If you plan to make your clients’ portfolios a little more defensive, you face some challenges.

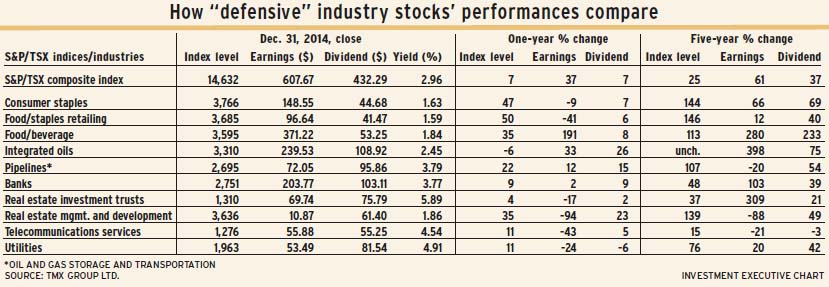

The usual recession-resistant, steadily dividend-paying sectors in the stock market are popular – too popular, perhaps. These sectors include consumer staples, banks, pipelines, utilities and telecommunications. But some of these stocks have dividend-payout issues; yields that are relatively low; and some have faltered in the nervous market trading at the end of 2014 and the start of 2015.

There may be defensive opportunities in parts of the real estate sector, particularly in real estate investment trusts (REITs) and real estate management companies.

Perhaps integrated oil stocks also could become a defensive refuge if oil prices stabilize soon.

Consumer staples have a deserved reputation as resilient stocks in falling markets and economic slowdowns. These stocks now look less appealing. A key point to consider: the dividend yield for this sector, at 1.6%, is the lowest it has been since 2005. In fact, the sector’s dividend yield has dropped to 40% of the S&P/TSX composite index’s dividend yield from 80% in 2011.

Although defensive in nature, consumer staples have been growth stocks in Canada since 2010. Their latest surge lifted the S&P/TSX consumer staples index by 170% since early 2010. This sector’s parabolic rise resembles climax action of a long bull run.

The two halves of the consumer staples sector are food and staples retailing (including drug stores), and food and beverage processors. Both industries’ earnings growth has wobbled, dropping in late 2014 after years of steady gains.

But three often defensive stocks – telecommunications, utilities and pipelines – also have earnings and dividend challenges. In all three sectors or industries, dividends exceed earnings.

Pipelines – known as “oil and gas storage and transportation” in the S&P/TSX index system – have a special earnings problem, with a clear drop since August 2014. Earnings dropped to a decade low in 2013 from a peak in 2008.

Dividend yields for defensive industries are in multi-year low ranges, cutting their appeal. Banks, as recorded by the S&P/TSX bank index, have yields at three-year lows. The index is yielding 3.8% vs a high of 4.3% in 2012.

Telecoms are yielding 4.3%, having dropped from almost 6% before the 2008-09 market crash and ensuing recession.

Utilities have followed a similar path, to almost 4% from 6%.

Price strength has become uncertain for defensive industries. This metric conventionally is measured as the ratio of index or stock price to the S&P/TSX composite index. The flaw is that the S&P/TSX composite index is dominated by financial services and resources industries.

Comparing prices of these Canadian stocks with the S&P 500 composite index (the most followed measurement of the U.S. stock market) produces clearer and less favourable relationships for Canadian stocks. For example, the S&P/TSX bank index has risen in relative strength to the S&P/TSX composite index since 2011. Compared with the S&P 500, though, Canadian banks’ relative strength has dropped since 2010.

The Canadian utility sector, relative to the S&P 500, is at the lowest level since 2002. However, comparing that same Canadian utility index to the S&P/TSX composite index looks more positive.

Another example: the S&P/TSX food/beverage industry index has risen relative to the S&P/TSX composite index since early 2012. But compared with the S&P 500, Canadian stocks made no gain in that period.

Rising relative strength brings REITs and real estate development stocks to the fore. Relative to the S&P/TSX composite index, the Canadian industry has been gaining since August 2014. In early trading in 2015, this gain continued, joined by a jump in price relative to the S&P 500.

The S&P/TSX real estate management and development index has been rising faster than the S&P/TSX composite index since 2009. These stocks also have a clear rising trend since mid-2013 compared with the S&P 500.

© 2015 Investment Executive. All rights reserved.