The federal government’s softened version of the Canada Recovery Dividend (CRD) on banks and insurers will save the industry $1 billion, according to the Office of the Parliamentary Budget Officer (PBO).

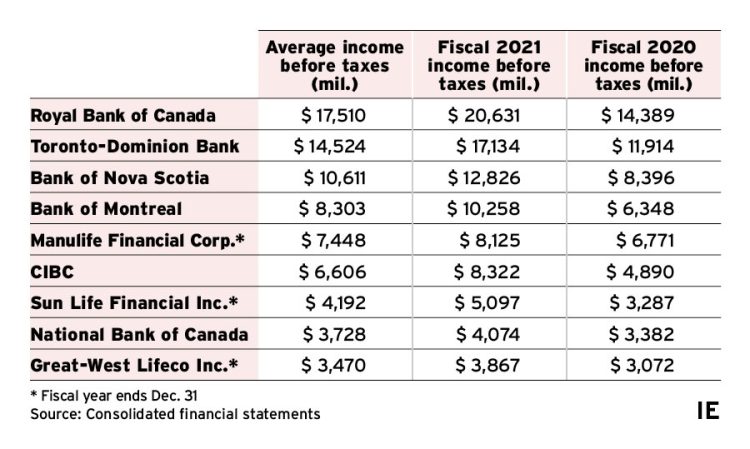

The Department of Finance released draft legislation in August modifying the one-time 15% tax on banks and insurers’ taxable income above $1 billion, known as the CRD. The amended version bases the CRD on the average of taxable income for the 2020 and 2021 tax years.

The proposal in the 2022 federal budget was for the tax to be based on income for the 2021 tax year only. The budget estimated the tax would rake in $810 million annually between fiscal 2022–2023 and fiscal 2026-2027, or $4.05 billion over five years.

A legislative costing note released Thursday by the PBO estimated the modified CRD will only net $604 million annually over the same period, for a total of $3.02 billion.

The CRD liability will be imposed for the 2022 taxation year and is payable in equal amounts over five years.

The PBO also released updated projections for the the bank and insurer surtax, which will be 1.5% for taxable income over $100 million beginning in the 2022 taxation year. Those companies will pay 16.5% on income above that threshold going forward.

The surtax is now expected to result in $2.250 billion in revenue, up from $2.055 billion as estimated in the federal budget. The PBO now expects lower revenue in 2022–2023 than the budget did, but higher revenue than the budget assumed in the following fiscal years.

The surtax will apply beginning in the 2022 taxation year and be prorated based on the number of days in the taxation year after April 7.

The surtax and CRD combined are now estimated to raise $5.3 billion over five years, down from the $6.1 billion initially estimated in the 2022 federal budget.

The draft legislation containing the modified CRD and the surtax remains out for comment until Sept. 30.

Banks and insurers’ average pre-tax profits, 2021 and 2020

All years ended Oct. 31 unless otherwise indicated. Click image to view full size.