Stock market action in January, as almost every financial professional and investor probably has heard, is supposed to signal how Wall Street will perform in the year ahead.

This is not necessarily true, of course, but it works often enough to justify being taken seriously on Bay Street as well as on Wall Street. After all, Wall Street’s primary trend determines the direction of Canada’s stock markets.

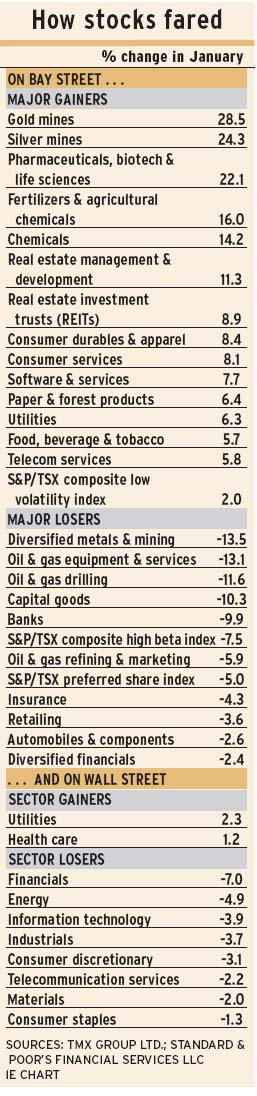

Wall Street’s benchmark, the S&P 500 composite index, dropped by 3.1% in January. The year started ominously, with several down days, regarded by some analysts as more indicative than the whole month’s performance. In contrast, the S&P/TSX composite index gained in January, although ever so slightly.

After the fear-and-cheer gyrations of stocks in the past few weeks of 2014, what happened within the stock markets in January may be particularly significant.

As Wall Street’s trends dictate what happens to Canadian stocks, the lesson (whatever it may be) should be heeded when considering how to manage your clients’ financial affairs this year.

The impact of the accelerated Canadian dollar’s meltdown and the price avalanche of oil and other commodities registered. The resulting gains and losses may signal the best-performing and worst-performing industries in the months ahead.

As you would expect, defensive stocks gained in January as apprehension about a bear market returned. Consumer staples, utilities and telecommunications all rose. No surprise, either, that volatile stocks dropped while low-volatility stocks gained.

Dividend stocks, as defensive players, developed some investor apprehension. Pipelines, a major dividend payer, dropped. So did banks, the largest source of dividends for Canadian investors.

Weaker demand for dividend stocks was registered by other S&P/TSX indices, such as the S&P/TSX dividend aristocrats index and the S&P/TSX composite dividend index.

Nevertheless, stock market action suggests the year may be a better one for real estate stocks, principally real estate investment trusts and management/development companies. Canada’s slender health-care and information-technology sectors also attracted buyers.

Overall, the consumer discretionary sector had mixed results. Buying power lifted consumer durables/apparel and consumer services. The big winner, though, appeared like a ghost from the past: gold and silver mining. Together with chemicals (which were more attractive thanks to cheaper feedstock oil), fertilizers and renewed gains in forestry products, the materials sector advanced.

Predictably, energy stocks dropped heavily, but one segment, dividend-paying integrated oils, held fast. Other big losers included capital goods, retailing (excluding food/staples retailing), banks and insurance.

Despite the Canadian market’s slight overall rise in January, our market compares unfavourably with the U.S. market. The S&P/TSX composite index has been in an extended decline and has been dropping since reaching a record high in September 2014. In contrast, the S&P 500 reached its record high only three trading days before yearend 2014.

On Wall Street, utilities were the big gainers in January. Health care was the only other winning sector. Financials – especially the recently favoured regional banks – were big losers, along with utilities. Consumer staples were surprise losers.

Examination of the 32 largest industries within the S&P 500 composite index reveals a downward bias. These industries account for about half of all the U.S. stock market’s capitalization.

Of the 32 largest industries, 24 dropped in January. Losers include eight of the 10 largest: pharmaceuticals, diversified banks, integrated oils, Internet software, systems software, aerospace/defence, industrial conglomerates and integrated telecommunications.

The biggest losers in the month were banks and systems software, as both were down by almost 11%. The only substantial big industry gainer was Internet retail, up by 7%. Among the 10 largest industries, biotechnology rose by 5%.

Among smaller industries in the S&P 500, tire/rubber dropped by 15%; distributors, consumer finance and life/health insurance each dropped by 13%. The notable gainer was consumer electronics, up by 11%.

As an aside, it’s worth noting that the “January indicator” actually is not that unusual. Market performance in March, June and November is about as useful in predicting the subsequent market trend as is January’s.

© 2015 Investment Executive. All rights reserved.