The name of the game for advisors and planners in the financial advice industry is growth. Frontline professionals working in the brokerage, dealer and retail-bank segments were all delivering gains in assets and productivity coming into 2025 — and those results boosted their bottom lines.

According to Investment Executive’s latest series of industry Report Cards, the retail investment business in Canada managed solid growth last year, before entering 2025’s gloomier macroeconomic environment.

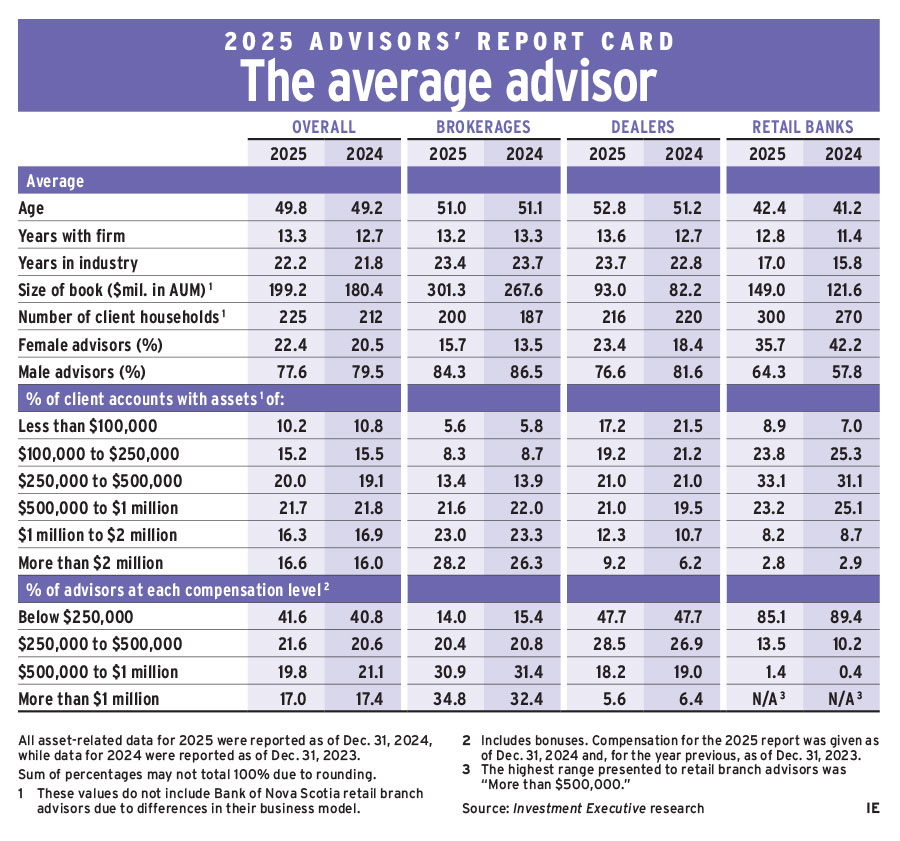

For the industry overall, measured across IE’s three reports, average assets under management (AUM) among the advisors surveyed was just shy of the $200-million mark — rising from $180.4 million in the 2024 research.

This overall gain in average AUM was accompanied by an increase in average client numbers, with that metric rising to 225 from 212 a year ago. That implies that some of the increase in assets was generated by industry advisors adding client households. Yet, the rise in AUM was also driven by other factors such as market returns and the capture of a greater share of existing clients’ wealth.

In the dealer segment, advisors generated solid asset growth with average AUM climbing to $93 million this year from $82.2 million. At the same time, they saw a modest decline in average client numbers, indicating that their asset growth was driven by market gains and rising wallet share.

In the other two industry segments, the asset gains were accompanied by increases in client numbers.

Retail bank advisors and planners recorded the strongest gains in both assets and client households, with their average AUM jumping to $149 million from $121.6 million in last year’s report. Their average client roster topped 300 coming into 2025, up from 270 in the previous year.

For the brokerage space, overall trends were the same. These advisors’ average assets and client numbers were up year over year. But the rate of growth for both metrics was slower than seen in the retail bank space.

Of course, the brokerage advisors have much larger starting asset bases than the rest of the industry. So, despite their slower growth trajectory, average AUM for the brokerage segment was still roughly double that of retail bank advisors in the 2025 report. The average brokerage advisor now has $301.3 million in AUM (up from $267.6 million last year).

Client asset breakdowns

Client account distribution data in this year’s research indicated that a growing share of the average advisor’s book may be devoted to wealthier clients. The share of the average advisor’s book allocated to client accounts worth more than $2 million was up slightly to 16.6% from 16%.

That trend was led by the brokerage advisors, with their share in that client asset bracket rising to 28.2% from 26.3% in last year’s research. Their allocation to every other account size range was down a bit year over year.

Dealer advisors also increased their exposure to wealthier clients. For these advisors, allocation to accounts valued at more than $500,000 rose to 42.5% on average from 36.4%. Their biggest increase also came in the $2-million-plus account group, with that allocation jumping to 9.2% from 6.2%.

These rising allocations to larger client accounts reinforce the fact that advisors in both the brokerage and dealer segments are expanding their share of clients’ assets and seeking business growth.

The opposite was true for the retail bank space, even though that segment saw the largest increase in client household numbers. Their allocations to client accounts worth less than $100,000 grew to 8.9% from 7%. At the same time, the average advisor in the bank space reported contraction in their share of accounts worth more than $500,000.

For retail bank advisors, the most common client account size was in the $250,000–$500,000 range. Their allocation there grew to 33.1% from 31.1%.

These results indicate that retail bank advisors, who were more active in adding new clients, made those additions in the lower ranges.

Advisor paydays

There also were changes in the average advisor’s take-home pay.

For brokerage advisors, the share of top-earning reps rose. The proportion of advisors who reported earning at least $1 million by year-end 2024 rose to 34.8% from 32.4% in last year’s research (as of year-end 2023).

Among retail bank advisors, the share of respondents in higher-earning categories was up year over year, too. Most advisors there (85.1%) still earned less than $250,000 per year, but that was down from 89.4% in last year’s report. The proportion of bank advisors earning $250,000-$500,000 climbed in this year’s report to 13.5% from 10.2%. The percentage of advisors earning more than $500,000 rose to 1.4% from just 0.4%.

For the average dealer advisor, compensation growth came in the middle ranges. The cohort earning less than $250,000 remained the single largest within this group of advisors, with that share unchanged from last year. Conversely, the proportion earning more than $500,000 in the dealer space dropped to 23.8% this year from 25.4%. The only gains in reported pay for this segment came in the mid-market, as the share of reps in the $250,000–$500,000 range climbed to 28.5% from 26.9%.

Across the frontline advisors interviewed for our research series, the average respondent recorded strong book growth, though the drivers for each segment varied. Still, larger asset totals seem to be translating for some into higher annual compensation.

Click image for full-size chart

This article appears in the November 2025 issue of Investment Executive. Read the digital edition or read the articles online.