Unlocking locked-in accounts

If your client leaves an employer that offered a defined-benefit pension plan, the client may have options for handling the assets in that plan. Some…

- By: Dwarka Lakhan

- November 11, 2016 November 9, 2019

- 00:50

If your client leaves an employer that offered a defined-benefit pension plan, the client may have options for handling the assets in that plan. Some…

Some advisors forecast a range of outcomes for clients with private-sector DB plans, ranging through full benefits to partial reduction of benefits to a complete…

Persuading millennial clients to start saving for retirement while they're young can be difficult. But even small, regular amounts can add up impressively over decades

In an ideal world, retirees would not need to use home equity to fund their retirement. But, for many people, their homes will be their…

Many Canadian seniors are carrying significant debt and they don't appear to be too worried about it. In some cases, your role may be to…

The full effects of the federal Liberals' proposed expansion of the Canada Pension Plan will not be felt for years to come. Both benefits and…

Although 90% of advisors feel they have an obligation to their clients to create a succession plan, only 19% of advisors have a succession plan…

With investors being more informed, they are less likely to sue their advisors if their investments go south

And with most Canadians avoiding the topic of taxes until the New Year, now is an opportune time for advisors to help clients take advantage…

The provincial regulator’s recent examinations of life insurance agents revealed several gaps in compliance, especially as they relate to disclosure

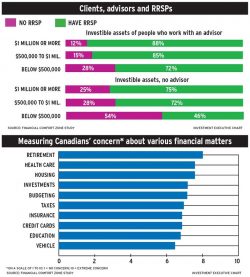

Other financial priorities make contributing to these accounts difficult for some clients

Developing a process that will underpin the relationship between mentor and mentee can help the partnership flourish

In the final video of a six-part series on regulatory changes, Dan Richards, CEO, Client Insights and Lynn McGrade, partner at Borden Ladner Gervais LLP,…

A well-suited mentor is not necessarily someone who is more experienced than you, and he or she may even be in a different industry

Mentoring has many benefits for both junior advisors establishing their careers and senior advisors striving to keep up with changes in the industry

In part three of a three-part series about yearend tax planning, Jamie Golombek, managing director of tax and estate planning with CIBC Wealth Strategies Group,…

In part five of a six-part video series on regulatory changes, Dan Richards, CEO, Client Insights and Rebecca Cowdery, partner at Borden Ladner Gervais LLP,…

In part four of a six-part video series on regulatory changes, Dan Richards, CEO, Client Insights, speaks with Lynn McGrade, partner at Borden Ladner Gervais…

There are three tax strategies expiring at the end of the year that clients should take advantage of before Dec. 31

In part one of a three-part series about year-end tax planning, Jamie Golombek, managing director of tax and estate planning with CIBC Wealth Strategies Group,…

Jamie Golombek, managing director of tax and estate planning with CIBC Wealth Strategies Group, reviews some of his major yearend tax planning tips

Investors will no longer be able to switch from one fund to another within these structures without potential tax liability, but tax strategies such as…

Skyrocketing home prices in Vancouver and Toronto are attracting the attention of the CRA, which is boosting its surveillance of the higher-value transactions to look…

While the Harper government was a strong proponent of tax credits, many experts suggest that these credits cost Canada more than they are worth because…

Numerous changes are in the works to make the tax code more coherent while making the pursuit of tax evaders and closing the so-called "tax…