Strong relationships drive client loyalty

Advisors with Raymond James, DS and IPC received some of the best ratings from their clients, according to new research

- By: Rudy Mezzetta

- January 15, 2018 November 9, 2019

- 00:19

Advisors with Raymond James, DS and IPC received some of the best ratings from their clients, according to new research

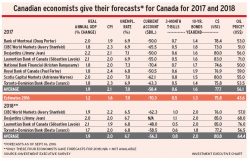

Canada’s growth expected to return to a more sustainable pace

Changes to CI Insurance come at a time when sales have stalled

Canada's top court will weigh in yet again on new national regulator

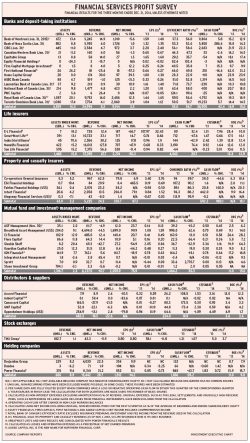

But Brookfield's recent substantial expansion has resulted in a drop of 50.9% in earnings, bringing down the sector's overall growth

CRM2 has raised investors' awareness regarding how much they pay for advice and how financial advisors are paid

Fidelity portfolio manager Mark Schmehl has outperformed consistently

IIROC proposal raises concerns

Hybrid concept could be more appealing than LTC insurance

Some robo-advisors are adding platforms and partnerships to make offering ETFs to clients much easier for mutual fund advisors

After 25 years with an insurance giant, Michael Stanley now oversees day-to-day operations at Sterling Mutuals

As TFSAs surpass RRSPs in popularity, both vehicles have their place in retirement planning

The Competition Bureau's draft report states that fintech firms face issues similar to those of traditional financial services firms

Provinces take different approaches to controversial practice

Feds take a “step in the right direction”

OSC LaunchPad is in high demand

The winner of the IIAC Top Under 40 Award has made up for his lack of experience by educating himself at every opportunity

Handling complaints internally could harm clients by diverting them from using OBSI or the courts

OSC allows Toronto firm to launch ICO via the offering memorandum exemption

Proposed bill would result in fundamental shift in Quebec

New rules in Quebec would allow consumers to buy life insurance online

Partnerships are at the heart of TD’s plans to modernize operations

Newsmaker: The CBA, long viewed as an excessively cautious group, is altering its approach to meet a shifting banking landscape

The SRO is better positioned to collect the sanctions it levies against individuals in Ontario: It now can enforce its disciplinary orders in court