This article appears in the April 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

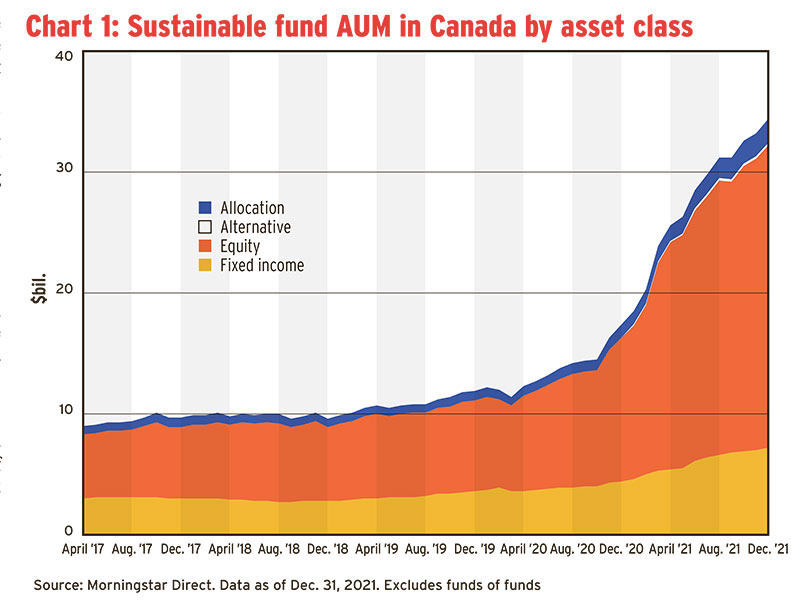

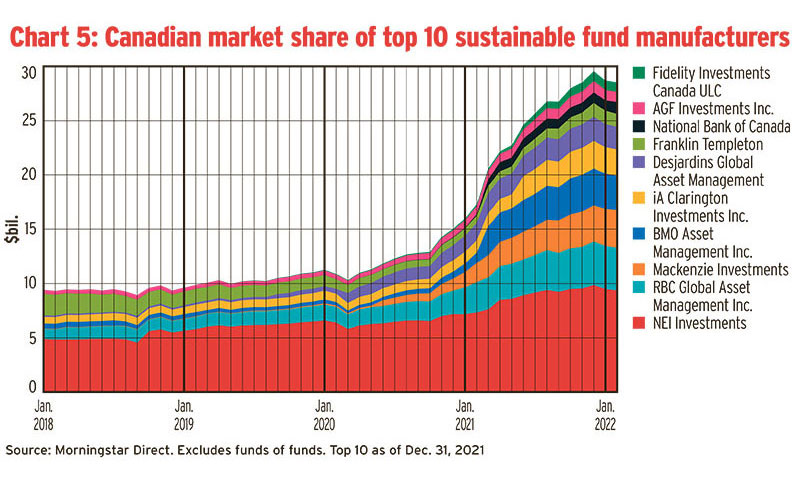

Sustainable mutual funds and ETFs had another banner year in 2021, with their assets under management (AUM) doubling to $34.5 billion from $17.4 billion* over the course of the year, according to Chicago-based Morningstar Inc.

“2021 was a pretty good year for investors in general, so of course assets will grow,” said Ian Tam, director of investment research, Canada, with Morningstar. Sustainable fund flows were positive in all fiscal quarters, he said. And investors generally didn’t sacrifice returns: in 2021, 49% of sustainable funds (70 of 144 with sufficient data) outperformed their Morningstar category peers; for the five years ended Dec. 31, 53% (31 of 59) outperformed.

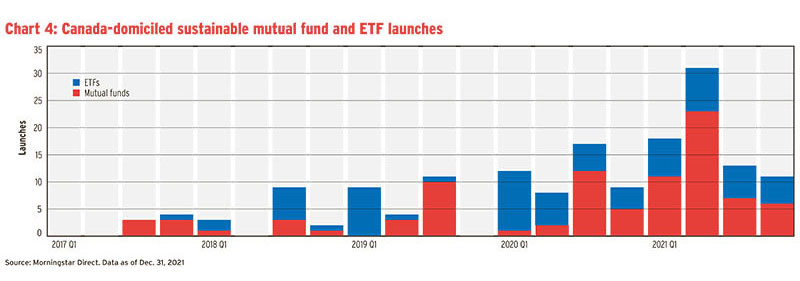

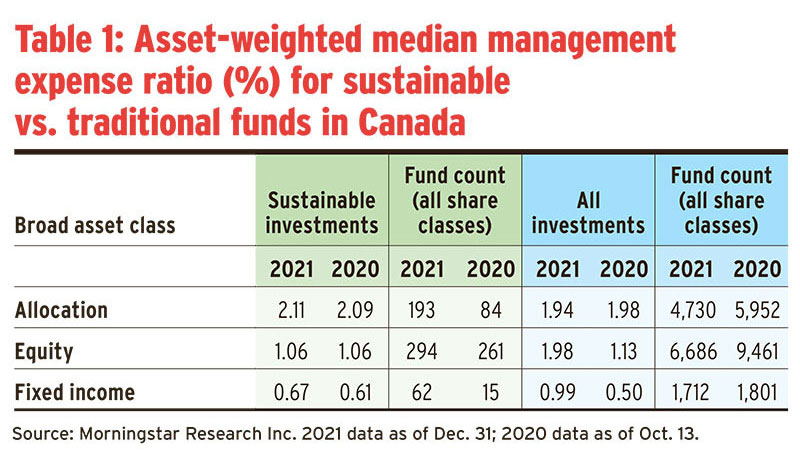

Manufacturers launched 73 sustainable mutual funds and ETFs in 2021 (see Chart 4), collecting $3 billion in assets, Morningstar reported. While mutual fund launches outnumbered those of ETFs, indexed products are influencing the average management expense ratio for sustainable funds.

“Surprisingly, sustainable equity funds appear cheaper than the broader universe,” Tam said. (See Table 1.) The reason, he explained, is “a proliferation of low-cost indexed ETFs in this space, which drags the calculation down. [But that’s] still very good news for investors.”

This year has more good news for investors: the Canadian Securities Administrators (CSA) released guidance in January on how funds should disclose ESG factors, and the Canadian Investment Funds Standards Committee released a draft identification framework in April. (Tam is CIFSC’s chair.)

“Once funds start to renew their prospectuses, we’ll get a lot more detail, which will help [investors] to identify funds,” Tam said.

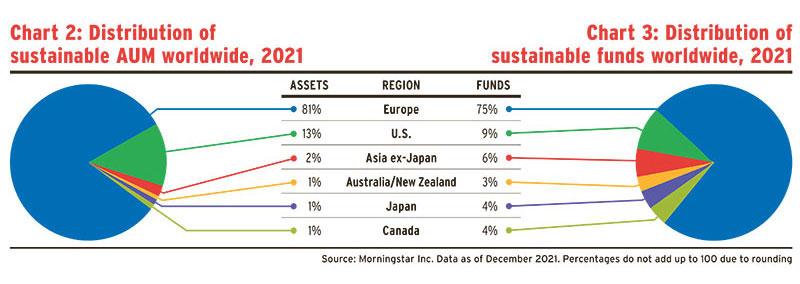

Many investors were spooked by Morningstar’s reclassification of more than 1,200 Europe-based sustainable funds at the end of 2021, but Tam said the change was due to a methodology adjustment — “it didn’t have to do with greenwashing.”

Morningstar stated that the reclassification was “primarily the result of [a] shift in the fund universe analyzed [and] not widespread evidence of prospectus or marketing claims that do not meet their promises.”

Based on the restated figures, sustainable fund AUM globally rose by 53% in 2021, reaching US$2.7 trillion as of Dec. 31.

Tam doesn’t anticipate the CSA’s guidance will lead to a similar reclassification in Canada — either by Morningstar or by the industry in general. “I don’t think [the fund universe] is going to change dramatically, but I won’t know until I read the [revised] prospectuses,” he said. “I think the majority of the data providers and research houses in Canada tend to view a similar universe of what we deem as sustainable funds.”

Click image for full-size chart

Click image for full-size chart

Click image for full-size chart

Click image for full-size chart

Click image for full-size chart

*This figure was cited as $13 billion in our April 2021 edition, which was correct at the time. Ian Tam of Morningstar said the firm re-states assets under management as it receives more information.