This article appears in the May 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The expert:

Guillaume Lamothe-Laurin, associate advisor with Le Groupe Vachon, RBC Dominion Securities Inc., in Montreal.

The philosophy:

Laurin constructs customized portfolios for his clients by using a holistic approach to assess their personal situation, investment objectives and risk tolerance.

The scenario:

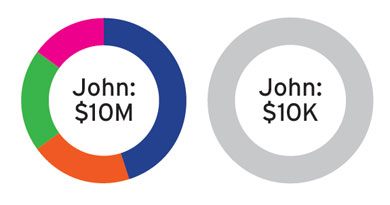

John, 60, sold his business for $10 million. He is not a savvy investor and is seeking balanced growth in preparation for retirement.

The allocation:

45% to corporate bonds with a minimum credit rating of A. Laurin said the income generated from the bonds is held in cash to meet the client’s demand for liquidity. Among the bonds recommended are:

- Province of Ontario, 3.16%, due June 2, 2022

- Province of Alberta, 2.65%, due June 1, 2027

- Province of Quebec, 3.75%, due Sept. 1, 2024

20% to core Canadian equities with a minimum market cap of $10 billion. These securities include:

- Toronto-Dominion Bank (TSX:TD)

- Calgary-based TC Energy Corp. (TSX:TRP)

- Canadian National Railway Co. (TSX:CNR)

- Montreal-based Alimentation Couche-Tard Inc. (TSX:ATD), which operates convenience stores and other retail businesses in North America and parts of Europe

- Manulife Financial Corp. (TSX:MFC)

- Calgary-based Suncor Energy Inc. (TSX:SU)

20% to U.S.equities, such as:

- Microsoft Corp. (NASDAQ:MSFT)

- McDonald’s Corp. (NYSE:MCD)

- Texas Instruments Inc. (NASDAQ:TXN), a global manufacturer of semiconductors and integrated circuits

- Johnson & Johnson (NYSE:JNJ)

- Honeywell International Inc.(NASDAQ:HON), a multinational conglomerate with operations in aerospace, building technologies, performance materials and technologies, and more

- Starbucks Corp. (NASDAQ:SBUX)

15% to American depositary receipts (ADRs). Laurin said he likes exposure to ADRs because they are traded in “a deeper U.S.market” and there is no international foreign currency exposure. Among the ADRs he recommends are:

- Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE:TSM)

- EssilorLuxottica SA ADR (ESLOY.OTC), which designs, manufactures and distributes ophthalmic lenses, frames and sunglasses

- Tencent Holdings Ltd. ADR (TCEHY.OTC), a multinational technology and entertainment conglomerate and holding company

- Barratt Developments PLC ADR (BTDPY.OTC), which develops residential and non-residential properties, mainly in the U.K.

- LVMH Moët Hennessy Louis Vuitton ADR (LVMUY.OTC), a worldwide leader in the luxury goods industry

The scenario:

John later receives a $10,000 signing bonus for some consultancy work. He is seeking balanced growth for this amount.

The allocation:

Laurin said this account will be used to address “portfolio drift” in John’s $10-million investment account. Laurin will use this account to rebalance the portfolio to its original asset allocation by locking in gains from asset classes that performed well and investing in asset classes that have underperformed.

The expert:

Clayton Goodwin, associate portfolio manager with Harness Investment Management Inc., and financial advisor consultant with Oculus Private Wealth Corp. in Calgary.

The philosophy:

Goodwin uses strategic asset allocation to broadly diversify clients’ portfolios. He uses a combination of passive individual ETFs, passive ETF portfolios and active mutual funds, depending on the specific client’s scenario and investment objectives.

The scenario:

Carol, 50, received a $10-million inheritance. She is recently divorced, has one child and works full-time. She expects to retire in five years. She is risk-averse, seeks balanced returns and doesn’t want any surprises.

The allocation:

Equities (55%)

- 10% to the Vanguard S&P 500 Index ETF (CAD-hedged; TSX:VSP), which provides low-cost exposure to the S&P 500

- 10% to the iShares Core MSCI Emerging Markets IMI Index ETF (TSX:XEC), which provides lowcost diversified exposure to emerging markets

- 10% to the Mackenzie Investments Maximum Diversification Canada Index Fund

- 20% to the Mackenzie Global Dividend Fund, which provides broad global diversification while seeking stable dividend income and growth

- 5% to the Mackenzie Greenchip Global Environmental All Cap Fund, which invests only in companies that provide sustainable environmental solutions to fight climate change

Fixed income (45%)

- 25% to the Mackenzie Unconstrained Fixed Income Fund, which provides broad tactical exposure to the fixed-income space and has a flexible mandate to find yield

- 15% to the Mackenzie Floating Rate Income Fund, which offers less interest-rate sensitivity than traditional bonds and could benefit from rising interest rates

- 5% Purpose High Interest Savings ETF (TSX:PSA), which provides a monthly interest payment

Goodwin said PSA could help mitigate losses during potential down markets, and that a balanced asset allocation in general can provide downside protection and the ability to make modest returns over time. Once Carol retires, the yield generated from her fixed income and dividend-generating equities holdings should help provide stable returns she can live off.

The scenario:

Carol also received a $10,000 employment bonus.

The allocation:

- 80% to the Vanguard Growth ETF Port folio (TSX:VGRO), which is a one-ticket solution

- 20% to the Mackenzie Floating Rate Income Fund

Carol “has a relatively long-term time horizon,” and thus “an equity lean” in her asset allocation, Goodwin said. The 20% allocation to the Mackenzie Floating Rate Income Fund will help to further diversify VRGO’s fixed-income sleeve (20% of its total holdings), which is invested in more traditional fixed-income assets. Meanwhile, the floating rate exposure will prove beneficial in the current rising-rate environment.