This article appears in the April 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The investment industry’s assets, revenue and profits all soared over the past two years as companies benefited from a surge of retail investment during the Covid-19 pandemic.

According to the latest data from the Investment Industry Association of Canada (IIAC), client assets under management (AUM) were up by 55% since the pandemic began in March 2020, rising to $3.8 trillion as of Dec. 31, 2021. The industry’s financial fundamentals improved too, with most revenue sources growing and profits surging.

The pandemic has had a salutary effect on household savings. The latest data from Statistics Canada indicate that household net wealth rose to record levels in 2021, finishing the year at $15.9 trillion, up by $3.6 trillion from Q4 2019.

Much of this gain came thanks to the red-hot housing market: real estate equity accounted for more than half of that $3.6-trillion increase.

But real estate isn’t the whole story. The value of households’ financial assets (including equities, life insurance and pension assets) rose by more than $1.1 trillion from pre-pandemic levels, StatsCan reported. And households’ deposits grew by more than $300 billion from pre-Covid totals.

The investment industry has benefited from these trends. Alongside the 55% gain in client AUM, investors’ cash positions surged, rising by almost 50% to $102.1 billion at the end of 2021 from $69.2 billion in February 2020. Margin debt rose as well, climbing to $39.3 billion from just under $26 billion over the same period.

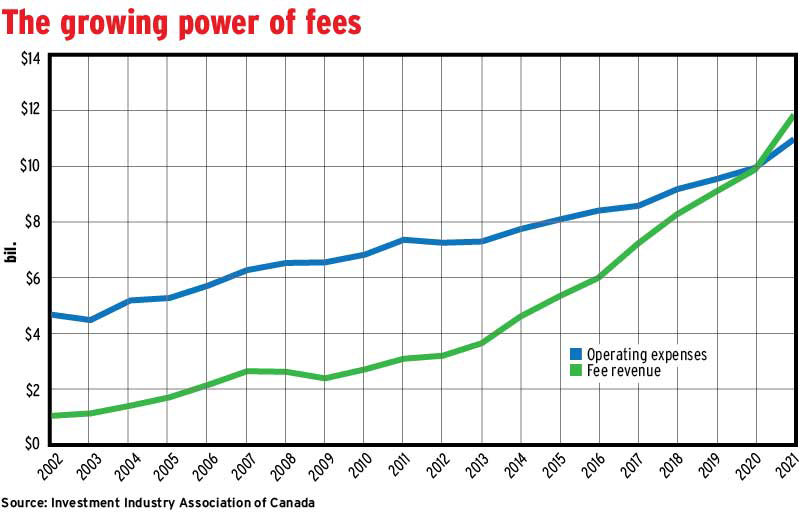

These trends have fuelled strong results for industry firms. For example, industry fee revenue rose by more than 30% during the pandemic. In 2021, total annual fee revenue came in at $11.9 billion, up from $9.1 billion in 2019. As a result, the industry’s annual fee revenue exceeded total operating expenses for the first time. (See chart.)

Commission revenue grew even faster than fees. Annual commission revenue (excluding mutual fund commissions) topped $4.4 billion in 2021, the IIAC reported, up from just over $3 billion in 2019.

These robust increases were bolstered by soaring investment banking revenue, as both equities underwriting and merger & acquisition activity ramped up in the past year. Annual industry revenue from equities issuance jumped to almost $2.4 billion in 2021 from just under $1.4 billion the previous year. At the same time, corporate advisory fee revenue (from M&A and other assignments) climbed by 65% to almost $1.7 billion last year from just over $1 billion in 2020.

There were weak spots — notably, industry net interest revenue, which dropped alongside the central bank’s shift to rock-bottom interest rates. In 2021, industry firms generated less than $1.5 billion in net interest revenue, down from $2.4 billion in 2019.

Nevertheless, total industry operating revenue still rose smartly over the past couple of years, rising to $30.4 billion last year from $23.6 billion in 2019. And, while expenses were up too, operating profits surged by 43.4% from pre-pandemic levels, rising to more than $10.9 billion in 2021.

All the major industry segments recorded gains over the past couple of years, but retail firms made the biggest leaps. For them, operating profits effectively doubled during the pandemic — jumping to over $1.2 billion at the end of last year from $615 million in 2019. In 2021 alone, retail firms saw annual operating profits rise by 30.8% as revenue rose by 26.5%, driven by strong increases in both fee and commission revenue.

Within the retail sector, the larger self-clearing firms led the industry’s gains in 2021, as they saw revenue climb by 39.1% during the year. Profits were up by 31.9%.

In contrast, retail introducers saw revenue rise by only 9.7% in 2021 from the previous year. Profits still climbed by 28.1% year over year, however, as firms trimmed operating expenses by 6.1%.

This reduction in operating costs runs counter to the overall industry trend of relentlessly higher expenses. In 2021, total industry operating expenses almost reached the $11-billion mark, up from $9.5 billion in 2019.

Yet, while the pandemic years have been good for the investment industry, the future might be less rosy. The large pile of household savings may be called on to cushion the effects of high inflation and higher debt-service costs.

According to the Bank of Canada’s latest survey of consumer expectations, households expect to spend about a third of their excess savings over the next couple of years.

In terms of household wealth, the resilience of equities valuations and the strength of the housing market pose additional risks. The prospect of corrections in elevated real estate and financial asset prices continue to loom large.

Click image for full-size chart