Financial services firms that focus on employing financial advisors who are able to establish strong relationships with clients – based on professionalism, trust and strong communication, among other positive personality traits – are more likely to earn client loyalty and to retain those clients over the long term, according to recent research from Mississauga, Ont.-based Credo Consulting Inc.

Advisors with Toronto-based brokerage firms Raymond James Ltd. and RBC Dominion Securities Inc. (DS), as well as Mississauga, Ont.-based full- service dealer Investment Planning Counsel Inc. (IPC), enjoy some of the strongest relationships, according to the research.

In contrast, advisors with the Big Six banks’ retail branch networks have the weakest relationships with their clients. Survey participants who worked with these advisors were less likely to ascribe positive personality traits to their advisors, felt less comfortable discussing concerns and were more likely to consider switching advisors.

“As investors climb the net-worth ladder, they tend to work with more highly trained, more knowledgeable advisors,” says Hugh Murphy, managing director with Credo. “What you see in [this] research is that when the relationships are deeper – and those deeper relationships exist more reliably at the dealer and brokerage level – investors will ascribe greater scores to positive personality traits for their advisors because [these clients] know their advisors better.”

This research was part of the ongoing Financial Comfort Zone Study, a national consumer survey conducted in partnership with Montreal-based TC Media’s investment group. (TC Media publishes Investment Executive.) The report referred to here focuses on the responses of 12,000 survey participants who indicated that they worked with an advisor, and tabulates the results by firm.

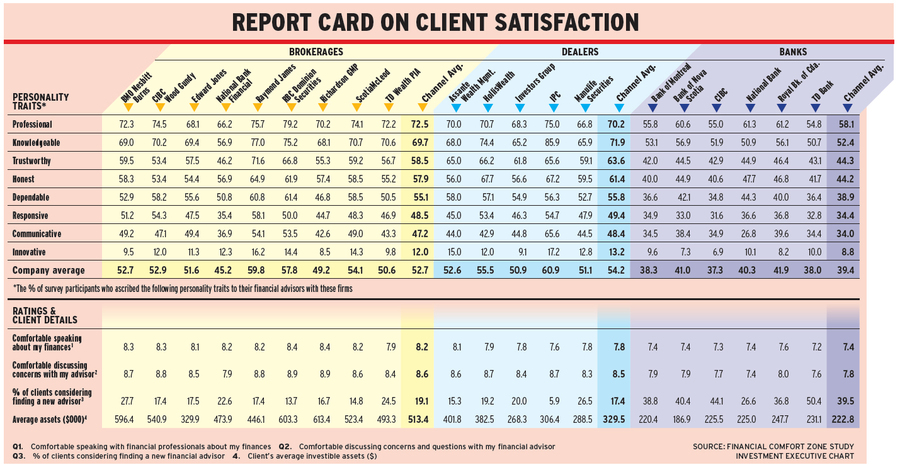

Credo asked survey participants who worked with an advisor to indicate which of several personality traits they would ascribe to their advisor, including “professional,” “knowledgeable,” “trustworthy,” “honest,” “dependable,” “responsive,” “communicative” and “innovative.” (See accompanying table below.)

Firms employing advisors who were noted most often as having some or all of these positive personality traits tended to be firms that employed advisors who also received strong scores when survey participants were asked if they felt comfortable discussing problems with their advisor or if they felt loyal to their advisor.

IPC’s advisors received some of the strongest responses across all the personality trait categories. For example, 85.9% of clients who worked with an IPC advisor described him or her as “knowledgeable”; 65.6% described the advisor as “communicative”; and 17.2% described the advisor as “innovative.” In each of these categories, IPC advisors received the highest percentage of positive responses from clients.

In addition, survey participants who have IPC advisors gave an average score of 8.7 when they were asked to rate the statement: “I’m comfortable discussing concerns and questions with my financial advisor” on a scale of one to 10. This score was tied for third place among all firms in the survey and was tied for the top score among the dealer firms.

When survey participants were asked if they were considering finding a new advisor, only 5.9% of those who had an IPC advisor said yes, the lowest percentage among all the firms in the survey.

Core priorities

IPC advisors increasingly go beyond the traditional questions of investment objectives and time horizons, and focus on identifying clients’ core priorities and values, says Sam Febbraro, executive vice president of advisor services with IPC.

“I’m finding a lot more advisors are asking clients questions such as, ‘What does money mean to you?’,” Febbraro says. “They’ll ask, ‘What’s your ideal advisor?’ ‘Do [you] want someone who’s more of an engaged partner, an expert partner or a trusted member of a team [of professionals]?'”

Among the brokerages in the survey, Raymond James was the standout in the personality categories: 71.6% of clients described their advisor as “trustworthy” and 58.1% described the advisor as “responsive” – the highest rankings in these categories among all firms covered in the survey.

As well, survey participants who have an advisor with Raymond James gave an average score of 8.8 out of 10 to the statement: “I’m comfortable discussing concerns and questions with my financial advisor.” This score was tied for second place among all firms in the survey.

Furthermore, only 17.4% of survey participants who have a Raymond James advisor indicated that they were considering finding a new advisor – among the lowest responses to that question.

Raymond James’ relatively strong results most likely can be attributed to the firm’s commitment to fostering an entrepreneurial and independent culture, suggests Richard Rousseau, executive vice president, wealth management, with the firm: “I fundamentally believe in a professional relationship between the client and [advisor], as opposed to an employee relationship in which the person is acting more on behalf of the firm.”

DS stood out among the bank-owned brokerages in the survey: 79.2% of survey participants who have a DS advisor described him or her as “professional” and 61.4% described the advisor as “dependable” – the highest ratings among all firms in these categories.

Survey participants with DS advisors gave an average rating of 8.9 to the statement: “I’m comfortable discussing concerns and questions with my financial advisor” – which was tied for the highest rating among the firms.

As well, only 13.7% of survey participants with a DS advisor said they were considering finding a new advisor, the second-lowest ranking in the survey.

DS advisors benefit from their firm’s long-standing commitment to providing clients with comprehensive support services, such as estate and trust, financial, investment and business-owner and business succession planning, says Tony Maiorino, vice president, wealth-management services, in Royal Bank of Canada’s wealth-management division.

“You really are now getting to the point at which the client is looking at the relationship [with his or her advisor],” he says, “and there is a significant gap in the value that they might be receiving elsewhere versus what we’re trying to deliver.”

In contrast, the fact the banks’ branch-based retail advisory sales forces tended to have weaker relationships with clients, according to the survey’s results, is not surprising, says Sara Gilbert, founder of Montreal-based Strategist Business Development.

That’s because the client/advisor relationship at the bank branch level is transactional, product-based and reactive rather than proactive as is at dealers or brokerages, she says.

“If the relationship is based on a transaction,” she says, “there is no relationship.”

Credo surveyed more than 25,000 Canadians about their attitudes toward their financial lives and priorities during 2016 and 2017.