PAID CONTENT

Designed Securities started in 2021, in an overcrowded industry, in the middle of COVID, with no advisors and no assets under administration (AUA). Since we operate in an industry with the biggest companies in Canada, we had to act fast, and seriously innovate. We knew that our vision was not going to be easy explain, because it challenges existing dealer models.

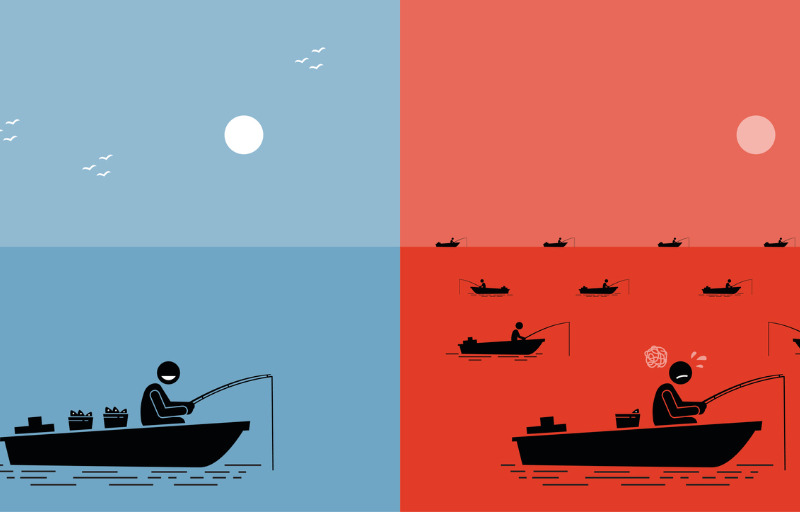

As a new dealer, rather than using a traditional business model to compete against the financial giants, we decided to focus on a new model for working with advisors, with a goal to make our competition irrelevant. By doing so, we introduced a value proposition for advisors that has never been offered using some of the concepts of Blue Ocean Strategy.

What makes us different? We offer all these following ingredients: High quality, low cost, customization, and an overall metaphor of homemade, rather than store-bought or mass-produced.

The industry has an interesting dichotomy. On one hand, it has been the same. That is, advisors build trust with clients for the long run, in pursuit of their financial objectives. On the other hand, the industry has changed significantly. Regulatory evolution, changing fee structures and mergers and acquisitions of dealers make the industry look and feel significantly changed.

For us, client focus, is where we drew our inspiration. While other changes are typically driven by corporate agendas, the experience our advisors have is driven by that long run foundation of trust and their relationship with their clients. To serve their client with high quality, we need to deliver high quality. To operate independently and serve clients free of bias, they need manageable costs and need to have the flexibility to approach each client’s uniqueness. Our high quality, low cost and customized approach reflects the tenets of a Blue Ocean Strategy.

How are we able to do it? 1. We eliminated much of the excess. In costs, and in unnecessary processes. 2. We maintain a high ratio of staff to advisors to provide a high level of personal touch. Currently, we have a 2 to 1 advisor to staff ratio 3. We reduced our investment in unnecessary platforms, software, and systems most of our advisors would never use. We also avoid hiring analysts, economists, etc. since we realize, independent advisors have many options to find this type of information on their own. 4. We created something that isn’t currently offered. A totally independent dealer, that provides a true partnership experience. One that helps advisors explore the best available options for clients, to foster that ongoing trust and dedication they demonstrate every day.

Another differentiator is our transparency. Part of our philosophy is total transparency and iterative dialogue amid our decisions. It reveals a lot to our advisors about how we prioritize, and who we are putting first and when. We’ve been demonstrating this from day one and it is part of our competitive advantage. Every dealer has its method of decision making and advisor communication, however, it’s something that is very hard to change, and for many reasons, shifting gears to create more transparency between a dealer and its advisors is impossible. This may be due to structure, ingrained behaviours and reward systems or incentives. Because of this, in many cases our competition doesn’t want to, or simply can’t, be competing against us on this philosophy, making it an uncontested market space – a concept found at the root of the Blue Ocean Strategy.

When speaking with advisors from virtually every dealer in Canada, the most common thing we hear is “I like the way my dealer used to be.” When digging into that comment, we often find that the past experiences seemed rich with considerations of what the advisor needed, and there was more mutual understanding about decisions made by a dealer. Whether through growth, change in leadership, or a sale to a financial giant, most of our competitors have lost the homegrown culture that made them great in the first place.

To maintain what “used to be” a dealer must actively manage that culture consciously, which is so often overlooked. Culture can be seen as secondary to other priorities of a dealer, like technology or product development. To us, those are operational tools that can’t be compared to strategic concepts like culture. Others find culture hard to manage amid the rigidity of a highly regulated industry. We see it as a key element of maintaining what we offer despite our growth and department evolution. With this intentional cultural focus, our advisors will like the way we are, and not the way we “used to be”. Again, we find that our focus, and divergence from the norm are parallel with Blue Ocean Strategy approach.

In summary, we decided not to fight with our rivals in a shrinking profit pool. We’ve created a new pool for advisors. Our unique business model continues to thrive, as advisors not only choose to learn about our vision, but ultimately, be part of it.