Some fund managers are struggling to keep up with rapidly evolving ESG expectations. To be fair, keeping up is not easy nowadays as it requires juggling a growing and sometimes conflicting list of demands from regulators, clients, non-governmental organizations and others.

On the regulatory front, securities commissions are ramping up ESG disclosure rules and enforcement measures. Here in Canada, provincial regulators have been quietly engaging with fund managers to review their disclosures and, in some cases, request changes to marketing materials and prospectuses to align with regulatory guidance. This is happening while the U.S. Securities and Exchange Commission plans to announce new rules this month governing investment funds’ ESG-related disclosures.

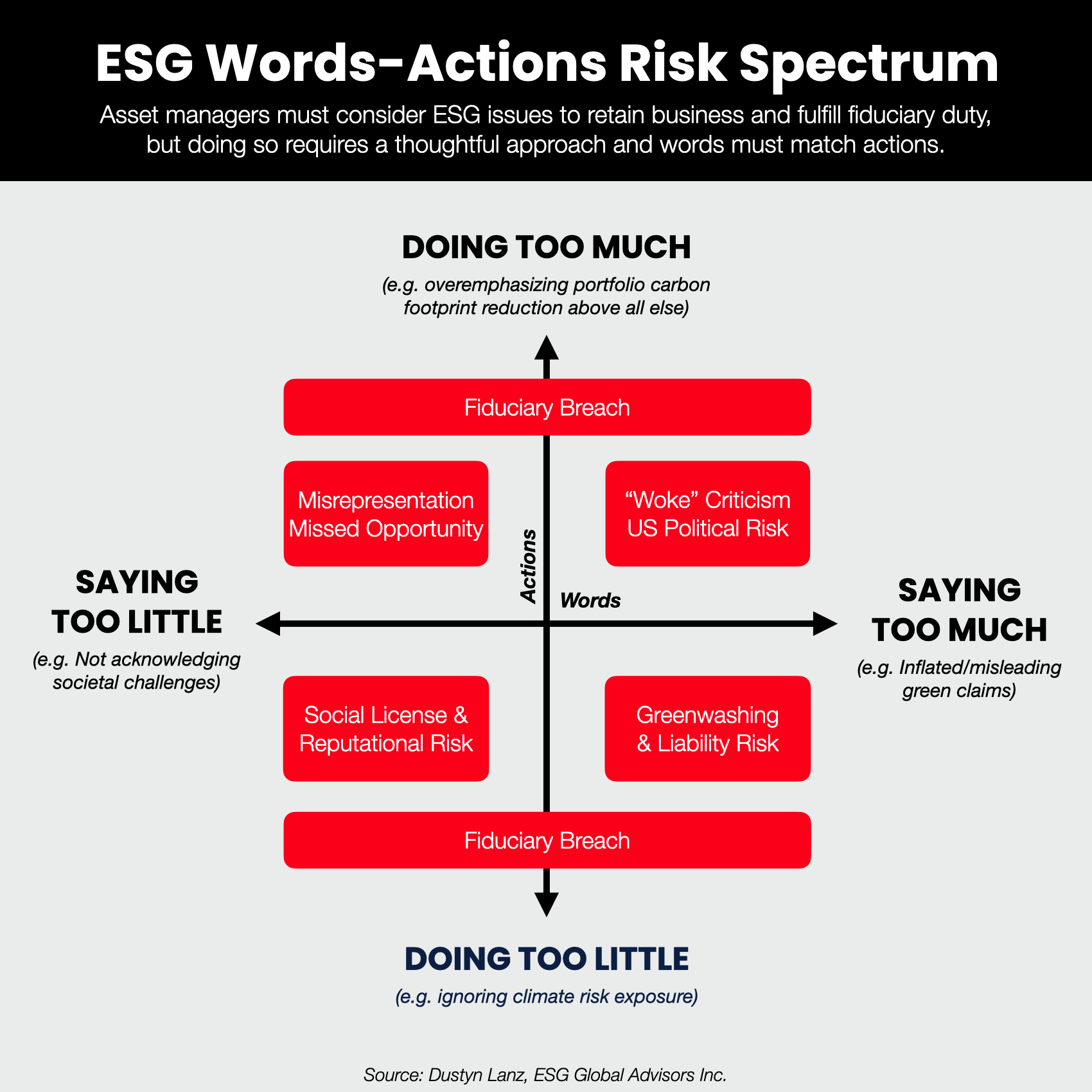

Meanwhile, fund managers are facing attacks from both ends of the political spectrum. On the one hand, pro-sustainability groups deride financial institutions for owning or lending to oil and gas companies, or for otherwise not doing enough on sustainability. On the other hand, U.S. fund managers have been dragged into the political agendas of Republican-controlled state legislatures, facing accusations of “wokeness” and related bans on managing state funds for considering ESG issues.

And, of course, there are the actual clients and asset owners, who sit squarely at the top of fund managers’ stakeholder list. While many are keen to support ESG-related goals such as portfolio carbon footprint reductions, some are not.

So, fund managers face scrutiny from all directions.

Importantly, fund managers also risk breaching their fiduciary duties if they do too much or too little on ESG. For example, completely ignoring climate change and other material ESG risks would be a fiduciary problem, while overprioritizing ESG-related goals such as portfolio carbon footprint reductions could also be a problem.

All of this makes inaction look rather appealing at first glance. It may be tempting to say, “This ESG stuff is hard, so let’s forget it.” But ignoring ESG issues is not viable in a world where issues such as climate change have increasingly obvious economic and financial implications. No one can credibly argue that ESG issues are immaterial, and firms’ social licence now requires some level of engagement with ESG issues.

In this environment, it may be tempting for fund managers to engage in “greenhushing” — adopting ESG and sustainability practices but keeping them quiet to meet the demands of some clients without attracting negative attention from others. But greenhushing comes with its own risks such as missed business opportunities and, more obviously, misrepresentation.

For instance, the CFA code of conduct explicitly prohibits CFA charterholders from knowingly making “any misrepresentations relating to investment analysis, recommendations, actions or other professional activities,” and this surely includes selectively disclosing information to some but not all clients.

Further, if a fund manager is considering ESG issues because it deems ESG information to be material, then it goes without saying that withholding information about an ESG strategy means withholding information that is material to investors.

So, fund managers face a delicate balancing act in which they must have some level of ESG or sustainability ambition, but they must pursue the “right” level of ambition for their business objectives and, crucially, their words must match their actions. The diagram below provides a visual representation of this balancing act.

Click on the image to enlarge it.

Against that backdrop, some fund managers probably feel like they’re damned if they “do” ESG and damned if they don’t. But it doesn’t have to be that way; thoughtful managers who invest in ESG capacity can alleviate their pain points and position themselves for long-term success.

Managers who feel they’re struggling to keep up with evolving expectations should consider the following actions. Advisors can use this list as a tool for engaging with fund managers on their ESG disclosures and strategies.

1. Determine your firm’s level of ESG or sustainability ambition. While there are clear benefits to being a market leader, leadership takes time and resources. It’s not simply a matter of hiring an “ESG person,” because leadership requires active participation across functions and, crucially, engagement from leadership and governing bodies. If your firm wants to call itself a leader in responsible investment or sustainability, make sure ample resources are available to support such claims. Alternatively, perhaps your firm is happy to be among the “middle of the pack,” offering ESG-related products to interested clients without going all in on ambitious firm-wide strategies. In any case, the key is to make sure ambition and messaging are aligned with actions and resources. In short, pick your ESG lane and lean into it.

2. Engage key decision-makers in ESG education and capacity building. Regulator inquiries, greenwashing accusations and other headaches often arise from the misuse of terminology. The world of ESG and responsible investing encompasses a rather vast and complex lexicon, so it’s essential for decision-makers to be aligned on terminology and have a good understanding of key concepts so they can fulfil their oversight roles. This also enables the firm to establish the “right” level of ambition for its business objectives and ensure its words match its actions.

3. Adopt ESG disclosure best practices. Disclosure is a huge topic that requires more space than a bullet point in a column, but there are a few practices worth highlighting. At the product level, there should be clear alignment between fund names, strategies, objectives, policies and disclosure materials such as prospectuses and fund facts. At the firm level, comprehensive ESG disclosure is challenging since details vary across teams, asset classes and fund strategies. While these nuances can be disclosed at the product level, there are some best practices to keep in mind for firm-level disclosure:

- Scope of adoption: Disclose whether the firm’s approaches to responsible investment (e.g., ESG integration, engagement, screening, etc.) apply across all assets and investment teams, or only to select assets/teams.

- Key ESG resources: Disclose any resources the firm leverages to support ESG-related work internally (e.g., ESG ratings or analytics).

- ESG frameworks: Disclose any overarching ESG frameworks within which investment teams must operate (e.g., alignment with Sustainability Accounting Standards Board standards, periodic review of holdings against ESG metrics).

4. Develop a well-governed marketing strategy. Any mismatch between marketing claims and observable ESG activities is a red flag for regulators, clients, advisors and other stakeholders, and the complex nature of ESG-related terminology makes it ripe for such mismatches. For example, the word “impact” sounds great in a marketing slogan, but in practice an investment claiming to make an impact must measure and report positive impacts in order to be credible. Marketing teams may not be aware of these nuances, which creates risk for the firm. Effective oversight of ESG-related marketing is therefore essential. ESG policies and disclosures should be approved at the highest levels of the firm, and marketing content should flow directly from approved materials. Further, fund managers should use plain language, define ambiguous terms, and align terminology with global standards and frameworks wherever possible.

5. Ensure the ESG or responsible investment policy is robust yet achievable. Publishing a policy without certainty that it can be achieved is a recipe for greenwashing risk. Well-designed ESG or responsible investment programs begin with a sound policy that is both robust and aligned with internal capacity. A sound policy includes definitions of key terms, position statements on key ESG issues such as climate change, a description of the responsible investment approach, and a word on governance and any relevant policy advocacy.

While each asset manager has its own unique circumstances and challenges, considering the above actions would alleviate a number of pain points that some fund managers are experiencing in the market right now.

Dustyn Lanz is senior advisor with ESG Global Advisors Inc.