This article appears in the April 2023 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

ESG strategies were not unscathed by last year’s bear market.

Only 23.5% of Canadian sustainable funds yielded above-average returns in 2022, according to Chicago-based Morningstar Inc.: of the 204 ESG funds tracked by Morningstar, just 48 ranked in the first or second quartile last year.

“There were some bright spots. For example, in the global small/mid cap equity [category], the majority of sustainable funds (six of eight) outperformed their peers,” said Ian Tam, Morningstar’s director of investment research for Canada. However, he cautioned that the sample size was small.

Nonetheless, Tam is optimistic about the outlook for sustainable funds.

“A year is not really a fair measure of performance for any fund manager or strategy,” Tam said. “With ESG integration, you use [that approach] as a risk-mitigation tool, not as a performance-enhancement tool.”

Tam, in pointing out that 2022 was a difficult year for most asset classes, said, “It’s not surprising that a risk factor may not have made itself evident over the course of one year.”

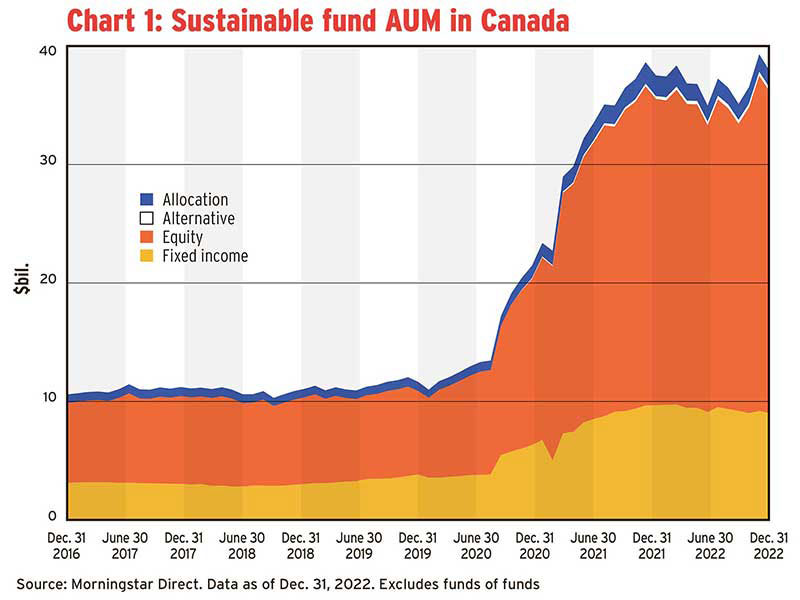

Amid the challenging investment environment, sustainable assets under management remained flat year over year, dropping by 1.9% to $37.9 billion as of Dec. 31, 2022, from $38.6 billion the previous year. (The 2021 figure was revised from the $34.5 billion reported previously because Morningstar received new information.) Inflows for 2022 were generally positive, so the decline was mostly due to market factors.

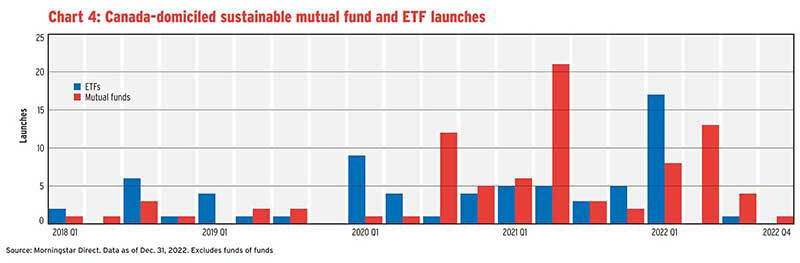

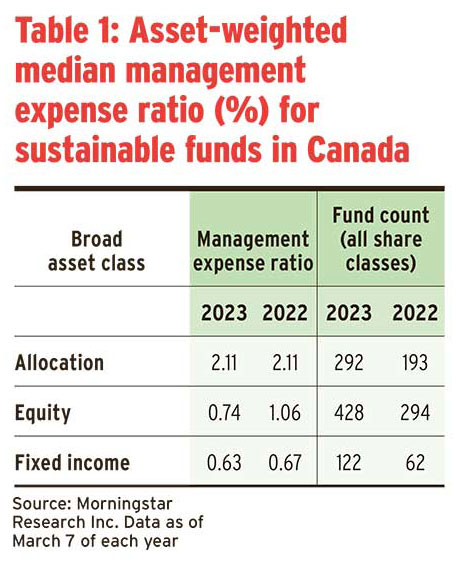

Median pricing for sustainable investment funds remained similar year over year for allocation and fixed-income funds, but fell by 43% for equity funds. As more funds launch, “fund manufacturers get more competitive [on costs]. It’s great for competition and great for investors,” Tam said.

However, given the relatively small universe of sustainable funds, “a bunch of new fund launches can skew [the median] up or down,” he warned.

Tam said the January 2023 release of the Canadian Investment Funds Standards Committee’s (CIFSC) responsible investment framework has given financial advisors a fresh tool in discussing ESG with clients, suggesting that the space could grow as clients and advisors become more educated on the topic.

The framework divides sustainable funds among six categories: impact investing, ESG integration, ESG thematic investing, ESG exclusion, positive screening, and ESG engagement and stewardship. Funds may fall into more than one category.

In some cases, the framework narrows the definition of sustainable funds. For example, CIFSC excludes carbon-offset funds from its framework, while Morningstar does not. Future analyses from Morningstar will use CIFSC’s definition for the sustainable fund universe, Tam said.

Click image for full-size chart

Click image for full-size chart

Click image for full-size chart

Click image for full-size chart