Retail financial planners and advisors working at the Big Six banks’ branches continue to say they have access to plenty of products. On average, they feel they can readily meet clients’ needs, despite being limited to certain product types and despite the bank branches’ closed shelves.

Researchers for Investment Executive’s (IE) 2025 Report Card on Banks asked 300 retail planners and advisors to rate the quality of their bank’s product shelves and then their ability to make suitable product choices. This year, respondents were more explicitly asked to rate their freedom to choose products within the confines of the banks’ proprietary shelves, with that second category name changed from “freedom to make product choices” to “ability to make suitable product choices.”

On average, the respondents rated overall shelf quality across the Big Six at 8.8 out of 10 — up from 8.4 the previous year. The banks’ performances nearly all improved on last year’s ratings. National Bank of Canada’s rating increased almost a full point.

Given the banks made no significant changes to their product shelves over the past year, the rating rebound in the quality of banks’ product shelves was likely attributable — at least in part — to respondents becoming even more accustomed to working within the framework of their proprietary shelves.

As in previous years, respondents overall said they had a wide range of products to meet client needs. For example, a planner in Atlantic Canada with BMO’s Financial Planning division said they had access to “a full suite of managed products, ETFs, mutual funds [and] GICs.” (On average, across all banks, ETFs accounted for less than 3% of respondents’ assets under management.)

Still, when asked to rate their bank on either of the product categories, approximately one in five respondents (18%) shared a verbatim comment about the limits of proprietary shelves. They did so despite being asked to provide their ratings based on their proprietary shelves.

“We are forced to use [proprietary products] even if they aren’t the best product available,” said a planner in British Columbia with TD Bank’s TD Wealth Financial Planning business.

“No third-party products [are available], which narrows the scope for the client,” a retail bank advisor with Scotiabank in Ontario said.

“It’s in clients’ best interest to open the market to offer third-party funds,” a planner in B.C. with RBC’s Financial Planning division said.

Client-focused reforms

Respondents’ average rating for product-shelf quality had been on a downward trend leading up to 2021, the year when three of the six banks trimmed their shelves of third-party funds as the client-focused reforms (CFRs) came into effect. Those reforms allowed proprietary product shelves.

All the big banks’ branch divisions now have proprietary shelves. The other three had already adopted that stance prior to 2021.

“If you’ve got an entirely closed shelf, to deliver entirely unconflicted advice is not possible,” Michael Thom, managing director of CFA Societies Canada in Toronto, said. “It’s a question of ‘How do you disclose [the conflicts].”

That all the banks have proprietary shelves at the branch level “speaks to the uncompetitive nature of our financial services sector,” said investor advocate Harvey Naglie. “It speaks to the fact that Canadians still pay the highest [management expense ratios] for their mutual funds — plain and simple.”

In 2021, Ontario’s finance minister directed the Ontario Securities Commission (OSC) to investigate banks’ move that year to proprietary shelves. The OSC submitted its report, but no action resulted.

Nearly two years ago, the federal Department of Finance asked in a competition-focused consultation whether large banks should be required or incentivized to offer third-party products. No report was released.

Ian Tam, director of investment research, Canada, with Morningstar Inc. in Toronto, said in an email that the CFRs’ allowance of proprietary shelves “undercuts the broader intent” of the reforms. With enhanced know-your-product requirements, a rep must show that they have compared a fund against a “reasonable” range of alternatives before recommending it. “If the rep’s product shelf is limited to proprietary products, is the comparison truly reasonable?” Tam said.

The comparison includes cost. Within a bank’s proprietary shelves, “you [as a retail planner] can put together a well-diversified portfolio, but are you putting together an economical diversified portfolio?” Naglie asked rhetorically.

The OSC’s business plan for 2026–28 references conflicts, “including those related to [a] firm’s product shelves.”

During interviews conducted throughout August and September, the leaders responsible for the retail-branch businesses across the Big Six said product shelves were regularly reviewed, and they had no plans for major changes to the shelves — which they generally said provided clients with a wide range of competitive products.

Annual shelf reviews consider whether “we have enough breadth of product,” and also consider how well the shelf stacks up from a “fees and cost standpoint,” Brent Currie, senior vice-president, Scotia Financial Planning & investment distribution, said. This year, the bank added more ETFs to its all-in-one portfolios made up of mutual funds and ETFs, Currie said.

Advisor training is also a priority among the banks. According to Franceen Bernstein, head of financial planning with TD Wealth, it’s important to “understand each and every client” and know what’s appropriate for them in terms of products and advice. “We invest significantly in training and development of our planners, so they have the product knowledge to be in front of clients confidently, understanding their needs and offering advice and products based on their individual circumstances,” she said.

Less pressure to sell

On average, planners and advisors rated their ability to make suitable product choices at 8.9 out of 10, up significantly from 8.4 the previous year (although RBC’s rating dropped by 0.3 in the same period). The average rating for this Report Card category dropped in 2021 and 2022, as the banks moved to proprietary products, but of course IE has since clarified the category to reflect advisors’ limited product scope.

So, again, the rating rebound this year is likely partly attributable to respondents rating the category with proprietary shelves taken as a given.

When asked about their ability to choose products, respondents overwhelmingly said they weren’t pressured to sell. A typical comment: “We don’t push any product,” said a retail branch advisor with Scotiabank in Ontario. “We do what’s right for the client.”

Respondents may have been particularly inclined this year to mention sales pressure given ongoing negative attention being paid to the banks’ sales practices. The latest evidence comes from the OSC and the Canadian Investment Regulatory Organization in a survey conducted last fall of nearly 2,900 mutual fund dealing representatives in Ontario. (National Bank of Canada was not included.)

In that research, 25% of the reps surveyed said clients have been recommended products or services that aren’t in their interests, at least “sometimes.” (For products, the research considered mutual funds only, although the reps could also offer products such as credit cards and mortgages.) The finding by regulators may be tied to pressure to meet sales targets and the use of scorecards to track those targets, the regulators said in its July 2025 report.

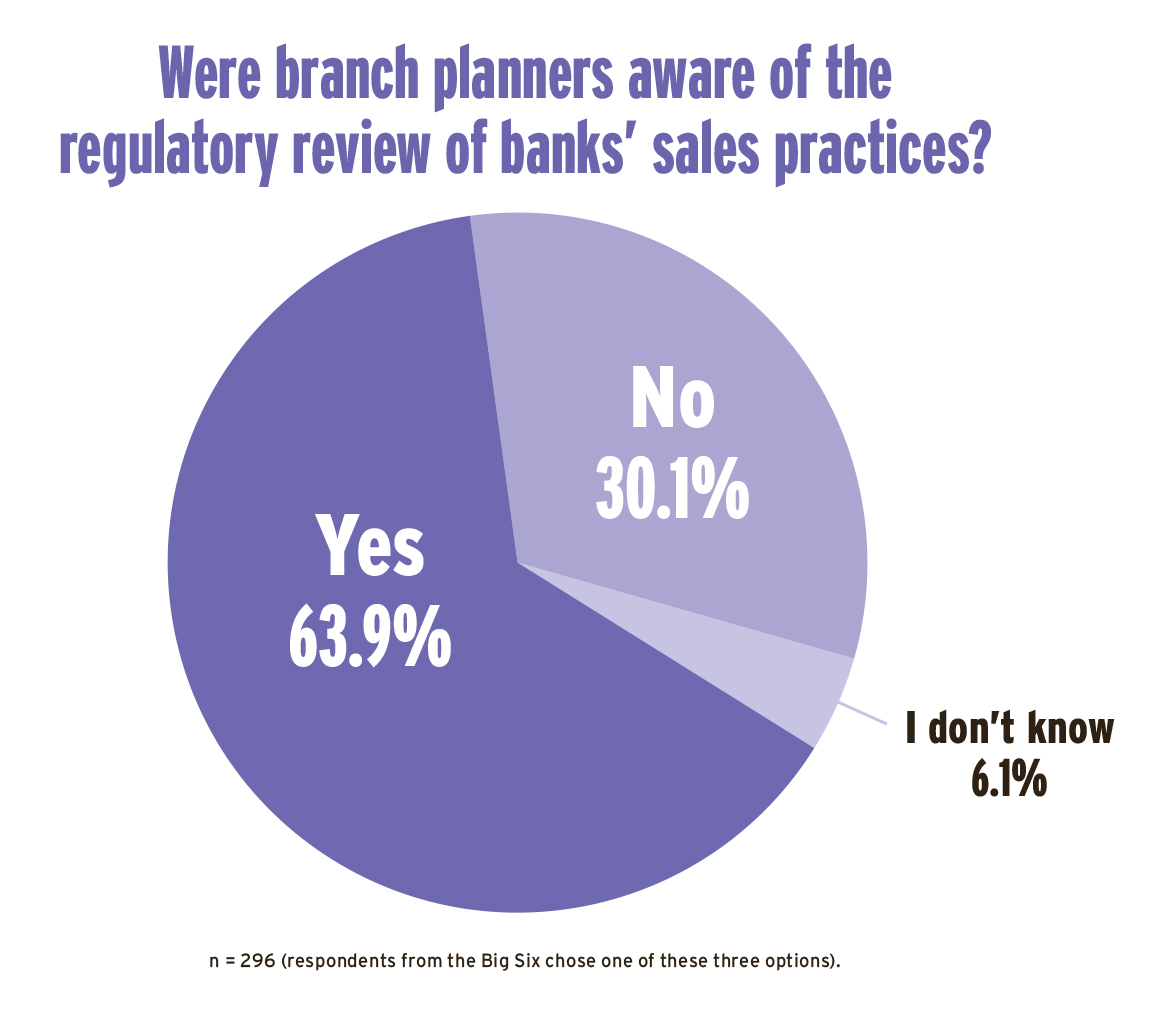

In IE’s 2025 Report Card on Banks, 63.9% of the planners and advisors surveyed, (who were more credentialed and experienced than the mutual fund reps in the regulators’ study), said they were aware that the regulators were conducting research on the bank-owned fund dealers’ sales practices.

Respondents were asked by IE about the regulators’ review of sales practices after they had rated the product categories and commented on sales pressure, so that their category rating responses wouldn’t be influenced by the reference.

Overall, the advisors and planners interviewed by IE said the research by the regulators didn’t affect them because they’re in financial planning roles that are client focused.

Those roles are “more focused on doing the right thing for clients,” said a planner in Atlantic Canada with RBC’s Financial Planning division.

The regulators’ research “doesn’t have an impact on someone like me, who is a [certified financial planner],” a planner with BMO Financial Planning in Alberta said.

Moreover, one planner said they’d seen someone lose their position because of product pushing. “We had a colleague who [offered] more expensive solutions to make more money,” said a planner with National Bank of Canada in Quebec. “[They] had to resign.”

National Bank didn’t confirm or deny this statement. Tony Scalia, vice-president, investments with National Bank, simply said, “Client interests are always at the forefront of what we do,” adding that “quality advice” is key for the bank.

A handful of IE’s 300 respondents perceived some pressure being placed on them, despite bank leaders citing codes of conduct and efforts to prioritize the client.

“Sometimes, there can be pressure to look at managed products rather than guaranteed products,” an advisor with CIBC’s Imperial Service business in B.C. said.

“Sometimes, we’re kind of directed to push managed solutions more than I think we need to,” a planner, also in B.C., with TD Wealth Financial Planning, said.

The IE Report Card for 2025 found that respondents’ assets under management was largely distributed among the banks’ proprietary managed portfolios (39.8%), followed by mutual funds (31.6%) and GICs (13.8%) — the three products to which respondents are largely limited for mass affluent clients. (Read: Top producers see a business turnaround.)

Across financial services, it’s typically a matter of how conflicted you are, not whether you’re conflicted, Thom said. Material conflicts should be avoided, mitigated or otherwise addressed, he added. “It takes effort, skill and education to recognize conflicts for what they are and to think about and design appropriate controls institutionally and individually to account for them in order to deliver the most unbiased advice that you can.”

What’s next for bank sales review?

Regarding mutual fund reps, the regulators said their next step will be to study each bank-owned fund dealer’s sales practices, including the use of scorecards and the dealers’ controls to address material conflicts arising from sales practices. Meanwhile, consumer advocates want action to address the regulators’ survey findings.

When IE asked about sales pressure and the regulators’ review, the bank leaders overseeing financial advisors and planners in the branches generally said that clients’ personal needs and financial planning are priorities. They also said compensation includes behaviour-related factors such as client retention.

RBC’s culture “doesn’t place pressure on selling,” Jodi Wright, senior director and head of financial planning and mass affluent client strategy, with RBC, said. “We are constantly evolving our sales practices to ensure client-centricity, and client discovery guides our advice and product recommendations.”

Rory Mitz, senior vice-president, CIBC Imperial Service, said he wouldn’t expect Report Card respondents to feel sales pressure, “given [CIBC’s] value proposition is anchored on financial planning.” Further, the bank has “the necessary training, controls [and] policies, including a code of conduct, to ensure we’re always providing our clients with the right advice and solutions to meet their needs,” Mitz said.

Across the Big Six, the leaders told IE that their banks would work with regulators on the next phase of the research on the bank-owned dealers’ sales practices.

A planner with BMO Financial Planning in the Prairies holds out hope for change: “I hope that the major banks and BMO will learn something from that [regulatory review].”