There are about 770 exchange-traded fund (ETF) tickers in the Canadian market right now. With so many options available, narrowing down which ones suit your client’s unique needs takes deep analysis and a knowledgeable team, noted RBC Global Asset Management (GAM) experts during a panel at the recent 2018 ETF Summit in Toronto.

“There are multiple types of ETFs in the marketplace today,” explained Trevor Cummings, Head, Business Development, Exchange Traded Funds, with RBC GAM. “Since there are so many, what you’ve got to do is compartmentalize. I would bucket them into four main categories: broad index, narrow beta, rules-based, and, finally, active.”

Cummings defines the four main ETF categories as follows:

Broad index ETFs: These can be used as core building blocks of portfolios. Advisors can set asset allocation effectively at low cost by using broad or passive exposures to certain asset classes.

Narrow beta ETFs: These ETFs track indexes that are sector or country specific. They allow advisors and portfolio managers to be tactical. If, for instance, an advisor thought energy was due for a rebound, they might take a position in an ETF that tracks the energy sector.

Rules-based ETFs: These offer factor exposure, such as value, growth, dividends, or quality. These ETFs can be used strategically to tilt portfolios based on investor needs or current market conditions.

Active ETFs: As the name suggests, these ETFs are actively managed. The key is to understand your client’s investment objective and be very clear on how the ETF will be run. Choose a portfolio manager with a proven track record of delivering risk-adjusted returns through a range of market conditions.

“Choosing the right type of ETF is going to be based largely on what you’re trying to achieve—whether it’s offering broad exposure or trying to find a solution to fill a specific gap in a particular portfolio,” said Cummings. “If you’re trying to add incremental returns for an investor, but you don’t want to add substantial risk, then you may want to look at rules-based ETFs that can address a certain theme or opportunity you believe will help the portfolio. As long as the objective and methodology of those ETFs meet your expectations, they are worth considering.”

“Since there are so many ETFs in the marketplace today, what you’ve got to do is compartmentalize. I would bucket them

into four main categories: broad index, narrow beta, rules-based and, finally, active.”

Trevor Cummings

Alternatively, if advisors want to be opportunistic or timely, they might consider narrow beta ETFs, like corporate bonds or Canadian banks. “You can determine when you want that exposure and when you

put the trade in a client’s portfolio,” said Cummings. “That said, you would also need to determine the exit strategy.”

When evaluating ETFs, cost is often an important consideration. Cost is primarily management fees, which typically include operating expenses.

“One of the myths surrounding ETFs is that they are always cheaper than mutual funds. Some niche ETFs have management fees of 90, 100, even 115 basis points,” said Cummings. “That is well above what you might pay for a low-cost Series F mutual fund.”

Still, when deciding on what product is best for your clients, fees aren’t the only factor to consider. “You should also think about the value proposition that an ETF can offer your clients,” noted Cummings. “Think about the quantitative aspects: assets under management, history, distributions. But also think about the qualitative aspects: will the ETF sponsor be able to help me run my practice more efficiently?”

“At RBC GAM, we want to differentiate ourselves on the basis of that qualitative level of service—to be consultants to portfolio construction, before we’re salespeople for ETFs,” he added.

“Fees matter, but they’re not the be-all and end-all. Fees are only an issue in the absence of value. One of the things we want to do at RBC GAM—whether it’s with ETFs, mutual funds, hedge funds, or segregated funds—is to make sure there’s a great value proposition for the fee that someone is going to pay.”

6 TIPS TO CONSIDER WHEN TRADING ETFs

Limit orders allow you to set the price; market orders are based on the market price, which can change due to volatility or liquidity. This is why trading using limit orders is beneficial in certain situations, because it provides your client greater control of the execution price.

Volatility can cause bid/ask prices to widen. The market is particularly volatile in the first and last 20 minutes of the trading day due to settlements and supply adjustments.

Most international markets close by our afternoon. And if the market is closed, then market makers are pricing based on guesses and can’t hedge until the next day. “If you’re trading international ETFs when the international markets are closed, you’ll see the spreads are wider,” said Naseem Husain, ETF Capital Markets Specialist, Exchange Traded Funds, with RBC Global Asset Management (GAM). “Market makers don’t know exactly what the price is going to be when those markets open next, and when there is uncertainty, there has to be some sort of price premium attached to that.”

This is why advisors should consider the time of day. For instance, for European ETFs, the market closes at 11 a.m. EST. Husain suggests avoiding the market between 9:30 a.m. EST and 10 a.m. EST, when possible. There are typically rapid price fluctuations as market makers adjust their quotes on securities and complete the market-opening price discovery process. Trading between 10 a.m. EST and 11 a.m. EST is the ideal time to trade to minimize paying this uncertainty premium.

Many ETFs that trade on Canadian markets hold U.S. and international securities. There may be days when the ETF will trade on a Canadian exchange even though it is a holiday in the country where the underlying securities trade. This can cause bid/ask spreads to widen. “One of the worst days to trade a European equity ETF is the Thursday before Easter,” noted Trevor Cummings, Head, Business Development, Exchange Traded Funds, with RBC GAM. “That’s because Canadian markets will be closed for Good Friday. On Easter Monday, the TSX is open, but the European market is still closed. So if you’re trying to trade a European equity on the Thursday before Easter, market makers have got two full days of exposure to worry about before European markets resume trading on Tuesday.”

These types of announcements introduce greater fluctuations to securities values and can potentially widen bid/ask spreads.

If you’ve done your research and know you have the best information, then don’t hesitate to join the bid.

The key is to keep your emotions out of it, and focus on quantitative analysis.

One of the main challenges advisors may have when trading ETFs is to understand their liquidity, explains Naseem Husain, ETF Capital Markets Specialist, Exchange Traded Funds, with RBC Global Asset Management.

“One of the common misconceptions out there is that a new ETF may be less liquid than an ETF that has been on the market for decades,” he observed.

“If we launched a product tomorrow that tracked the same index as an existing product on the market, we would know the exact volume and volume characteristics of all the underlying securities in both ETFs,” he said. “We’d have an understanding of what the implied liquidity would be at any given time. So even though the competing product could have the benefit of 10 years of trading volume history, both ETFs could trade $100 million at the same spread costs, as that new product has the exact same liquidity characteristics.”

Liquidity of an ETF is a mathematical calculation of the weighted average of its constituents, or holdings, noted Husain. “So what makes up the fund, where those securities are trading, and any other relevant characteristics are factored into the price. And a market maker is available when you’re ready to trade to provide that liquidity.”

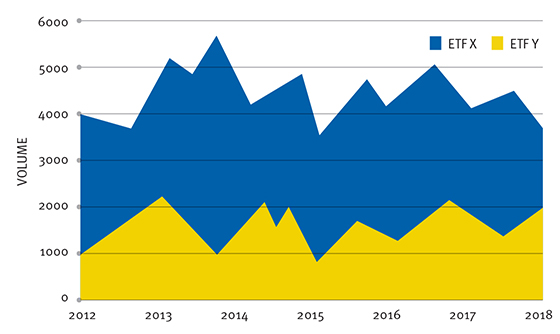

LOW TRADING VOLUME DOESN’T MEAN LOW LIQUIDITY

Your client is looking to buy an exchange-traded fund (ETF) that holds Canadian large-cap stocks, which represent ownership in large, in-demand companies. Your research turns up two ETFs that are almost identical in holdings and bid/ask spread.

At first glance, you may think you should buy ETF X because it appears to be more liquid—there are more units changing hands with a small bid/ask spread. But, in reality, ETF Y is just as liquid as ETF X because it holds essentially the same highly liquid securities. Facing a choice between two ETFs with similar liquidity, advisors can then look to other factors—product quality, level of service from each provider, and management fees—to decide.

Both experts agree that it’s not about whether an active or passive strategy is best. If you choose one over the other, you may miss out on opportunities to create a better risk-return relationship for your clients. Instead, consider both. William F. Sharpe, who created the Sharpe Ratio, noted that the sum of alpha is zero, explains Cummings. “For someone to find alpha and outperform the market, someone else needs to underperform the market by a similar amount,” Cummings points out. “So finding alpha can be challenging in certain efficient asset classes.”

“One of the common misconceptions out there is that a new ETF may be less liquid than an ETF that has been on the market for decades.”

Naseem Husain

Emerging market equities is one example where active management has a greater opportunity to outperform. “If a portfolio manager is skilled, emerging markets are an asset class where they have a much better chance of creating investment outperformance, or excess returns,” observed Cummings. “Overall, it’s about evaluating where you think there’s alpha. It’s also about evaluating whether your providers have a track record of delivering alpha at cost-effective levels.”

No matter which strategy or ETF you choose, you have to ensure it meets the goals of your clients. And that’s why it’s helpful to have a team of dedicated experts behind you.

RBC GAM’s sales support team is available to investment advisors, helping them with any issues, noted Husain.

“Advisors may feel left on their own when trading ETFs,” he added. “There’s a last trading price and a NAV price, and there’s a bid/ask price. All these things are moving around throughout the trading day.Advisors don’t necessarily know when it’s a good time to trade, or how much they can trade at one time. That’s a service we provide at RBC GAM. We help advisors execute their trades; there’s someone to help them through the entire process.”

The team uses a system that looks at the underlying holdings of each ETF that RBC GAM offers. The system helps evaluate the ETF’s pricing in real time, using the same data as the market maker.

“We can bring advisors right up to speed, educate and level the playing field, to help them get the best possible execution for their clients,” said Husain.

So, after evaluating the different types of ETFs and their providers, focusing on the value you provide, and working with a team, you’ll be able to help your clients choose the ETFs that suit their unique needs.

“At the end of the day, what is an advisor’s worth? Is it beating some index or arriving at some return, better than your competitors?” Cummings asked. “Really, it’s about putting it all together, the sum of the parts. And it’s partnering with ETF providers you want to work with.”

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds (ETFs). Please read the prospectus or Fund Facts document before investing. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. ETF units are bought and sold at market price on a stock exchange and brokerage commissions will reduce returns. RBC ETFs are managed by RBC Global Asset Management Inc., an indirect wholly-owned subsidiary of Royal Bank of Canada.

® / ™ Trademark(s) of Royal Bank of Canada. Used under licence.

© RBC Global Asset Management Inc. 2018