This article appears in the March 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The expert: Chris Ferris, financial planner and associate portfolio manager with Ryan Lamontagne Inc. & SONA Wealth Counsel in Ottawa, Ont.

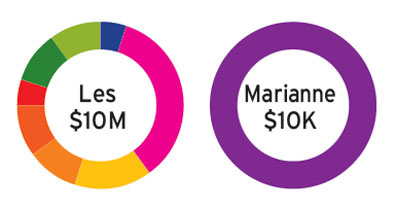

The philosophy: Ferris uses a global equities market index as a base for building portfolios, “with a measured tilt towards Canadian equities and an appropriate allocation to fixed income.” He then adds temporary tactical positions based on current market conditions. His focus is on simplicity, low fees and tax efficiency, and he prefers using ETFs for those reasons.

The allocation:

Cash

- 5%, to finance one or two years of income if the market corrects.

Fixed income

- 35% to the BMO Discount Bond Index ETF (TSX:ZDB). “More of the return is driven by capital gains than interest payment, making this fund more tax-efficient than alternatives,” Ferris said.

Core equities

- 15% to the Horizons S&P/TSX Capped Composite Index ETF (TSX:HXCN)

- 10% to the Horizons S&P 500 Index ETF (TSX:HXS)

- 10% to the Horizons International Developed Markets Equity Index ETF (TSX:HXDM)

- 5% to the Horizons Emerging Market Equity Index ETF (TSX:HXEM).

“These ETFs use a tax-efficient total return structure,” Ferris said. “My preference is for all-cap indexes, so one downside is that all but the Canadian equity exposure is limited to large-cap stocks.”

Alternatives

- 10% to the Purpose Diversified Real Asset ETF (TSX:PRA), which provides actively managed exposure to REITs and equities tied to real asset performance, as well as exposure to less-traditional assets like commodity futures and metals.

- 10% to the BMO Premium Yield ETF (TSX:ZPAY). The driver of returns in this ETF is the writing of put options against cash, and call options against equities, Ferris said.

The allocation

- 100% to the Vanguard Balanced ETF Portfolio (VBAL), a diversified fund invested in allcap equities indexes and U.S.and international fixed income.

“For accounts of this size, single-ticket solutions are a great way to reduce transaction costs and keep things simple,” Ferris said.

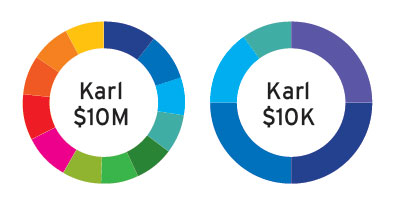

The expert: Jeff Kaminker, CEO, founder and investment manager with Frontwater Capital in Toronto.

The philosophy: Kaminker seeks out market leaders across various industries, regions and styles. He selects companies based on fundamental analysis, the management team’s track record, and a history of delivering strong total returns for shareholders.

The allocation: Kaminker believes that “an allequity port folio built around ‘best-of-breed’ companies will outperform for the long-term investor” and that “high-quality, leading companies are best positioned to retain their value in volatile conditions.”

U.S.equities

- 7% to Nvidia Corp. (NASDAQ:NVDA), a technology/semi-conductor company that designs and manufactures graphics processors and chips.

- 6% to Lockheed Martin Corp. (NYSE:LMT), a large U.S.defence contractor known for capital-intensive plays.

- 5% each to household names Microsoft Corp. (NASDAQ:MSFT); JPMorgan Chase & Co. (NYSE:JPM), which has a dividend yield of 2.6%; Costco Wholesale Corp. (NASDAQ:COST); VISA Inc. (NYSE:V); Walt Disney Co. (NYSE:DIS); and Airbnb Inc. (NASDAQ:ABNB).

- 5% to Medtronic PLC (NYSE:MDT), a global leader in medical technology sales, which has increased its dividends for the past 44 years and is likely to continue raising them.

- 5% to Becton Dickinson and Co. (NYSE:BDX), one of the world’s largest global medical technology companies in the areas of medical discovery, diagnostics and the delivery of care.

- 5% to Honeywell International Inc. (NASDAQ:HON), an industrial company with divisions in aerospace, chemicals, advanced material production, and energy efficient products for commercial markets.

- 5% to Deere & Co. (NYSE:DE), which manufactures and distributes equipment used in agriculture, construction, forestry and turf care.

Canadian equities

- 6% to Enbridge Inc. (TSX:ENB), a large pipeline operator which provides a stable and growing dividend.

- 6% to TC Energy Corporation (TSX:TRP), a natural gas pipeline operator.

- 5% each to Brookfield Asset Management Inc. (TSX:BAM), a leading global real estate and private equity player and Brookfield Infrastructure Partners LP (TSX:BIP.UN), a stable income play which owns and operates ports, bridges and airports around the world.

- 5% each to Canadian Pacific Rai lway Ltd. (TSX:CP) and Canadian National Railway Co. (TSX:CNR).

- 5% to Air Canada (TSX:AC).

The allocation: “For smaller portfolios, ETFs are a cost-efficient way for investors to achieve an optimal level of growth and diversification,” Kaminker said.

- 25% to the Vanguard US Dividend Appreciation Index ETF (TSX:VGG).

- 25% to the BMO S&P/TSX Capped Composite Index ETF (TSX:ZCN). The ETF “is option-eligible to write covered calls, or buy puts against to hedge the portfolio,” Kaminker said.

- 25% to the iShares NASDAQ 100 Index ETF (TSX:XQQ), which provides Canadian-hedged exposure to the NASDAQ 100.

- 15% to the Vanguard Global Momentum Factor ETF (TSX:VMO), which provides exposure to securities included in the FTSE Developed All Cap index and the Russell 3000 index.

- 10% to the Vanguard S&P 500 ETF (TSX:VFV).