Advisors and planners with Canada’s Big Six report progress in their retail branches, across a range of workplace measures. In addition to well-received digital investments, these institutions are thinking hard about the cultures they’re building, Investment Executive’s 2025 Report Card on Banks found.

Four of the six banks garnered improved IE ratings compared with a year ago, based on results from their retail bank advisors (an IE rating is the average of all of a company’s category ratings, excluding the Net Promoter Score). Two of those institutions — Bank of Montreal (BMO) and Bank of Nova Scotia (Scotiabank) — earned significantly improved ratings (up by half a point or more). Both Canadian Imperial Bank of Commerce (CIBC) and National Bank of Canada had multiple categories in which their retail branch advisors signalled improved support.

Collectively, the banks’ performance averages improved significantly compared with 2024 across nearly half of the 22 categories reviewed.

The largest year-over-year increase was for these banks’ “client relationship tools” (rated 8.3 from 7.6 collectively), with four of the six banks clocking notable improvement in advisor sentiment within their retail branches. The next largest increases were for “effectiveness in keeping advisors informed” (communication effectiveness category; rated 9.0 from 8.4) and “compliance relationship & support” (8.4 from 7.8).

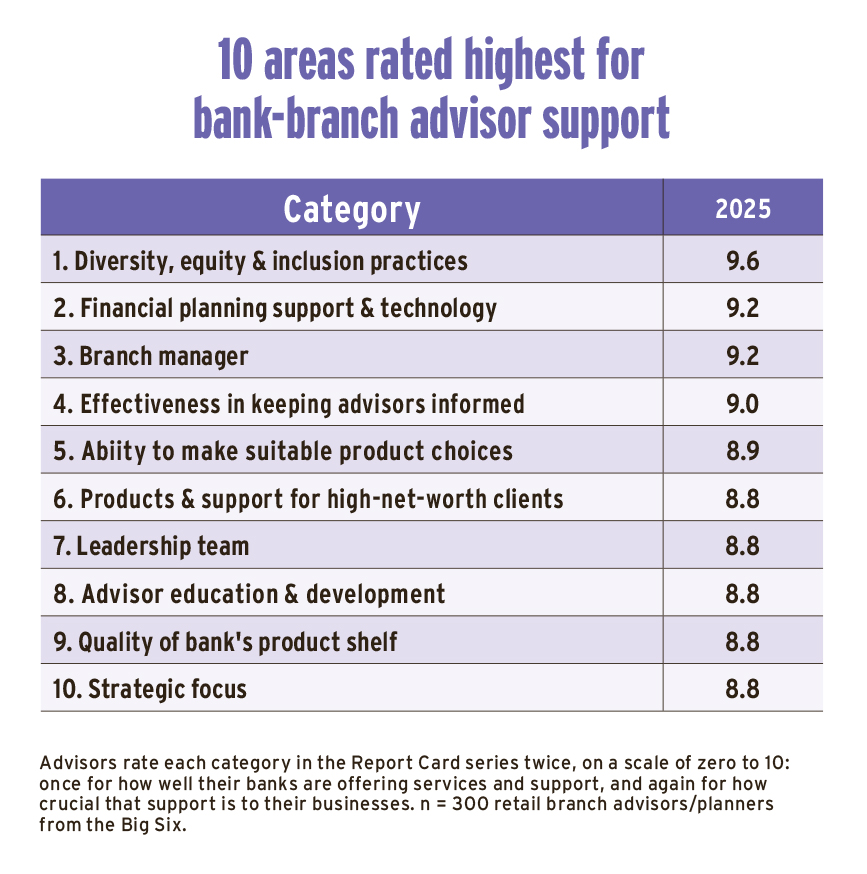

The communication effectiveness category was also one of the 10 areas where the Big Six’s retail banking businesses posted their strongest performance for 2025, after “diversity, equity & inclusion practices” (rated 9.6 for overall performance from 9.3).

Advisors and planners polled collectively also felt good about their “financial planning support & technology” (rated 9.2 from 8.7), and about “branch manager” and “leadership team” guidance from the banks’ retail-branch businesses (rated 9.2 from 8.8, and 8.8 from 8.4, respectively).

Satisfied advisors appreciated their ability to connect easily with clients, colleagues and managers at their institutions, and at the same time remain relatively autonomous.

An advisor in Ontario with Scotiabank (these branch-level respondents are registered with Scotia Securities Inc.) reflected on their access to leadership and job flexibility: “[I like] that we have [a] line of communication with management and executives; they are fluid and adaptive to change. They listen to our voices … In my division they give us freedom to operate how we want to, [with] no micromanaging.”

A planner in Alberta with BMO’s financial planning division didn’t mind a little oversight and direction, so long as the bank respected him and prioritized the client. “For me, personally, they trust me to do what I need to do [and] they usually support me well. I’d say the compensation is pretty good, and recently they are push[ing us] to do more planning. I can see that growth is important to them and … that’s important to me.”

Still room to improve

Every Report Card, no matter how positive, comes with calls for improvement.

In this case, even though the client relationship tools and compliance-support categories were among those with the greatest year-over-year improvements in collective performance, neither of those categories made the list of best-performing areas. They remain on the list of the 10 areas where the Big Six could deliver better support within their branches.

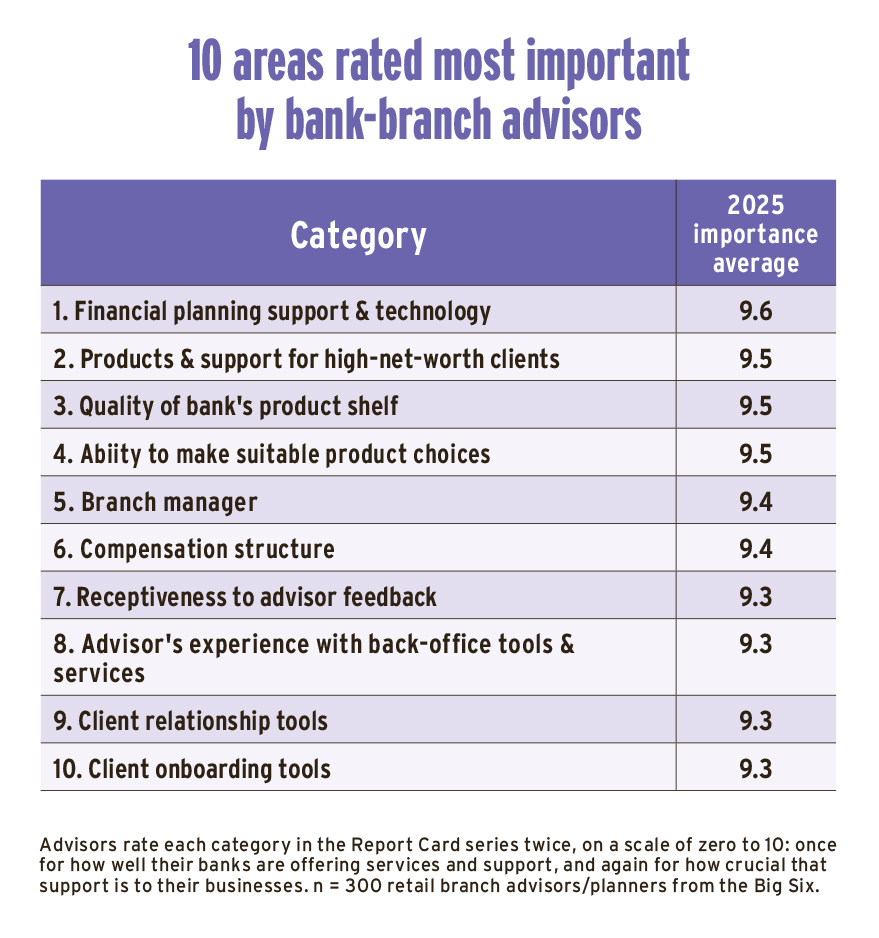

Each year’s satisfaction gap list is compiled by identifying the largest negative differences between each of the categories’ overall performance and importance averages. The importance averages indicate how crucial each type of support is to the average advisor.

This year’s list included all five of the technology-suite categories, reflecting how bank advisors feel technology tweaks are never really complete. When asked where their banks could improve the most, more than one-third of this year’s retail bank advisors mentioned technology issues and glitches.

For example, a planner in Quebec with National Bank said they appreciated their bank’s collaborative culture and their own “proximity to senior management,” but that their digital tools could at times hold them back. They felt consistently improved technology would “make it easier for us internally.” The advisor said, “The system slows us down and we have goals to achieve.”

National Bank had stable ratings for its branch-level technology suite overall — and even saw a significant bump in its client relationship tools rating (8.0 from 7.2 in 2024). Tony Scalia, vice-president, investments, with National Bank confirmed the institution continues to use the SAP Customer Relationship Management (CRM) application, chosen and piloted more than 10 years ago. However, the bank is putting “more rigour and emphasis” into the support offered for that program, to ensure its planners both understand and use it.

For Royal Bank of Canada (RBC), where IE spoke with planners from RBC Financial Planning, three of the five technology categories had significantly lower ratings this year relative to 2024. Planners there suggested rollouts of new digital tools could be smoother. One planner in Alberta requested “reliable technology, where system outages and glitches aren’t a daily part of our jobs.”

That same planner sought more automation, to cut down on repetitive data entry for compliance documents. Across the bank’s respondents, 73.2% said RBC was proactively investing in time-saving tools, but that result was lower than this Report Card’s collective average of 85.5% for that query.

Jodi Wright, who became RBC’s senior director and head of financial planning and mass affluent client strategy in the spring, said fixes are on the way. The bank’s new five-year, multi-part strategy includes digital investment.

“Ensuring consistent reliability is a top priority,” she said. “As is typical with any new digital rollout, there may be glitches here and there.” Still, Wright feels the bank’s branch-level tools and calculators are “tremendously valuable and critical,” and she said there are ways for advisors and planners to give feedback should any issues arise.

Advisors want to feel valued

Both advisor pay categories also appeared on the satisfaction gap list for 2025.

That matters because, based on a separate and new query, about one-third of the advisors and planners polled (32.1%) said advisor pay consistency and transparency was most important to them — no other category ranked higher, out of the six options. (Read: Retail bank advisors identified pay as a key motivator.)

The second-most popular choice for where banks should put their attention was the culture group of categories (chosen by 27.8% of respondents).

Retail branch advisors want support systems within their banks that enable efficient client connections and help them feel valued personally.

“No bank is perfect,” said one planner in British Columbia, with TD Wealth Financial Planning under Toronto-Dominion Bank. Still, “We sacrifice many hours for this job,” they told us. This planner said fair compensation, supportive managers and in-depth planning resources all matter when it comes to advisor satisfaction.