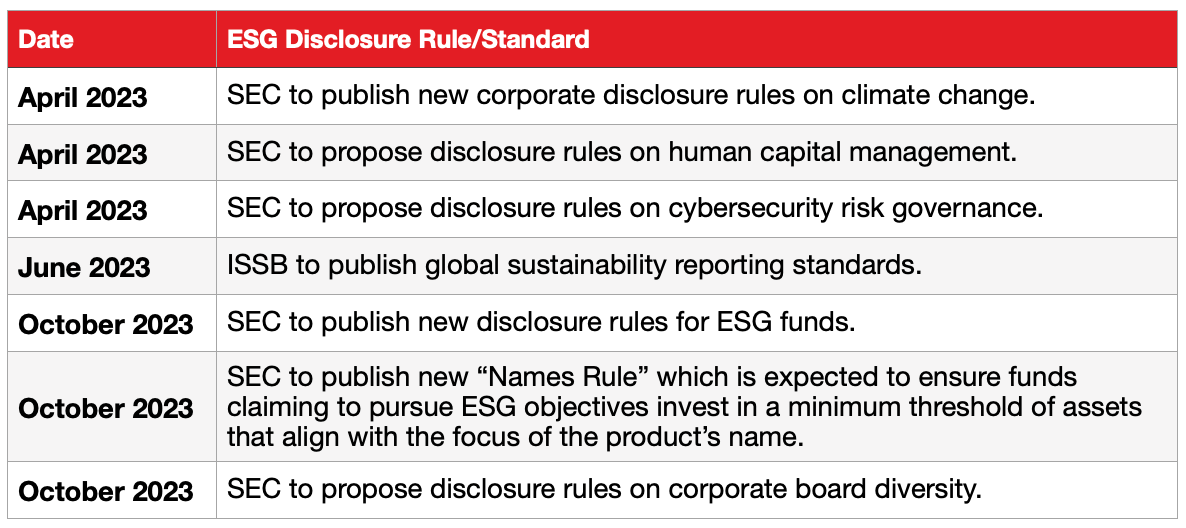

Below is a timeline of upcoming disclosure rules and proposals from the SEC, as well as the expected publication date of the ISSB’s forthcoming reporting standards, which are not regulations per se but will serve as a global baseline for sustainability-related information in capital markets.

Click on the table to enlarge it.

Here in Canada, most regulators have not published timelines for their forthcoming ESG-related rules, but they are definitely coming. Below is a summary of what’s brewing in Canada.

Corporate climate disclosures. In 2022 the Canadian Securities Administrators (CSA) collected stakeholder feedback on draft rules for corporate climate disclosures. Although the CSA has not given a timeline for the new rules, its chair, Louis Morisset, told Investment Executive in June 2022 the regulators were “reflecting on the wisdom of waiting until the SEC and the ISSB have finalized their positions” before proceeding with their “second publication.” So, Canada can expect to see new corporate climate disclosure rules, or perhaps an updated proposal, sometime after June of this year.

Investment fund ESG disclosures. The CSA published guidance in 2022 to clarify how existing rules apply to ESG-related funds. However, the SEC proposed far more rigorous disclosure rules for ESG funds just a few months later. So, we could potentially see a highly uneven regulatory landscape in North America with respect to ESG funds. For example, it could be much easier for a fund to call itself an “impact investment” in Canada than in the U.S., where managers may be required to substantiate impact-related claims with evidence. Therefore, the CSA might elect to develop or propose new rules that are more on par with its southern counterpart. But even if it doesn’t, some Canadian fund managers, such as those who do business with U.S. institutional clients, may need to adopt the SEC rules as their de facto reporting framework in order to stay competitive.

Financial institution climate disclosures. The Office of the Superintendent of Financial Institutions consulted stakeholders on its draft guidelines for the climate-related practices and disclosures of federally regulated financial institutions last year, and is expected to announce the final version in March of this year.

Pension fund ESG disclosures. The Canadian Association of Pension Supervisory Authorities released draft guidelines for ESG practices and disclosures of pension plan administrators in 2022, and is expected to announce the final rules in the months ahead.

The inevitable flight to quality in ESG

This wave of disclosure rules and standards will provide investors with access to more reliable and comparable ESG information, triggering a flight to quality in the ESG space. While “quality” may be elusive and hard to define from an ESG practitioner’s perspective, it probably involves answering questions like: “So what?”

So what if a fund manager considers ESG risks and opportunities? So what if a manager takes ESG issues into account? While considering ESG factors in investment decisions is vital from a risk management perspective, doing so is now table stakes and says nothing about the outcomes of investments that are marketed as sustainable or responsible.

In the context of growing droughts, wildfires, floods and other extreme weather events around the world, many investors want to know if their savings are mitigating or exacerbating climate change. They want to know if their investments are doing something positive or negative for communities and the planet.

In short, investors increasingly want to know the outcomes of their investments. A recent PwC survey of 227 institutional investors found that ESG outcomes accounted for eight of the top 10 investment outcomes that investors see as priorities for companies to help deliver. Thus it is no surprise that a Morgan Stanley survey of 311 institutional investors found a majority (57%) agreed that sustainable investing loses credibility when outcomes aren’t measured.

On the retail side, a 2022 RIA survey of 1,000 individual investors found 80% of respondents want their fund managers to encourage portfolio companies to reduce emissions, while 78% want exposure to companies that are delivering climate solutions. An earlier edition of the same RIA survey found 72% of individual investors want their fund managers to engage companies to encourage more diversity in leadership.

So, with such strong investor interest in ESG outcomes, the transparency-enabled flight to quality will ultimately be a flight to sustainability leadership.

This view is supported by data out of Europe, where sustainable finance disclosure regulations recently impacted the market. A Morningstar report found that “light green” (Article 8) funds recorded €28.7 billion of outflows in Q3 2022, while “dark green” (Article 9) funds saw inflows of €12.6 billion over the same period, more than doubling their inflows of the previous quarter. So, in a challenging macroeconomic environment, the lower-sustainability funds lost significant assets while the higher sustainability funds saw positive inflows for consecutive quarters. These are the green shoots of a flight to sustainability leadership. This trend was disrupted in Q4 as hundreds of funds were downgraded from Article 9 to Article 8 following regulatory guidance, but the fact remains that investors were allocating more assets to funds deemed to be more focused on sustainable outcomes.

Conclusion

Over the past couple of years, the ESG space has been pretty noisy, raising questions about the credibility of market participants flying the ESG flag. The forthcoming era of transparency will help to strengthen confidence in the market by giving capital markets access to more reliable and comparable ESG information. In this new era, measuring and reporting on ESG outcomes will be a source of credibility for companies and asset managers looking to attract capital and differentiate themselves as leaders.

Does this analysis suggest that all investors will immediately flock to funds and companies that are leading on sustainability? Certainly not. But the assets that are flowing to ESG will increasingly flow to sustainability leaders in the months and years ahead — because investors want sustainability leadership, and the new era of transparency will help them find it.

Dustyn Lanz is senior advisor with ESG Global Advisors Inc.