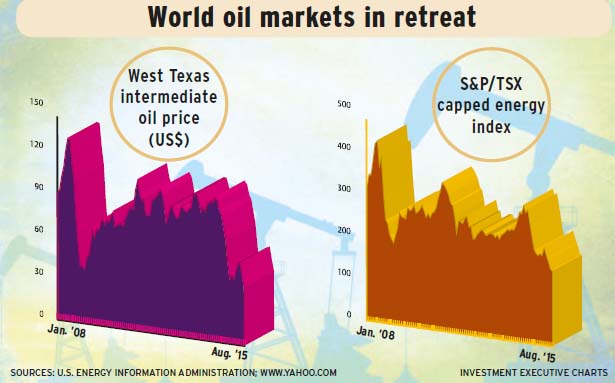

The sharp and sustained drop in oil prices is making covering costs hard for oil producers. As a result, many of these companies are losing money. Investment in new wells has dried up, dividends are being cut and layoffs are starting.

But there are some opportunities to pick up good oil stocks at bargain prices. The trick is to identify those companies that can withstand another year or two of very low oil prices.

No one is expecting a return to US$80- to US$100-a-barrel oil prices. (All oil prices are quoted per barrel.) But those price levels are not necessary for producers to generate profits. Production costs are declining, due to general efficiency gains and ongoing technological improvements. That means a price of US$65-US$75 will be sufficient for producers to post solid profits and invest in new wells when company coffers have been replenished, says Benoît Gervais, senior vice president and resources portfolio manager with Mackenzie Financial Corp. in Toronto. He is among the optimists, and predicts the oil price could rise to US$65 by the end of this year.

Eight Canadian bank and brokerage economists are forecasting an average oil price next year of between US$45 and US$65.

Christopher Brown, director of international oil and gas at Canaccord Genuity Group Inc. in Calgary, assumes an average price of US$55 next year and slightly higher than US$60 in 2017.

Charles Burbeck, co-head of global equity with UBS Global Asset Management (U.K.) Ltd. in London, thinks oil will trade between US$40 and US$60 for the next three to four years.

There are many factors that will affect when and by how much oil prices will rise. On the demand side, a major question is how much China’s economic growth is slowing. Growth in other emerging countries, as well as in Europe and Japan, also are factors. But there also are changes in energy efficiency, which could dampen demand.

On the supply side, there are a number of factors. The Organization of Petroleum Producing Countries (OPEC), and particularly Saudi Arabia, have been increasing production. The aim has been to keep prices low, so that high-cost producers cut their output and OPEC’s market share increases. But there are rumours that there could be an about-face by OPEC, due to the decline in government revenue as a result of very low prices.

U.S. shale-oil production hasn’t dropped by as much as was expected and ongoing technological improvements may mean less of a production decline than had been anticipated.

There also has been new supply from Iraq and Libya, and Iran could be exporting 500 million barrels a day, starting in January, if the nuclear deal with the U.S. is approved by Congress, which most analysts anticipate.

Care is required in picking investment opportunities in this environment. In general terms, investment candidates are companies with good margins, strong balance sheets and trustworthy management.

The competitive situation generally is better for non-U.S. producers, most of which have seen their domestic currency lose ground to the U.S. dollar. With the Canadian dollar at US76¢, a barrel of oil at US$45 translates into $59.

Firms with heavy debt will find servicing it difficult and expensive to roll it over. That is, if a firm has to borrow more or refinance its debt, lenders are likely to charge a significantly higher interest rate than the borrower is paying on its current loans. The alternative is to sell oil assets.

On the other hand, firms with strong balance sheets and relatively little debt will be able to take advantage of the acquisition opportunities that will arise as weaker players sell assets or go bankrupt.

A strong management team is crucial. Many decisions need to be made – how much to produce, how to cut costs, whether to cut dividends, what acquisitions to make. These decisions require due diligence, including evaluating the decisions that management teams have made in the past and making sure the decisions are aligned with shareholder interests.

Cost-cutting will be required in most companies. Costs for some expenses, such as drilling, already are down by about 25%. Technology improvements, particularly in shale extraction, also continue to reduce costs.

In addition, there’s a lot of fat. “Oil companies are like financial service companies were before the global financial crisis: with a lot of unnecessary costs,” says Burbeck. He notes that most oil companies have been built up for oil at US$80-US$100, so their overhead costs are “significantly” higher than required.

However, oil companies can have major problems down the road if they cut field staff too much, says Robert Mark, associate director of research with MacDougall MacDougall & MacTier Inc. in Toronto. “It takes a long time and a lot of money to train fieldworkers properly. If they’re let go, they tend to return to the farms they came from or go to other industries and never come back.” Companies also don’t want to lose professional staff, Mark adds, such as physicists, geologists and engineers: “It’s a real juggling act.”

Here’s a look at some of the firms that these oil analysts like:

– Exploration and development companies

Vermillion Energy Inc. is many analysts’ top Canadian pick, while EOG Resources Inc. tops the recommendations for U.S. stocks. Other possibilities include U.S.-based Advantage Oil & Gas Ltd., Cabot Oil & Gas Corp. and Hess Corp. Popular Canadian picks include ARC Resources Ltd., Canacol Energy Ltd., Crescent Point Energy Corp., Gran Tierra Energy Inc. and Torc Oil & Gas Ltd. All these companies have good margins, strong balance sheets and excellent management.

Vermillion is one of the few companies ramping up production, with its gas project in Ireland starting up by year end. Mark says Vermillion’s management not only “owns a lot of the stock, but is also very proactive in positioning the company for good times and bad.”

EOG is the poster child for shale-oil production. EOG was an early entrant and is a leader in the technology. The firm has low-cost shale deposits and continues to lower production costs.

– Integrated companies

Refining is the ace in the hole for these companies during downturns. Demand for gasoline and other refined products continues and usually rises when the underlying commodity price falls.

“[Refining] is the perfect hedge because when the oil price is low, refining margins are higher,” explains Mark.

Mark favours Suncor Energy Inc., which recently raised its quarterly dividend to 29¢ from 28¢. He likes Suncor’s strong business model, noting that even though it is a big player in the oilsands, the firm has enough other businesses to offset low oil prices.

Craig Bethume, portfolio manager at Manulife Asset Management Inc. in Toronto, likes Suncor management’s focus on efficiency and shareholder return.

Burbeck suggests two other integrated firms: U.S.-based Chevron Corp. and U.K.-based BP PLC.

Chevron has a “very strong” balance sheet, which puts it in a position to make acquisitions.

BP has finally settled the legal claims from its 2010 oil spill in the Gulf of Mexico and still has a strong balance sheet, says Burbeck. He adds that BP has ongoing cost-cutting and is maintaining its dividend.

– Royalty companies

These are good defensive stocks because they don’t have exploration and development costs or risks. These firms own land on which others drill, collecting a portion of the cash flow and distributing most of that to shareholders.

Joe Overdevest, portfolio manager with Pyramis Global Advisors, a unit of FMR LLC, in Toronto, likes Prairie Sky Royalty Ltd. He says the firm has a very strong management team that aligns itself with shareholders.

Les Stelmach, vice president and portfolio manager with Franklin Bissett Investment Management Ltd. in Calgary, agrees that Prairie Sky is a good company. However, he prefers Freehold Royalties Ltd. because its valuation is cheaper.

© 2015 Investment Executive. All rights reserved.