Portfolio managers are cautiously optimistic about Canada’s equities market for 2017, as Canada’s economic prospects are looking a little brighter. A report from Royal Bank of Canada (RBC), for example, states that Canada’s gross domestic product (GDP) is expected to reach 1.8% in 2017, up from 1.3% last year, driven by an increase in business investment and consumer spending.

However, says Stephen Groff, principal and portfolio manager with Cambridge Global Asset Management, a unit of CI Investments Inc., in Toronto: “[Picking stocks] is not super-easy out there. [Canadian equities] is a more challenging market.” Groff is portfolio manager of Cambridge Dividend Fund and co-manager of Cambridge Pure Canadian Equity Fund.

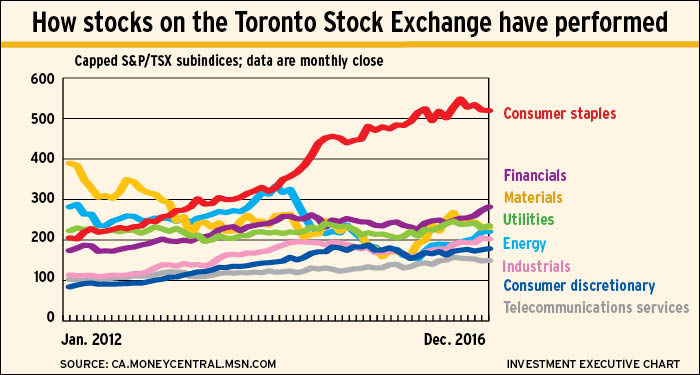

Investors should be particularly wary of the defensive sectors, such as utilities and telecommunications, which typically are viewed as bond proxies and are sensitive to increases in interest rates.

Instead, sectors that are positioned to benefit from a growing U.S. economy and a rebounding oil market are worth a look in 2017:

– Financials. With some exceptions, fund managers are bullish on banks although the financial behemoths are not without headwinds.

For instance, their valuations are slightly high, a housing bubble remains a concern, and loan growth is likely to slow given high household debt.

However, loan losses are down, mainly thanks to the oil market rally, and higher interest rates, flowing through from the U.S., will increase net interest margins.

Nevertheless it’s banks with exposure to outside of Canada that are the favourites. Bank of Montreal, Royal Bank of Canada, and Toronto-Dominion Bank are viewed positively for their foothold in the U.S. while the Bank of Nova Scotia is focused on Latin America.

Managers are also looking closer at life insurance companies because of higher interest rates, which lower their future liabilities, and their exposure to U.S. and global economies. James Morrison, associate portfolio manager with Mackenzie Financial Corp., for instance, sees potential in Manulife Financial Corp. and Great-West Life Assurance Co. because of their strong capital position and their footprints in Asia and the U.S, respectively.

Among investment companies, Brookfield Asset Management Inc. has caught the eye of many managers. “I’ve been finding Brookfield is a long-term secular winner,” says Darren Lekkerkerker, portfolio manager at Fidelity Investments Canada ULC in Toronto.

– Energy. Portfolio managers such as Zain Shafiq, senior investment analyst, with Mackenzie, are more positive in the energy sector, thanks to the recent increases in prices. But, despite this sliver of optimism, the focus is on firms that can weather price changes or sustained low prices.

“All we know about our forecasts for oil prices is that they will be wrong,” says Shafiq. One company that has caught Shafiq’s eye is the mid-cap stock Raging River Exploration Inc. because of its low costs, strong management team and solid balance sheet that can handle oil prices in the low $40-a-barrel range.

Similarly, Groff looks for firms that can withstand price fluctuations because of their unconventional business models. For example, PrairieSky Royalty Ltd. is of interest to Groff because it collects fees from companies that drill on its land.

Mark Allen, vice president, Canadian equities, with Royal Bank of Canada‘s wealth-management division in Toronto, is interested in Suncor Energy Inc. because of its low operating costs and its opportunity to expand its oilsands operations over the long term.

– Consumer staples. Valuations in this sector are high because investors bought these stocks when seeking refuge from dropping oil prices in recent years. But there still are a few companies worth checking out. For example, Groff likes George Weston Ltd.: “It’s not a bargain, but it’s a very well-run company.”

Graham Meagher, associate portfolio manager with Mackenzie, likes Alimentation Couche-Tard Inc. because of its decentralized management style and its mergers-and-acquisitions strategy, which has seen the company gain a foothold in the U.S. and Europe.

– Consumer discretionary. There aren’t many bargains in this sector, but there are a few opportunities.

Lekkerkerker sees value in Restaurant Brands International Inc., which owns Burger King and Tim Hortons. Restaurant Brands, in turn, is owned by New York-based 3G Capital. “The [3G Capital] management team is well aligned by owning a lot of stock in [Restaurant Brands],” he says, “and has done a great job at capital allocation and improving operations.”

Morrison favours Linamar Corp. because of its valuation. As well, he isn’t too concerned about whether U.S. President Donald Trump acts on his election promise to tear up the North American Free Trade Agreement. “I don’t think [Trump’s actions] are a deal breaker if [that] mixes things up.”

-Industrials. The industrials sector as a whole is expensive, but there are some possibilities. For example, Groff’s Cambridge portfolios hold shares in Stantec Inc. and TransForce Inc., but those companies’ recent strong results mean he will not be increasing those holdings at their current prices.

“These are good franchises,” Groff says, “but we constantly reassess the valuations. And, in some of the cases, they’re not as attractive as they were.”

Lekkerkerker, for his part, continues to favour Canadian Pacific Railway Ltd. because of its strong management team, the fact that the company buys back stock and the likelihood of shipping volumes increasing due to an improving U.S. economy.

– Utilities and telecommunications. High valuations and interest rate sensitivity mean few opportunities can be had in these sectors in 2017.

Says Allen: “Valuations may face headwinds if bond yields continue to rise.”

– Technology. The sector is relatively small in Canada, so more investment opportunities are found outside Canada.

Lekkerkerker’s portfolio, however, holds shares Constellation Software Inc.: “[It has] bought good assets at attractive prices, which resulted in a lot of success for management and shareholders.”

– Small-caps. Most small-cap picks share a common theme: exposure to the U.S. economy.

When choosing small-cap technology, health care, consumer-related or financial stocks, David Barr, president, CEO and co-chief investment officer at PenderFund Capital Management Ltd. in Vancouver, looks for companies with connections to the U.S. in revenue or operations. The potential move toward a more insular, protectionist U.S. economy could be a positive for Canada-based companies that have operations in the U.S., Barr says.

One of Pender’s small-cap picks in the technology sector is Espial Group Inc., a software company that builds “set-top box” operating systems for cable and telecom companies.

Barr likes Espial, too: “Its product just makes staying in a cable company’s or telcos’ environment really easy for people.”

Barr also sees value in Medicure Inc., a company that licenses a drug for cardiac events in emergency rooms.

Michael Chan, vice president and senior portfolio manager, small-cap equities, in Toronto with Montreal-based Fiera Capital Corp., sees opportunities in industrials and resources, including natural gas producer Painted Pony Petroleum Ltd.

In industrials, Chan foresees plenty of room for growth for Badger Daylighting Ltd., a company that manufactures “hydrovac” trucks, which use water pressure to drill into the ground. Badger’s fleet has recently grown to 1,000 trucks, two-thirds of which are based in the U.S. IE

© 2017 Investment Executive. All rights reserved.