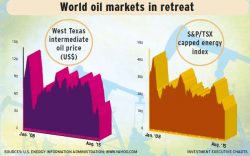

Oil price plunge creates opportunities

Care is required in this environment, with good margins and strong balance sheets among the key considerations

- By: Catherine Harris

- September 17, 2015 October 31, 2019

- 23:00

Care is required in this environment, with good margins and strong balance sheets among the key considerations

The aging Canadian bond bull remains alive and well

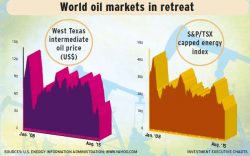

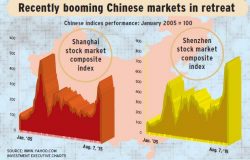

A drop in Chinese equities in June and July alarmed a lot of investors who were already worried about a slowing in China’s economy. However,…

Volatility-related ETFs purport to offer exposure to daily changes in the value of the CBOE VIX cash index

Global banks have been slow to recover from the financial crisis, but rising rates - and confidence - may boost growth

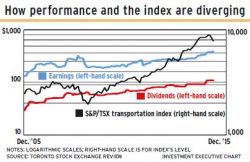

Transportation stocks, which rose strongly from 2000 onward, have started to decline despite solid corporate results

As the world awaits the next Fed move, bond managers share their strategies

Finding shelter when the bond bull market ends is a priority. Some suggest the place to be is Government of Canada bonds

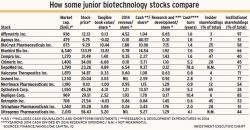

The biotech industry has had a strong run. Although some stocks may start slowing, others still have potential upside

Although growth in the U.S. looks positive, many variables could keep prices for commodities, including oil, low

Clients who consider emerging markets to be too risky can benefit by investing in firms that do business in these regions

Of the 358 dividend-paying companies listed on the TSX, 179 increased their payouts - some through an extra dividend - in 2014

After the stock market gyrations of late 2014, what happened in stock markets this January may be particularly significant

There have been concerns that there are too many condominium buildings going up in the Greater Toronto Area (GTA), which potentially could lead to a…

Negative interest rates on short-term bonds means investors are buying in for bond price appreciation instead of yield

Plunging oil prices have added to the default risk of energy issues, meaning potential payouts could be impressive

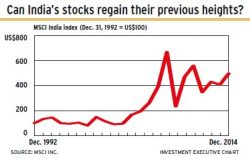

The leading stock market in India performed admirably in 2014 - and more is expected in the years ahead

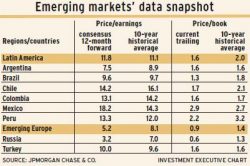

There's no consensus on the prospects for Latin America and eastern Europe, but there are certain stocks worth a good look

There may be defensive opportunities in parts of the real estate sector and in integrated oil stocks if oil prices stabilize soon

If deflation spreads, Canadian federal bonds and U.S. treasuries would soar in value, as their guarantees of payment trump all other debt

A covered-call strategy is an ideal approach for Twitter's stock