ETFs are proliferating rapidly as more providers enter the field, and the range of choices available allows financial advisors to construct a well-diversified, low-cost retirement portfolio using only ETFs.

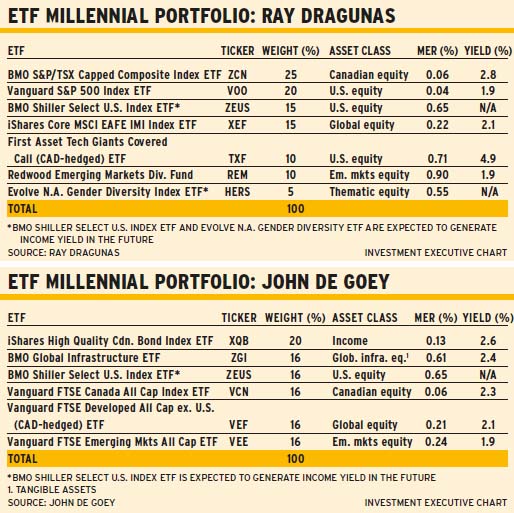

Investment Executive asked two portfolio managers with expertise in ETFs – John De Goey at Industrial Alliance Securities Inc. in Toronto and Ray Dragunas of the Ray Dragunas Investment Consulting team with Aligned Capital Partners Inc. in London, Ont. – to assemble model retirement portfolios for a millennial client saving for retirement.

The imaginary client is about 35 years old, employed in a well-paid job, upwardly mobile and expects income to increase with age. He or she is maximizing RRSP contributions, and the goal for the ETF portfolio is primarily growth, but not too aggressive, considering this is retirement money.

Both portfolio managers lean strongly toward equities in their recommended portfolios due to the client’s long-term time horizon and the ability to withstand some inevitable bearish periods in return for the superior long-term growth potential of stocks.

“An upwardly mobile millennial ought to be tilting his or her portfolio toward equities due to volatility working in his or her favour,” De Goey says. “People who can get into the habit of putting a little aside on a regular basis – such as monthly – might actually prefer a bouncier ride because it provides opportunities to buy on dips.”

De Goey allocates only 20% of the portfolio to fixed-income, with the choice of iShares High Quality Canadian Bond Index ETF. Dragunas’s portfolio excludes any exposure to traditional fixed-income. He includes Redwood Emerging Markets Dividend Fund ETF to generate some income in the portfolio and act as a stabilizer.

“The focus on equity in this hypothetical portfolio is based on the assumption that the time horizon is at least 25 years for this client,” says Dragunas. “Although equities markets exhibit volatility over the short term, over longer time horizons, equities should provide a better return. Also, given that we are nine years into a bull equities market, some dividend-paying ETFs are recommended to try to smooth out some [expected] volatility.”

At this point in the market cycle, Dragunas says, central banks appear to be embarking on a tighter monetary policy, which may put interest rate-sensitive investments such as bonds under pressure. Therefore, there isn’t any fixed-income allocation in his portfolio.

“Over the past 35 years, we have seen interest rates fall from double-digits to effectively zero,” Dragunas says. “If recent increases in interest rates continue, this will affect fixed-income prices negatively. Also, interest rate increases imply a strengthening economy, which is good for equities.”

On the equities side, both portfolios are diversified geographically, with a mix of Canadian, U.S., international and/or emerging-markets exposure. Dragunas includes some equity ETFs that focus on capped or equal-weighted stock holdings, thereby minimizing the concentration risk that comes with traditional market capitalization-weighted strategies.

Both portfolio managers include niche exposure. For example, Dragunas recommends a 5% weighting in Evolve North American Gender Diversity Index ETF, a responsible investment strategy sponsored by Evolve Funds Group Inc. of Toronto, and a 10% weighting in First Asset Tech Giants Covered Call ETF, sponsored by First Asset Investment Management Inc. De Goey includes a 16% holding in BMO Global Infrastructure ETF, sponsored by BMO Asset Management Inc. of Toronto.

“Infrastructure is a sort of tangible asset that’s weakly correlated to traditional financial assets, such as plain-vanilla stocks,” De Goey says. “Most people ought to have at least a little invested in countercyclical, inflation-hedge products that grow over time and often zig when traditional markets zag.”

Both portfolio managers include exposure to emerging markets, although they chose different ETFs in this category.

A common selection is BMO Shiller Select U.S. Index ETF, which is based on the research of Robert Shiller, professor of economics and finance at Yale University. This ETF offers access to Shiller’s cyclically adjusted price/earnings (CAPE) methodology, an equal-weighting strategy that combines value and momentum. CAPE is designed to uncover companies with a long history of earnings but are underpriced while avoiding companies that may be well priced but are mired in doldrums or are a “value trap.”

© 2017 Investment Executive. All rights reserved.