Financial advisor-owned brokerages have been successful in recruiting talent from bank-owned dealers in recent years — but banks don’t seem to be sweating the competition.

Independent investment brokerages such as Vancouver-based Harbourfront Wealth Management Inc. and Winnipeg-based Wellington-Altus Private Wealth Inc. have wooed advisors from the banks with the promise of greater autonomy and an ownership stake in the business.

“Advisors don’t want to go from one bank to the next — you see very little of that today,” said Danny Popescu, Harbourfront’s president and CEO. “They want something different, so they’re often intrigued by what the independents might offer.”

Harbourfront has 22 branches across Canada and plans to keep growing. In June, the brokerage welcomed the Peter Szeto Investment Group — formerly part of BMO Nesbitt Burns Inc. — to its roster, adding a $370-million book to Harbourfront’s growing asset base.

Harbourfront now has about $4 billion in assets under administration (AUA) and another $2 billion in assets under management through the third-party-managed pools it offers clients. But Popescu said he’s focused more on profitability than growing AUA.

“You can have huge assets, but if your profit margin is razor-thin, it really defeats the purpose,” Popescu said.

One of the perks of joining an advisor-owned firm — albeit one that comes with risks — is having skin in the game.

“We love advisors being shareholders with us because we find that’s the magic elixir,” said Shaun Hauser, president and co-founder of Wellington-Altus. “There’s only one rope, and everyone’s pulling in the same direction.”

Since Wellington-Altus launched in 2017, the company now has 33 offices and more than $15 billion in AUA. Hauser said most of the firm’s advisors have come from banks, which have several lines of business in addition to wealth management — and potentially competing priorities.

“That dislocation doesn’t exist here,” Hauser said.

Although independents have been eager to publicize the big names they’ve landed from banks, the banks themselves don’t seem fazed. Banks’ AUA still dwarfs the assets accumulated by advisor-owned independents — and not all banks have been losing advisors to independents.

“We’ve been very fortunate in that we’ve seen virtually no advisors leave us,” said Mike Scott, senior vice-president and managing director with RBC Wealth Management.

In fact, RBC has recruited advisors from independents — the bank just doesn’t publicize those successes, Scott said. When a small brokerage lands a team with hundreds of millions in AUA, it’s a big deal. For a bank, that’s a drop in the bucket.

“Obviously, the independents need to publicize it because that’s the only way they’re going to show there’s potential growth in their business and that’s how they’re trying to attract [new advisors],” Scott said. “We don’t have any interest in publicizing that.”

RBC didn’t reveal how many advisory teams or how much AUA it has added through recruitment. But Scott said media coverage of bank advisors moving to independents has been overblown: “There is no epidemic here at all with regard to advisors from bank-owned firms wanting to go to independents.”

There are numerous reasons an advisor might prefer to work for a bank, Scott said. Banks offer relative stability and name recognition. Banks also provide easy access to resources clients might need, from banking products to estate- and tax-planning services.

In a statement, Ed Dodig, executive vice-president and head of CIBC Private Wealth Management and Wood Gundy, touted referrals as one of the benefits enjoyed by bank advisors: “We have a collaborative approach in which our advisors work closely with colleagues across our bank on referrals and growth opportunities.”

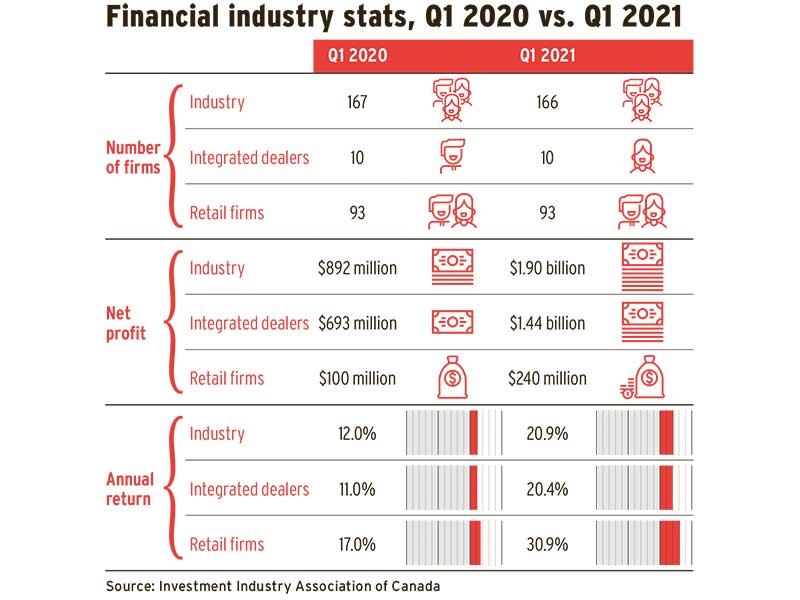

According to data from the Investment Industry Association of Canada, the large integrated dealers managed $2.79 trillion in client assets on May 31, or 80% of total AUA, down from an 85% share in 2015. Non-integrated retail dealers’ share has grown to 20% from 15% over that period, with total AUA more than doubling to $705 billion in 2021 from $325 billion in 2015.

So, why would an advisor choose to move from a bank to an independent, or vice versa?

The answer could boil down to company culture, said George Hartman, CEO of Toronto-based Market Logics Inc. Some bank advisors may thrive in the more entrepreneurial atmosphere of an independent, he suggested.

“I think the independents attract a different person than the banks do,” Hartman said. “But the banks have been better — to date, at least — than the independents at recruiting people. As a consequence, [banks] probably recruited people who, if they could do it over again, would probably have gone to an independent firm.”

Hartman emphasized that there are independent advisors who choose to move to banks. But banks that are worried about losing advisors to independents can do a number of things to retain advisors, he said, such as providing them with business-development support and making onboarding and serving clients easier.

“If I were an advisor, I’d want someone to help me manage my business, because it’s become overwhelming for many advisors,” Hartman said.

Simon Lemay, senior vice-president and national manager with National Bank Financial Wealth Management, said retention is “top of mind” for his firm, which strives for a more entrepreneurial spirit than the Big Five banks have.

“We’re trying to offer something a bit different than the other bank-owned brokerages,” Lemay said. “We’re trying to position ourselves as not the typical Bay Street bank, but as Montreal-based with a Montreal culture. There are the Big Five, and then there’s us.”

Lemay said he’s glad to see advisor-owned brokerages thriving — and National Bank, through a subsidiary, has benefited. Both Harbourfront and Wellington-Altus use National Bank Independent Network’s back-office system.

“I think it’s healthy to have strong independents as part of the wealth management landscape across Canada,” Lemay said. “If the banks have too much market share, it’s not healthy — you need strong independents.”

In 2011, National Bank Financial acquired Wellington West Holdings Inc. — which, like Wellington-Altus, was founded by Charlie Spiring.

The brokerage divisions of Toronto-Dominion Bank, Bank of Montreal and Bank of Nova Scotia did not agree to be interviewed for this story. While banks may continue to lose and gain teams to independents, Hauser said he doubts the banks are losing sleep over independent brokerages’ recruitment success.

“I think we’re just a mosquito bite on their shoulder,” Hauser said. “We may be an irritant, but I don’t think we really move the needle on their day to day.”

But if independent brokerages continue to grow, banks may see them as acquisition targets. The past decade saw smaller firms merging with other independents and being acquired, although technological developments and efforts to cut compliance costs may be levelling the playing field.

Both Popescu and Hauser said they aren’t interested in selling to a bank. But economics may eventually prevail, Hartman said: “It’s like in any institution: if the price gets high enough, the people at the top have an obligation to say yes.”

Click image for full-size chart