A select group of 40 top-quality Canadian stocks with the best long-term price stability have stumbled in the second half of 2013, as these equities have fallen behind the overall market.

This drop in relative strength may be a warning sign if their weakness persists into 2014. That’s because faltering relative strength is a subtle “sell” signal, according to market technicians.

Stocks with the best long-term price stability outperform the market in the long run. This discovery was made in the 1940s by Arnold Bernhard and confirmed later by Robert Haugen and other researchers. (It must be noted that all but two of these stocks currently pay a dividend.)

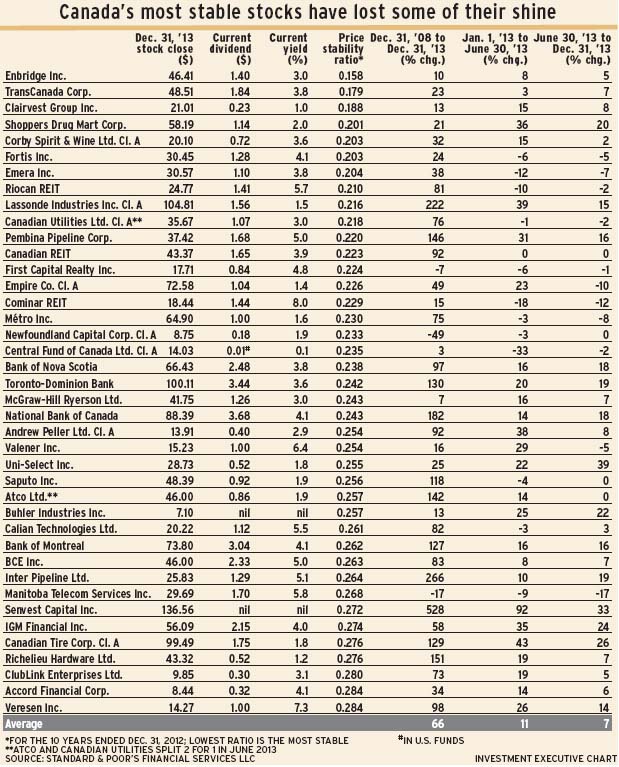

Collectively, these 40 stocks beat market indices handily between 2008 and yearend 2013. Their average capital gain was 66% in that five years vs 52% for the S&P/TSX composite index and 45% for the S&P/TSX 60 index.

In the first half of 2013, our Top 40 gained in price by 11%, beating both indices, which both rose by 10%. But between the end of June and yearend 2013, the group of 40 stocks rose by 7%, less than the S&P/TSX composite index’s 12% and the S&P/TSX 60 index’s 13%.

This stumble may be a sign of a peaking bull market. Latecomer buyers in a bull run tend to go after headline-making, volatile stocks.

In addition, anticipated changes in interest rates tend to influence investor expectations for income-producing stocks such as utilities and pipelines.

As interest rates rise – which is expected when the U.S. Federal Reserve Board ends its “quantitative easing” program – interest-sensitive stock prices decline. Their share prices drop to bring yields into line to be competitive with higher fixed-income yields.

This scenario also has bullish implications. A rise in interest rates will help banks and insurance companies, boosting their margins and investment returns.

Other companies in the Top 40 fall into the consumer staples sector, which is losing ground in both the U.S. and Canadian markets. Meantime, the more volatile consumer discretionary stocks continue to lead the market rise.

Another category in the Top 40 stocks is former income trusts, together with a few real estate income trusts. The latter, in particular, are dropping in lockstep with the broad decline in Canadian real estate industry shares.

The price stability ratios shown in the accompanying table should not be confused with beta measurements. The stability ratios (low is best) measure a decade of stock trading, and each stock’s individual performance, independent of anything else. In contrast, beta usually measures a short period and links each stock’s price action to an index.

© 2014 Investment Executive. All rights reserved.