At the close of last year, retail branch advisors and planners working with Canada’s big banks were succeeding at building their books, generating strong growth in assets under management (AUM) and productivity.

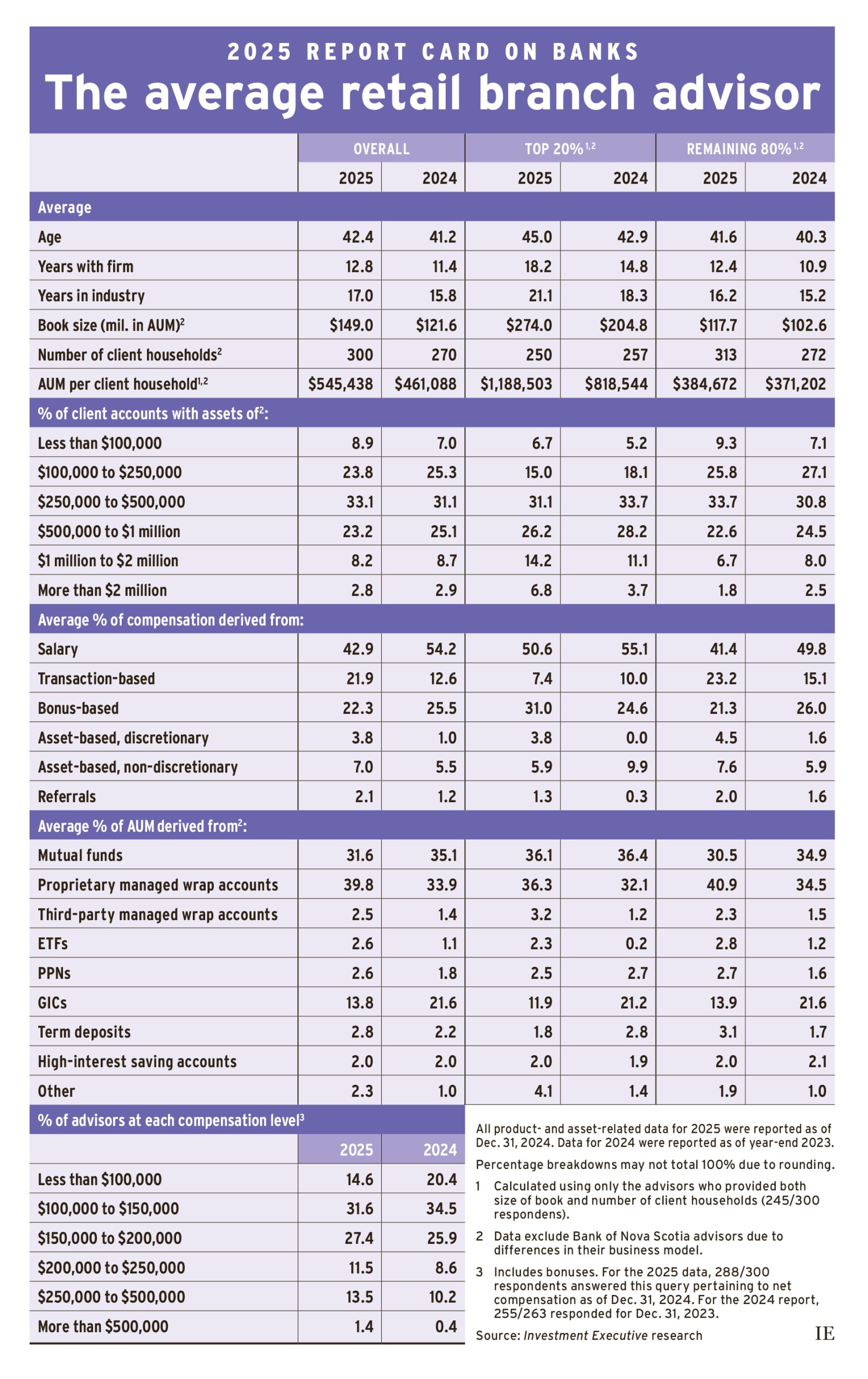

According to data from this year’s Investment Executive Report Card on Banks, the average retail branch advisor saw their AUM grow more than 20% in the one-year period between Dec. 31, 2023 and 2024. Their average AUM rose to almost $150 million as of Dec. 31, 2024 from $121.6 million the year before. This growth in average assets came alongside an increase in client numbers, with the average advisor now serving 300 client households (up from 270).

These strong gains likely reflected several constructive drivers. While the number of client households served by the average advisor has grown, average AUM grew at a much faster rate in the year measured — indicating market gains and possible other factors such as attracting a greater share of clients’ assets.

These advisors’ average productivity, measured as AUM per client household, was up this year, too. Average productivity for the industry overall rose to $545,438 from $461,088 in the 2024 report.

However, this trend wasn’t uniform across all retail bank advisors. This industry segment’s top-performing group — defined as the top 20% in terms of productivity — drove the general rise in productivity. That marked a reversal from last year’s theme, when the top 20% saw AUM per client household slide close to 11% on average.

This year’s data show that the top-performing respondents recorded stronger asset gains than the remaining 80% of the sample. Their activity translated into robust improvement, as their asset growth actually coincided with a modest decline in their client household numbers. Their average client list contracted to 250 from 257 in the 2024 report.

For the top-performing group, average AUM came in at $274 million from $204.8 million in 2024. Paired with their lighter client household data, their average productivity soared to nearly $1.2 million this year from $818,544.

For the remaining 80%, AUM climbed at a more modest pace. Their average book grew about 15% to $117.7 million. That increase in assets matched similar growth in their client numbers, indicating AUM growth that likely was primarily driven by adding new clients.

So, for this larger segment of the sample, reported productivity rose only slightly to $384,672 this year from $371,202.

Top performers focusing on high net worth, managed accounts

For the top 20% of those polled, there was also a shift in the composition of their books from a client and product perspective.

The average share of their books allocated to client accounts worth $1 million or more rose notably to 21% in this year’s report from 14.8%. The share devoted to the largest account size (more than $2 million) almost doubled to 6.8% from 3.7%.

When it came to these advisors’ average product choices, both the top 20% and remaining 80% focused less on GICs and more on managed wrap accounts and ETFs.

Among the top 20% group, average allocation to GICs was down to 11.9% of assets managed from 21.2% in last year’s report. At the same time, proprietary managed wrap accounts gained several points, rising to 36.3% from 32.1% of the average top performer’s AUM. These accounts edged out mutual funds as the top choice among the leading retail bank advisors.

For the remaining 80% group, their average allocations (as a percentage of AUM) to managed wrap accounts and ETFs were also higher in this year’s report than in 2024’s. However, those shifts came at the expense of mutual funds as well as GICs. Among these advisors, their average allocation to mutual funds declined to 30.5% from 34.9%, while their allocation to GICs was down to 13.9% from 21.6%.

As this set of retail bank advisors collectively turned away from old-school products, such as mutual funds and GICs, their allocation to proprietary managed wrap accounts jumped to 40.9% from 34.5% last year. ETFs also accounted for a greater share of their AUM on average, with allocation to those products rising to 2.8% from 1.2% — with an even larger increase seen among the top 20%, to 2.3% from 0.2%.

Bigger paydays

The evolution of retail bank advisors’ books is, at least in part, translating into higher compensation. According to this Report Card, most respondents were making $150,000 or more. (For more on these advisors’ perception of their pay, read Retail bank advisors identified pay as a key motivator.)

In the 2024 report, less than half (45.1%) of respondents reported earning more than $150,000 in net compensation including bonuses. This year, that share reached 53.8%, and each compensation range above the $150,000 – $200,000 mark was up from a year ago.

One quarter of the retail bank advisors in the survey reported making between $200,000 and $500,000, up from 18.8%.

This shift toward a higher average payday, which came alongside overall growth in average AUM, was most sharply driven by this segment’s top –performers. That cohort posted significant growth ahead of 2025’s gathering economic clouds.

Click image for downloadable version of the table