Strong relationships drive client loyalty

Advisors with Raymond James, DS and IPC received some of the best ratings from their clients, according to new research

- By: Rudy Mezzetta

- January 15, 2018 November 9, 2019

- 00:19

Advisors with Raymond James, DS and IPC received some of the best ratings from their clients, according to new research

The big issue is the fate of the proposed Co-operative Capital Markets Regulator. But other issues will contribute in making 2018 a confusing year

Canada's Big Six banks seek new ways to embrace technology - including working with fintech firms and incorporating AI into banking services

With robo-advisor platforms and similar services here to stay, these firms will magnify their existing offerings and enter new arenas

Both markets are poised to enjoy healthy growth in 2018, but the ETF market is broadening beyond products that mimic key benchmark indices

Although insurance products themselves aren't expected to undergo drastic changes, pricing is likely to shift for some products, and insurers are re-evaluating others

A growing list of compliance responsibilities - including advisor oversight - and a trend toward acquisition by larger firms presents challenges for independent insurance distributors

The federal government must find a way to proceed with changes to the tax rules affecting private corporations and respond appropriately to U.S. tax cuts

Some firms are revamping their strategies and training programs to ensure the next generation of advisors is prepared for a changing marketplace

Asset-management companies increasingly are integrating environmental, social and corporate governance factors into the selection and management of investments as investors' interest in responsible investing grows

CRM2 has raised investors' awareness regarding how much they pay for advice and how financial advisors are paid

Kevin Wark discusses three options for helping aging clients manage their property, and zeroes in on the pros and cons of joint interest trusts

The province will “consult extensively with stakeholders” on effort to restrict the use of financial planning titles and impose proficiency requirements on financial planners

Look for investment opportunities in a broad range of sectors that focus on older consumers

Many people are more afraid of running out of money than of dying. Advisors need to ensure retired clients act prudently

With interest rates beginning to inch higher after ultra-low levels over the past several years, generating decent returns from a fixed-income portfolio remains a challenge

Women are very concerned about maintaining support for their families. They also are more likely than men to be single later in life and to…

Technology can help older clients manage both long-term assets and daily finances

Many clients rely on the Canada Pension Plan to form at least part of their guaranteed retirement income. But deciding when to take the benefit,…

Many affluent families worry that a large inheritance will rob their children of motivation. There also are concerns about how they will handle the money.…

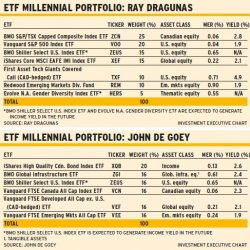

Millennial clients who begin a low-cost plan of saving for retirement now will reap the benefits over time. We asked two portfolio managers with ETF…

A desire to help children and grandchildren - combined with the availability of credit - is encouraging many elderly clients to carry debt into retirement

Spousal RRSPs can be a simple and effective tax-saving strategy for married and common-law couples. But these accounts are not for everyone - and have…

Clients seeking to access the value held in their homes during retirement often are faced with a difficult choice: should they sell and downsize, or…