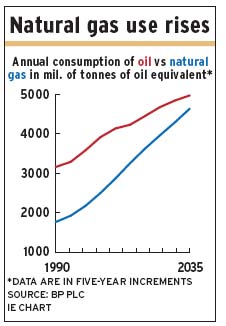

The long-term prospects for natural gas are very rosy, as supply is exploding with low-cost shale extraction while demand will rise even faster as liquefied natural gas (LNG) provides affordable imports for countries that are large energy consumers.

However, prices are likely to remain low in the medium term because it’s easier to increase production than to put the infrastructure in place to facilitate consumption.

Natural gas is a much cleaner fuel than oil, but the former’s use had been constrained by relatively high prices and transportation limitations. Prices traditionally were set regionally because transport primarily was by pipelines and supply constraints kept prices in line with oil, limiting the incentive to switch to natural gas.

But the advent of significant shale extraction in the U.S. in the past decade has resulted in large supplies and low prices – and other countries are getting on the shale-extraction bandwagon. This has resulted in many facilities that convert natural gas to LNG, which can be shipped anywhere.

Shale gas production, combined with low prices, also is spurring new or expanded uses for natural gas, particularly in transportation. Currently, about 90% of the world’s transportation is powered by oil, accounting for more than 60% of global oil consumption, says a recent report from National Bank Financial Ltd. (NBF) in Montreal.

According to the NBF report: “There are growing signs that natural gas in on the verge of taking significant market share away from oil in the transportation sector.”

This shift is likely to begin quietly. It won’t start with passenger cars, as the infrastructure for natural-gas fuelling stations is very limited and cars running on natural gas cost significantly more than cars that run on gasoline. However, these constraints don’t apply to shipping and heavy vehicles.

Ships will need to use “cleaner” natural gas rather than oil as fuel because they must reduce sulphur and other emissions by 20% by 2020 and by 50% by 2050 when operating within 200 miles of the European or North American coasts. Some estimates say LNG will account for 8% of shipping fuel by 2025 vs virtually zero today.

Natural gas-powered trucks, mainly buses and garbage trucks, are used extensively in the U.S. now – and major couriers also are planning to buy these vehicles.

In time, this switch will lead to more natural-gas fuelling stations and increased usage among long-distance trucks and passenger cars. The NBF report notes that the number of light-duty vehicles in the world is expected to more than double by 2040, necessitating more use of natural gas as fuel to keep pollution down.

Much of the increase will come from China, where the number of cars is expected to reach about 400 million by 2030 vs 90 million today. China has the world’s largest shale gas reserves, but won’t be able to produce enough to keep up with the country’s demand, which includes a shift to more natural gas-powered power plants from coal-powered. This will result in an ever-increasing need for imports.

Canada also has large shale gas reserves, but the NBF report cautions that if we don’t move quickly on LNG projects, we could miss the boat. The report notes that nine LNG projects on the West Coast have been approved but adds: “Certain skilled labour markets are already being stretched thin by the oilsands.”

© 2014 Investment Executive. All rights reserved.