Global infrastructure spending is expected to soar during the coming decade, presenting myriad investment opportunities in a sector that provides “real asset” exposure within investment portfolios.

“Like real estate, infrastructure falls into the ‘hard asset’ bucket, and deserves an allocation of its own,” says Gajan Kulasingam, vice president and senior portfolio manager at Toronto-based Sentry Investments Inc. “Infrastructure is a cash flow-driven asset that offers long-duration growth and provides valuable diversification in portfolio construction.”

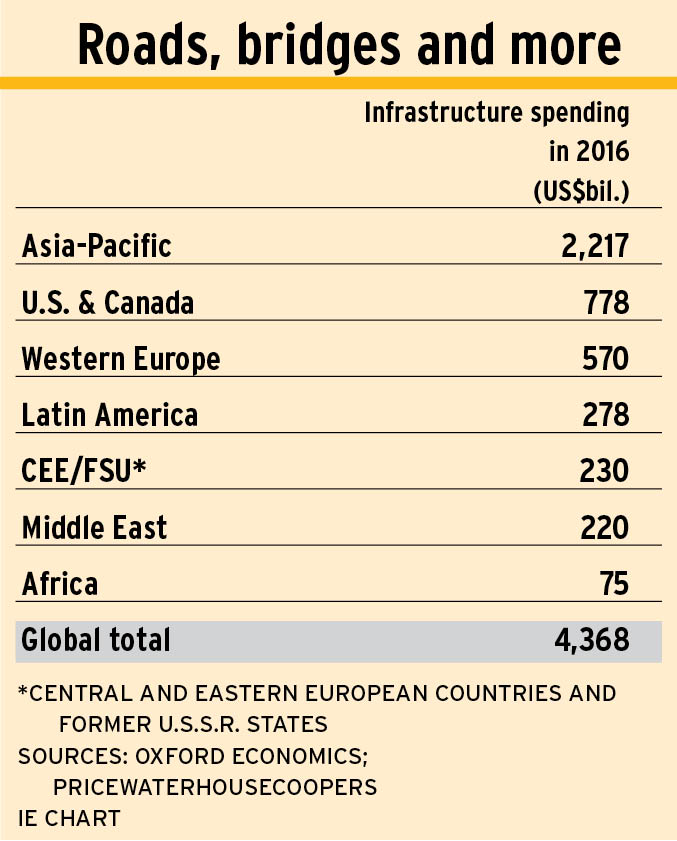

U.K.-based forecasting firm Oxford Economics predicts infrastructure spending in the 49 countries that account for 95% of global economic output will grow to more than US$9 trillion a year by 2025, more than double the US$4 trillion that was spent in 2012.

The continued growth of megacities in both emerging and developed markets is creating enormous need for infrastructure of all types, from power- and water-management systems to roads, bridges, airports, telecommunication facilities, storage terminals and shipping ports.

Emerging markets, especially China, India and other regions in Asia, are experiencing accelerated growth in infrastructure spending as they benefit from a rising middle class and improving tax revenue for governments.

Closer to home, Canada’s federal government intends to stimulate the domestic economy with infrastructure spending, launching an “infrastructure bank” with $15 billion in direct federal investment and another $20 billion in repayable contributions, loans and loan guarantees. The government hopes to attract $5 in private investing for every $1 in federal funding.

In the U.S., President Donald Trump also touts the economic benefits of infrastructure expansion, with talk of spending US$1 trillion to “build the next generation of roads, bridges, railways, tunnels, sea ports and airports.” With the Republican sweep of both Congress and the Senate, Trump may have more success in pushing through projects than the previous administration did.

“Infrastructure spending has been accelerating in emerging markets during the past two years, and the U.S. is joining the fray, as is Europe,” says Christine Tan, chief investment officer at Excel Investment Counsel Inc. in Mississauga, Ont. “The standouts are China, which spent US$1.2 trillion in 2016, and India.”

The latter is the fastest-growing major economy in the world, expected to expand at a sizzling annual rate of 7.6% for 2016. India’s annual gross domestic product (GDP) now stands at almost US$2 trillion, rivalling Canada’s GDP of more than US$1.8 trillion. However, India, with a population of 1.3 billion people, has 40 times as many people as Canada has to spur growth.

India’s government’s five-year plan includes spending US$1 trillion on infrastructure, says Atul Penkar, head of offshore equities at Birla Sun Life Asset Management Co. Ltd. in Mumbai and portfolio manager of Excel India Fund.

Among the companies that Penkar holds in his fund to capitalize on this expansion are Larsen & Toubro Ltd., an India-based construction company specializing in roads, bridges, railways and railway stations, as well as in servicing offshore construction.

While there are opportunities to invest in companies involved in the engineering and construction of massive projects, as well as in the providers of materials such as cement and steel, these businesses are vulnerable to economic cycles and competitive bidding pressures. These companies may benefit during the infrastructure-building phase, but don’t promise the long-term benefits of actual infrastructure ownership. Pure infrastructure investing is focused on ownership of revenue-generating assets such as electrical and water utilities, shipping ports, toll roads, airports, pipelines and communication towers.

“Our focus is on owning pure-play infrastructure assets,” says Craig Noble, senior managing partner in Chicago with Toronto-based Brookfield Investment Management Inc. and portfolio manager of Manulife Global Infrastructure Fund. “The companies provide stable cash flow for the long term and are defensive in times of volatility. These projects are capital-intensive and, once constructed, there are high barriers to entry.”

For example, a top holding in the Manulife fund is U.S.-based Kinder Morgan Inc., the largest energy infrastructure firm in North America and the operator of Canada’s Trans Mountain Pipeline, whose $6.8-billion expansion has just been approved by the federal government.

Infrastructure investment categories include:

– Utilities. This category includes electricity, water and natural gas distribution. Utilities usually are regulated, but are permitted to raise their fees to stay ahead of inflation.

– Transportation. Toll roads, airports, shipping ports and railways fall into this category.

– Energy. This group includes oil and natural gas pipelines, hydroelectric facilities and alternative sources of power, such as wind and solar.

– Communications. In this category, cellular tower networks are experiencing rising traffic as cellphone usage increases for video and data transmission.

– Technology. This new category is finding its way into some infrastructure portfolios. It includes web-based companies, such as Amazon.com Inc., that dominate online retail sales, warehousing and distribution; and cloud-storage companies such as Google Inc. Also included is Visa Inc., the world’s largest payment network for debit and credit transactions. (All three are U.S.-based.)

Infrastructure companies are not a homogeneous group, and the various sectors face different opportunities and risks. For example, utilities are more popular for their steady dividend income than growth prospects, and are vulnerable to rising interest rates. That sector has lost some value in the wake of the election of Trump, as positive economic expectations pushed up yields in the bond market and decreased the relative attractiveness of the dividend yield on utilities stocks.

Darren Spencer, director, alternative investment counselling, in San Diego with Seattle-based Russell Investments Group LLC, is portfolio manager of Russell Investments Global Infrastructure Pool. That portfolio currently is underweighted in utilities; however, Spencer says, there is a possibility that utilities could overcorrect and he is looking for buying opportunities. And, he adds, although rising interest rates may cast a shadow over certain slow-growth utilities, if interest rates are rising due to stronger economic growth, that can boost other infrastructure revenue on toll roads, railways, airports and marine ports.

“You need to analyze what is going on in the different sectors, geographies and individual companies,” says Spencer. “We have rotated out of U.S. utilities and increased our emphasis in Europe, where valuations are lower.”

Companies that own and operate telecom towers are popular, including American Tower Inc. and Crown Castle International Corp., both based in the U.S. and both expanding across South America, Europe and Asia.

In the case of American Tower, Dennis Mitchell, portfolio manager of Sprott Global Infrastructure Fund and senior vice president at Sprott Asset Management LP, a subsidiary of Sprott Inc. of Toronto, says 70% of American Tower’s assets are in the U.S., where organic revenue growth has been 5% a year. Even better, the 30% of assets outside the U.S. have been generating 10% revenue growth.

“The more functionality on the cellphone,” Mitchell says, “and the more data and apps that go through it, the better the network needs to be and the more towers [are required].”

Another stock held in both the Sentry and the Sprott infrastructure funds is Spain-based Ferrovial SA, developer and owner of concessions such as the 407 toll road in Ontario and Heathrow airport in the U.K. As well, Russell, Manulife and Sprott each hold shares in Australia-based Transurban Group, which owns toll roads in the U.S. and Australia.

© 2017 Investment Executive. All rights reserved.