Lessons from Air Canada

Financial advisors can learn significant lessons from major airlines about how to treat their top clients. Here are some ways you can offer "frequent flyer"…

- By: Dan Richards

- October 26, 2014 November 6, 2019

- 23:00

Financial advisors can learn significant lessons from major airlines about how to treat their top clients. Here are some ways you can offer "frequent flyer"…

Getting exposure to alternative strategies through exchange-traded funds has advantages over other methods

CLHIA releases compliance guidelines as part of its response to recommendations from regulators

Once an estate plan is finalized, it’s critical to ensure the right person – or team of people – is appointed to execute it, especially…

Tom Junkin, senior vice president, personal trust services, Fiduciary Trust Company of Canada discusses the top three issues advisors need to raise when planning for…

When working with blended families, advisors have the difficult task of helping clients ensure their estate plan accounts for their children, stepchildren and spouse —…

In this week’s Ruta’s Rules, Jim Ruta, managing partner and chief sales officer, InforcePRO, explains how acting like a business owner can actually damage your…

When clients settle down with new partners, advisors should help them make the appropriate adjustments to their estate plan

In this week’s Gaining Altitude, Dan Richards, CEO, Client Insights, explains how helping affluent clients discuss the difficult and sensitive issue of estate planning with…

A new method in financial planning that balances eight forms of capital will help you and your clients achieve their life and retirement goals

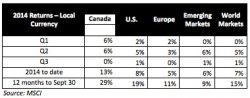

In this week’s Gaining Altitude, Dan Richards, CEO, Client Insights, gives tips on what to include in a quarterly letter to clients about recent market…

Customize this template to reflect your views, especially when it comes to recommendations for the period ahead.

In this week’s Ruta’s Rules, Jim Ruta, managing partner and chief sales officer, InforcePRO, gives six tongue-in-cheek tips on how to make sure you don’t…

The Department of Finance Canada has proposed revisions to the tax rules that limit how much clients can hold in the cash portion of their…

Now is a good time to review strategies - such as those involving charitable donations and TFSAs - that are affected by the end of…

Recent stock market growth has probably resulted in capital gains for many of your clients. Knowing how best to deal with the tax consequences of…

American taxpayers who own Canadian investment funds may be subject to U.S. taxes

T1135 is more than just a form. The new rules for reporting more details about foreign property are inconvenient, but must be taken seriously

A registered education savings plan is a great way to save for a child's post-secondary education. However, you should take advantage of the Canada education…

Three taxpayers recently found out that, whether or not they made mistakes on a technical rule, tried to game the system or got caught up…

Now that the IRS has new powers to track taxpayers who live outside their country, it is especially important to track changes in the U.S.…

The federal government is curbing the use of testamentary trusts as tax-saving vehicles for affluent families. However, there still are many uses for these trusts.…

There are various federal tax credits and deductions available for clients who are raising families

The tax treatment of a settlement involving investment losses depends on whether the payment replaces ordinary income, covers personal injury or is considered a windfall

Although half of the provinces in Canada made no changes to their taxation regimes, the other half took a different approach by either increasing or…