Advisors are more proactively working on succession plans, but some firms still have work to do on this front to meet advisors’ burgeoning needs, revealed Investment Executive’s 2025 Dealers’ Report Card.

More than half of 461 advisors surveyed (53.6%) said they had a documented succession plan. That was a jump from 40.6% (of 431 advisors) in 2024. A further 18.7% in 2025 said they were thinking about or working on a plan — meaning a combined 72.3% are engaged in planning at some level, up from only 59% a year ago.

A solid proportion of the advisors surveyed in 2025 (69.6%) also said they had contingency plans for their businesses — a question that wasn’t asked previously. That was based on a sample size of 362 advisors.

“It seems the message is getting through that succession planning is vitally important,” said Greg Barnsdale, a certified financial planner, certified executor advisor and author of Do Not Ignore Your Mortality: Practical Advice From a Funeral & Financial Insider in Cambridge, Ont. (No external sources were given access to IE’s specific research results, as Report Card results are kept confidential until publication.)

“I’m sure most advisors have heard of a story […] of plans going awry when advanced planning is not done,” he said.

The Dealers’ Report Card involves both full-service and mutual fund dealers, with advisors from 11 firms included in the results.

What’s driving planning?

The increase in advisors with documented succession plans makes sense, given the shifting demographics of the Canadian financial services industry, said Rob Grein, CEO of Guelph, Ont.-based research firm PMG Intelligence.

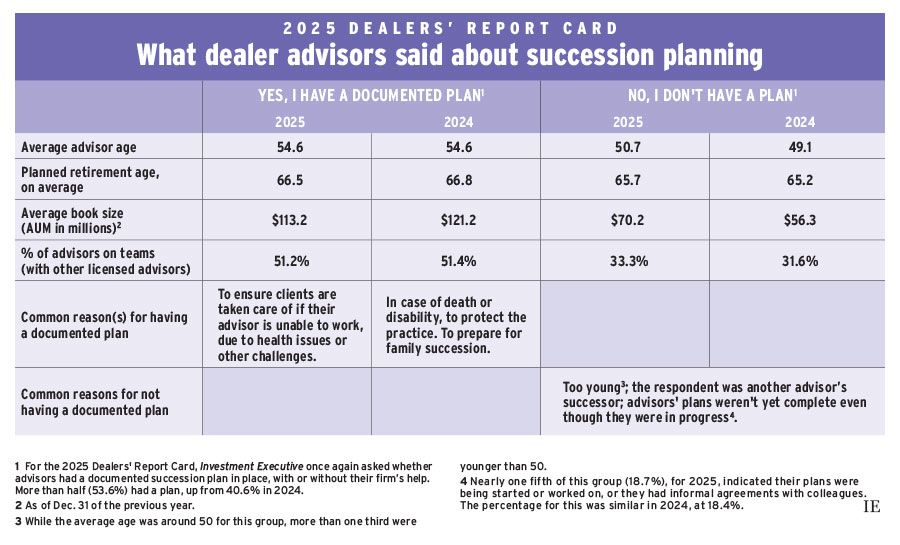

The average dealer advisor is 52.8 years old and says they plan to retire by 66, so that would mean they’re likely in the final 10–15 years of their careers, the 2025 Report Card found. Those metrics were similar in the 2024 report. (See table below for a detailed succession planning data breakdown.)

Advisors with documented succession plans said it was important to be prepared ahead of their retirement and in case of sudden death or disability.

An advisor with CI Assante Wealth Management in Quebec said they had an agreement with another advisor, adding that planning for the future is “important for the customer base.”

Another advisor in Quebec, with IG Wealth Management Inc. (IG Wealth) said their age is what drove them to create a succession plan. “I’m getting old. If something happens to me, I have younger advisors that can take over,” they said.

On the other hand, age was also one of the main reasons some advisors cited for why they hadn’t yet begun plans. More than one-third of advisors who said they didn’t have plans were under the age of 50.

“I have at least 20 years left in my career so it’s not important to me right now,” said an advisor with Investment Planning Counsel Inc. in the Prairies.

Others said their plans were in the works. For example, an advisor with Manulife Wealth Inc. in Ontario said they had a successor in mind but added, “We haven’t done the documents yet.”

Advisors seeking greater support

Amid increased succession planning activity, the data in this year’s Report Card also revealed that advisors were seeking more succession planning support from their firms.

The “succession planning support for advisors” category had a 2025 performance average of 8.1, a dip from its average rating of 8.4 a year ago. Meanwhile, the category’s average importance rating was less changed at 8.7, compared with 8.8 a year ago.

A satisfaction gap occurs when the average importance rating for a category exceeds the average performance rating. This year’s gap for the succession planning area was 0.6, up from 0.4 a year ago.

In cases where advisors devise succession plans on their own, Barnsdale said there are two possible reasons: they’re doing it themselves to cut down on costs, or they aren’t getting enough in-house guidance from their dealer.

“If the resources are not available through their firm, they’re taking the reins on themselves, organizing their affairs as they see fit,” he said.

Investia Financial Services Inc. saw a significant decline in its succession planning rating (by half a point or more; to 7.0 from 8.3). Advisors there want to plan ahead but are seeking improvement.

One of that dealer’s advisors in the Prairies said, “I have accessed this planning several times and the people here are salespeople and not much else.” This advisor had been exploring their succession options and needed more guidance on business “intangibles.”

They weren’t the only Investia Financial advisor to ask for added materials and coaching. An advisor in British Columbia said they planned to exit their business within a couple years and felt, “It would be nice to have ongoing materials and a game plan as to what one needs to do for succession planning. […] They do provide financing.”

Some of their peers were satisfied: “They inform us of the importance of this [succession plans] and bring us info. [They] provide us with the templates and even the lending; they have a full package,” said a different Investia Financial advisor in B.C.

The dealer’s president, Louis DeConinck, said the firm offers a succession website, transition agreements and a financing program. He was cognizant of what advisors are willing to pay for and how many already have good connections with lawyers and accountants.

“The focus is on ‘how do I sell my business and how do I [get] the financing?’” On that front in 2024, DeConinck added, “We did over 100-odd transactions of financing from senior advisors to junior advisors,” and good progress was being made for 2025 as of July.

More firms offer succession support

There were bright spots when it came to advisors’ perceptions of their firms’ support.

CI Assante saw its rating rise significantly in the succession planning support category, to 8.0 from 6.7 in 2024.

The firm talks about succession often and generally recommends that advisors begin to think about building teams and the future of their business about 15 years into their careers, said Joady Guyot, vice-president, advisor engagement with CI Assante Wealth Management. This can involve bringing in an associate advisor at that point.

“[With] our regional teams, this is the No. 1 conversation they have,” Guyot said, “because it’s a risk to us, it’s a risk for the clients.”

Advisors at the firm are taking notice, appreciating the guidance.

“They talk about it frequently. They want to make sure we have a succession plan,” said a CI Assante advisor in B.C.

Another positive sign in the 2025 Report Card results was that more dealers were rated in the succession planning category this year compared to previous years. Portfolio Strategies Corp. and Desjardins Financial Security Investments Inc. were each rated 7.5, as opposed to having non-calculable ratings last year, when not enough advisors offered insights or used the services.

Jason Bobee, now president of Portfolio Strategies, said the dealer’s been investing more time and effort into helping advisors build teams. One tool, which will help get new team members up to speed and smooth out business processes, is a new dashboard being developed with VieFUND.

“Succession’s huge. [Advisor] teams are becoming more and more important. And we want to keep the assets; we don’t want them leaving,” Bobee said.

Carte Wealth Management Inc. is also offering more support. The firm’s president, Maria Jose Flores Suarez, said it’s working on “identifying those advisors who are thinking, ‘Maybe the next three, four, five years, ‘We’re going to exit the business. Now who can you match me with?’”

Despite the progress observed among dealers over the past year, the topic of succession planning must be met with more urgency, “because critical illness, disability or death can happen at any age,” Barnsdale said.

“We have no way to predict what the future holds, but we all want to make sure that those that we care about, whether they are immediate family or clients that we’ve served and got to know well, are going to be truly looked after,” he added.

Many advisors understand this sentiment. They said finding successors and planning next steps for their practices is just as important for them as for the entire industry.

“The industry is getting older, so it’s going to be an issue if there is a massive shortage of qualified planners. Clients need planning — who is going to give it to them?” said an IG Wealth advisor in Ontario.

Click image for full-size chart

This article appears in the September 2025 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.