Finding yield in the bond junkyard

The high-yield bond market is being infected by the grim circumstances facing energy firms with high debt levels. The trick is to find the survivors

- By: Andrew Allentuck

- February 26, 2016 October 30, 2019

- 00:00

The high-yield bond market is being infected by the grim circumstances facing energy firms with high debt levels. The trick is to find the survivors

The relative pricing of Canadian assets, accessible leverage markets and a weak C$ are leading investors into private equity

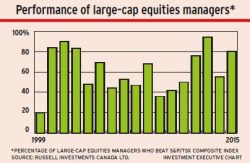

Last year's decline in Canadian equities markets was a tailwind for active managers of large-cap equity funds

PMAC says that changes are needed to spur participation in PRPPs, which have failed to gain much traction

Basing a strategy on currency swings often is a fool's game, but the drop in the C$ vs the US$ is something that cannot be…

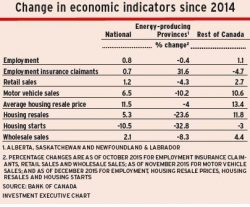

The resiliency in much of the country is the result of the concentration of oil production in only a few regions

The OSC, the MFDA and IIROC are planning reviews of fees and incentives that could negatively affect clients

The market for clients and investment dollars is changing, upended by the low fees and convenience of fintech

MFDA report shows that many firms are failing to make a genuine effort to implement new regulations

Segregated fund families that maximized exposure to foreign and U.S. equities performed strongly in 2015

Several concerns remain, such as linking payments to monetary sanctions

The independent investment-management firm is looking to double AUM within the next five years

Yvon Charest, president and CEO of Quebec City-based Industrial Alliance and Financial Services Inc. (IA), led Finance et Investissement‘s (FI) Top 25 ranking of leaders…

Study from U.S. firm found that advisors who made the switch to an AUM-based fee model retained 90% of their clients

With markets caught in the bear's swooping claws, now is the time to contact clients and demonstrate that you are on top of matters

For Beth Hamilton-Keen, the CFA Institute's new global chairwoman, the value of good advice goes far beyond portfolio returns

Retail investors in Ontario now have access to securities that previously were available only to accredited investors

Most independent mutual fund dealers don’t expect to survive if investment dealers are permitted to field their own teams of mutual fund representatives. That’s according…

One puzzling finding of the research is that many clients do not believe that they are paying for their advisors' services

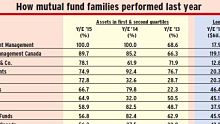

Mutual fund families that held significant amounts of foreign stocks performed well in 2015

Investment industry intransigence toward the dispute-resolution service has grown since the last independent review in 2011

The Canadian arm of Raymond James is looking for financial advisors to boost its wealth-management business. Mario Addeo and Richard Rousseau are putting out the…

Some insurance agents have raised concerns about the advisor screening, contracting and compliance initiative

Global economic growth this year is expected to be anemic

© 2016 Investment Executive. All rights reserved.