Three of Canada’s big bank CEOs saw their compensation drop slightly in 2022 amid a challenging market. In a year of higher interest rates, higher costs, increasing loan-loss provisions as well as acquisitions, Toronto-Dominion Bank’s CEO was the outlier, pocketing almost 12% more in total compensation.

Royal Bank of Canada CEO David McKay received $15.3 million in direct compensation in 2022, exceeding his target of $14.0 million but down slightly (2%) from direct compensation of $15.5 million in 2021, which was a 25% increase over 2020.

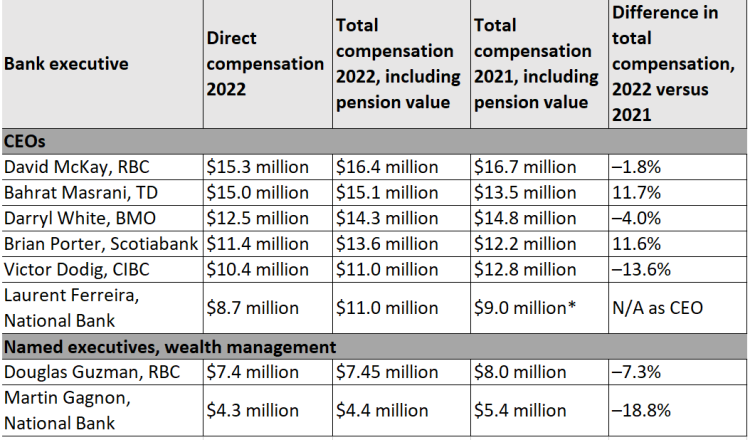

(For a comparison of total compensation among bank CEOs, which includes pension value, see the table below. Compensation was outlined in the banks’ proxy circulars.)

McKay’s direct compensation in 2022 included $1.5 million in base salary and about $3 million in a short-term incentive reward based on RBC meeting financial, client, and risk and strategic objectives. The short-term incentive was 33% above target but down by 27% from 2021, reflecting lower net income.

Also included in McKay’s direct compensation was $8.6 million in performance deferred share units (DSUs) and $2.2 million in stock options.

RBC earned $15.8 billion last year, or $11.06 per diluted share. That compared to record profit in 2021 of $16.1 billion, or $11.06 per diluted share.

Table: Bank CEO compensation in 2022

*as co-head of financial markets, then COO starting Feb. 1, 2021

Click to enlarge

Toronto-Dominion Bank

TD CEO Bharat Masrani followed closely behind McKay, receiving direct compensation of $15.0 million, beating his target of $13 million and up from $13.4 million in 2021.

In addition to salary of $1.5 million in 2022, Masrani received cash of $2.7 million, performance share units (PSUs) of $7.3 million and stock options of $3.6 million.

TD earned $17.4 billion in 2022, or $9.47 per diluted share — up from $14.3 billion, or $7.72 per diluted share in 2021. (In Q4, top-line earnings growth was boosted by financial moves in anticipation of the First Horizon acquisition.)

For 2023, Masrani’s direct compensation target rose to $15 million, based on market compensation levels reflecting the bank’s size and U.S. operations, the CEO role’s complexity and the bank’s performance under Masrani, the proxy circular said.

Bank of Montreal

Bank of Montreal CEO Darryl White received $12.5 million in direct compensation in 2022, exceeding his target of $10.5 million but down slightly from the $12.7 million he received the previous year.

In addition to salary of $1 million in 2022, White received a cash bonus of $3.3 million, PSUs of $6.3 million and stock options of $1.85 million.

BMO reported net income of nearly $13.5 billion last year, or $19.99 per diluted share, compared to $7.8 billion, or $11.58 per diluted share in 2021. (Fourth-quarter income in 2022 was boosted by the bank’s purchase of Bank of the West.)

Bank of Nova Scotia

Scotiabank CEO Brian Porter, who retired as CEO this past January, received direct compensation of $11.44 million in 2022, which was under his target of $11.75 million but up from $11.36 million the previous year.

In addition to a base salary of $1.3 million, Porter received $2.54 million in cash and $7.60 million in PSUs and stock options.

Scotiabank reported 2022 net income of $10.7 billion, a 5.7% increase over $10.2 billion in 2021. Diluted earnings per share increased 8% to $8.50 from $7.87 the year before.

CIBC

CIBC CEO Victor Dodig received direct compensation of $10.4 million, exceeding his target of $10 million but down from direct compensation of $11.7 million in 2021 (an 11% decrease and the biggest decline among the CEOs).

In addition to salary of $1 million, Dodig received a cash bonus of $1.9 million, $6.0 million in PSUs and $1.5 million in stock options.

CIBC reported a profit of $6.2 billion in 2022, or $6.68 per diluted share. That compared to profit of $6.4 billion the previous year, or $6.96 per diluted share.

National Bank of Canada

Laurent Ferreira, National Bank’s CEO since the 2022 fiscal year began on Nov. 1, 2021, received $8.7 million in direct compensation, exceeding his target of $7.7 million.

In addition to a base salary of $947,409, Ferreira received $1.9 million in cash, $3.9 million in PSUs and $1.9 million in options.

National Bank reported profit of $3.4 billion in 2022, or $9.61 per diluted share. That compared to a $3.1-billion profit a year earlier, or $8.85 per diluted share.

Compensation in wealth management

A couple of the banks’ named executives included heads of wealth management.

Douglas Guzman, group head, RBC Wealth Management, RBC Insurance and RBC Investor & Treasury Services, had total direct compensation of $7.4 million in 2022, compared to $8.0 million the previous year. The 2022 amount comprised a base salary of $700,000, a short-term incentive award of $1 million, performance DSUs of $4.6 million and stock options of $1.1 million.

Martin Gagnon, National Bank’s executive vice-president of wealth management, and co-president and co-chief executive officer of National Bank Financial, received $4.3 million in direct compensation in 2022 compared to $4.4 million the previous year. Gagnon’s direct compensation comprised a base salary of $548,496 and variable compensation of $3.7 million.

Shareholder proposals

The proxy circulars also included the shareholder proposals to be voted on at the banks’ respective upcoming annual shareholder meetings. These include establishing an advisory voting policy on environmental policies (TD, BMO, Scotiabank, CIBC, National Bank) and conducting racial equity audits (RBC, BMO).