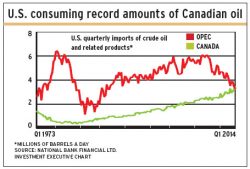

New high in Canadian oil exports

Although U.S. oil production has surged as a result of the discovery of shale oil, that’s not having an impact on Canada’s oil exports. Indeed,…

- By: Catherine Harris

- May 22, 2014 October 31, 2019

- 23:00

Although U.S. oil production has surged as a result of the discovery of shale oil, that’s not having an impact on Canada’s oil exports. Indeed,…

Persistent low bond yield rates in developed economies have pushed bond investors to look at bonds from Third World nations

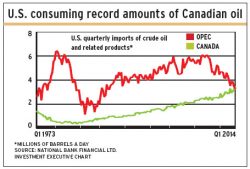

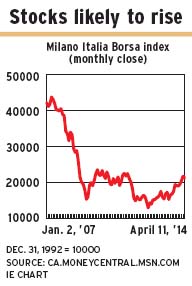

Although there are some long-standing structural issues in Italy's economy, there are also interesting opportunities

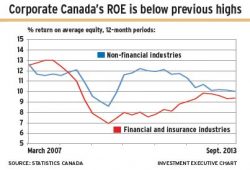

There's suspicion about the stock market's valuation of businesses, as their profitability has not yet recovered

Buying an investment-grade corporate bond and selling a government bond of the same term could work well for clients

Not only has the drop in bond prices not occurred, but yields are rising as investors take shelter in U.S. and Canadian bonds

Investors write options if they believe the implied volatility is too high but buy options when implied volatility is understating future risk

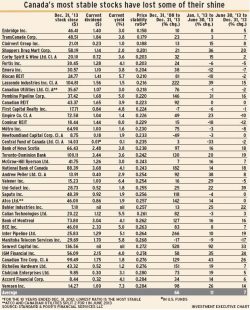

Income-producing stocks resist bear markets well but may not be the best to own when markets turn upward

A notable change in the PC industry, combined with the growth of smartphones and tablets, is good news for certain firms

Canada's main stock market index has remained very similar in composition since the global financial crisis hit in 2008

Now is an opportune time to invest in some strong companies based in Spain, as they're bound to benefit from growth

Rising risks due to disinflation - and, in some cases, deflation - concerns are giving new life to staid government bonds

There is cause for concern, as a group of Canadian stocks with top price stability are dropping in terms of relative strength

A new breed of hybrid, contingent convertibles are bonds that behave like equities but pay interest like bonds

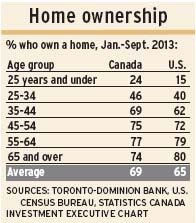

Significant disparities exist between American and Canadian consumers and how they spend their money

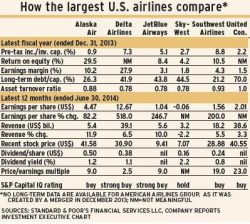

Although global airline stocks were once viewed as pariahs, they now are worth considering for clients' portfolios

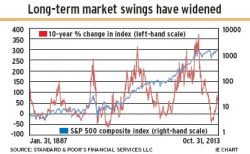

There's ample evidence that market swings have become wider since 2000, with higher bull-market highs and lower bear-market lows

Continued increases in demand, more cost-cutting and new growth initiatives could bode well for Air Canada and WestJet

Returns in the high-yield debt market have been spectacular this year based on the increased appetite for junk bonds

Assessing future volatility helps to determine the appropriate strategy

But prospects differ, depending on the geographical region tech is thriving in certain places but depressed in others

An improving economy and new environmental standards in the U.S. present opportunities for cement stocks

An increase in consumer spending, combined with a pickup in exports, will help to drive Germany’s economy in 2014

The financial crisis has brought up the issue of the U.S.’s willingness to cover its debts. Now may be the time to look elsewhere for…