Manulife Financial Corp. is aiming to help advisors improve client retention and engagement with the expansion of its Vitality program.

Vitality — already available with family term life and individual health products — will be expanding to universal life this November and to participating whole life in 2023, said Paul Savage, Manulife Canada’s head of individual insurance, on Monday.

Advisors have been telling Manulife it is tougher to sell life insurance — other than family term — when Vitality is not included, Savage said. The program launched in 2016.

With traditional life insurance, advisors have few opportunities other than billing and claims to engage with customers after they purchase the policy, Savage said, but some Vitality clients interact with the program more than 20 times a month.

Three out of four respondents (in a Manulife-commissioned survey in July of 510 advisors) said Vitality gives them “new opportunities to interact with their customers” while more than 50% of respondents said Vitality is helping them improve customer retention, Savage said.

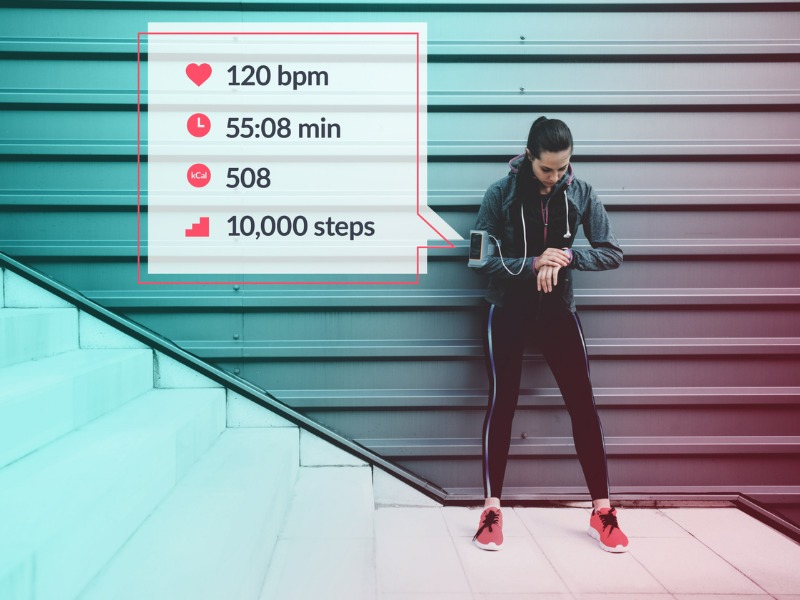

Vitality gives policyholders the opportunity to earn points for behaviour such as walking, going to the gym and completing online nutrition courses. The points can then be used toward discounts on running shoes and devices such as Fitbits, Apple Watches and Garmin vívofits.

“None of the information that we collect here is used for underwriting purposes,” Savage said, and Vitality is not mandatory if clients are not comfortable sharing their data.

As of Nov. 14, Vitality will also be available in a free version — Vitality Go — as well as Vitality Plus, which costs $6 a month and includes more rewards.

Paul Jones, senior manager with KPMG Canada, told Investment Executive this summer that Vitality is one example of a life insurer using technology to monitor its clients’ health and fitness, adding other large Canadian lifecos “are definitely exploring” the concept.

Similar in concept is Foresters Go, a mobile app launched in Canada in 2021 by Foresters Financial, which aims to give advisors additional value beyond the death benefit.

Correction: An earlier version of this article said Vitality would be available in a free version as of Sept. 27. That change will take place on Nov. 14.