This article appears in the November issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The Canada Revenue Agency (CRA) is charging higher interest rates on overdue taxes, raising the risk of heavier costs if a taxpayer makes payments late or is later reassessed.

Proposed changes to the general anti-avoidance rule (GAAR) extend the period the CRA has to reassess a tax return, giving the agency more flexibility to audit past returns. And the expanded trust reporting rules, the underused housing tax and the proposed mandatory disclosure and notifiable transactions regime give the CRA more information about taxpayers.

“There’s a huge data-gathering exercise going on right now, and I think, in a sense, it’s emboldening the CRA,” said Clayton Achen, a partner with Achen Henderson Chartered Professional Accountants in Calgary.

Combined with higher interest on overdue tax, the risks for clients have increased.

“The consequences [for taxpayers] are higher now than they were before,” said Peter Aprile, a partner with Counter Tax Litigators LLP in Toronto.

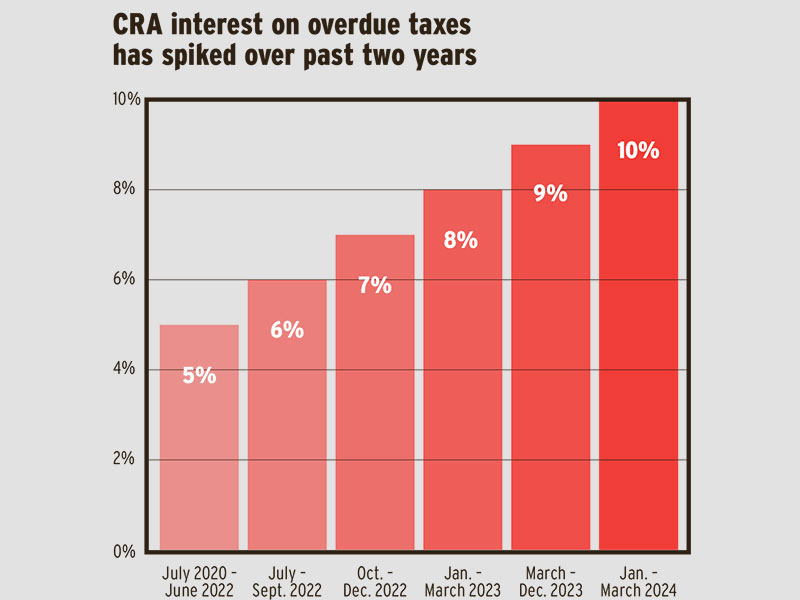

In January, the CRA will begin charging 10% interest on current or outstanding overdue taxes, up from 9% in the current quarter. The interest the CRA charges on overdue taxes is based on a prescribed rate, tied to the yield on Government of Canada three-month Treasury bills plus four percentage points, and recalculated every quarter.

The last time the CRA charged interest at 10% was the second quarter of 2001.

The CRA charges interest, compounded daily, on overdue taxes. It may also impose penalties, as well as interest on the penalties.

Where the CRA successfully reassesses a return, it retroactively charges interest on the overdue amount from the day the tax would have originally been due. The interest the CRA charges on an overdue amount over time will reflect the prescribed rates for each quarter over that period. The CRA also may apply penalties related to the non-compliance — and interest on those penalties.

The extra cost of high interest on taxes owed can be severe.

Kenneth Keung, director of Canadian tax advisory with Moody’s Private Client Law LLP in Calgary, and his colleague Evan Crocker, senior tax associate in Vancouver, have analyzed a potential scenario. Consider a Canadian-controlled private corporation (CCPC) that files a tax return for 2023 and pays all taxes owing by March 31, 2024.

Before the normal reassessment period ends in 2027, the CRA reassesses the corporation for $100,000 in additional taxes for 2023. The corporation unsuccessfully fights the reassessment through the objection and appeals process, and on March 31, 2029, finds itself owing the taxes and five years’ interest, compounded daily, on the reassessed amount.

If the prescribed interest rate on overdue taxes remained at 10% throughout the five-year period, the corporation would owe approximately $165,000 in taxes and interest on March 31, 2029. In contrast, if the prescribed rate was 5% (the lowest interest rate that can be charged on overdue taxes), the corporation would owe approximately $128,400 on that date — a difference of $36,600.

Generally, the CRA is allowed to reassess individual taxpayers and CCPCs for up to three years from the mailing of a notice of assessment. For corporations that are not CCPCs, the normal reassessment period is four years. Once the normal reassessment period has passed, a tax year becomes “statute-barred.”

However, new and proposed legislation is “slowly chipping away at this statute-barred period,” said Natalie Worsfold, a partner with Counter Tax Litigators. For example, the proposed new GAAR would extend the normal reassessment period by an additional three years unless the taxpayer had disclosed the transaction.

In addition, proposed new rules governing intergenerational family business transfers extend the normal reassessment period by three years for immediate transfers and 10 years for gradual transfers.

In addition to these proposals, the CRA can reassess beyond the normal reassessment period under certain conditions, including if it can prove that the taxpayer has made a misrepresentation attributable to neglect, carelessness or willful default. The CRA also may impose gross negligence penalties, but the burden of proof for the agency is high.

“The CRA has become increasingly aggressive when pursuing audits and frequently attempts to justify reassessments after the normal reassessment period on the basis of carelessness or neglect,” said Christopher Slade, a partner with Aird and Berlis LLP, at a Canadian Tax Foundation conference in Toronto in October.

In an emailed response to questions from Investment Executive, CRA spokesperson Nina Ioussoupova did not address whether the CRA had recently increased its audit activity.

However, Ioussoupova said that “with continued budget investments by the Government of Canada directed at collaboration with domestic and international partners, technological advancements, and new sources of information, the CRA is well positioned to make sure everyone pays the taxes they owe. These measures help the CRA target those who push or exceed the legal limits of tax planning to evade or avoid taxes and reporting obligations.”

David Rotfleisch, tax lawyer with Rotfleisch & Samulovitch Professional Corp. in Toronto, said he believes the CRA “has always been aggressive” in pursuing audits, irrespective of the rate of prescribed interest. “My sense is that [the CRA has become] more selective in what they’re auditing,” he said, and focusing on areas such as real estate and cryptocurrency transactions.

However, higher interest rates “become more of an issue if you’re a taxpayer thinking of getting into some sort of tax-assisted investment,” Rotfleisch said. “If it gets denied, you’ve got a real concern at 10%.”

When the prescribed rate on overdue taxes is low, a taxpayer could consider adopting a technically sound but aggressive tax position on the grounds that the benefit of the potential tax savings outweighs the risk of a reassessment if no gross negligence penalty is applied, wrote Keung and Crocker in a paper presented at a Canadian Tax Foundation conference in May.

However, when the rate for overdue taxes is high, pursuing the same position comes with greater risk, they said.

The prescribed rate on overdue taxes will decrease if interest rates begin to turn lower, somewhat mitigating the negative impact on taxpayers. “It’s a quarterly fluctuation,” Rotfleisch said.

However, high interest rates are not the only reason clients may become more cautious in their tax planning. Proposed legislative changes, such as the strengthened GAAR — which features a penalty equal to 25% of the additional tax owing as a result of the GAAR’s application, less any gross negligence penalty imposed — as well as the proposed mandatory disclosure and notifiable transaction rules “all serve to dial back the willingness of taxpayers to risk a CRA reassessment,” Keung and Crocker said.

Click image for full-size chart