Thanks largely to strong equities markets, mutual funds are enjoying a resurgence. And for Canada’s mutual fund dealers, the growth has been even headier.

Canadian mutual fund assets under management (AUM) topped $1 trillion for the first time earlier this year. And according to Investment Executive’s (IE) 2014 Dealers’ Report Card, mutual fund dealers are enjoying the spoils of these record levels. AUM and rep productivity are up sharply while the account mix is shifting to higher-value clients.

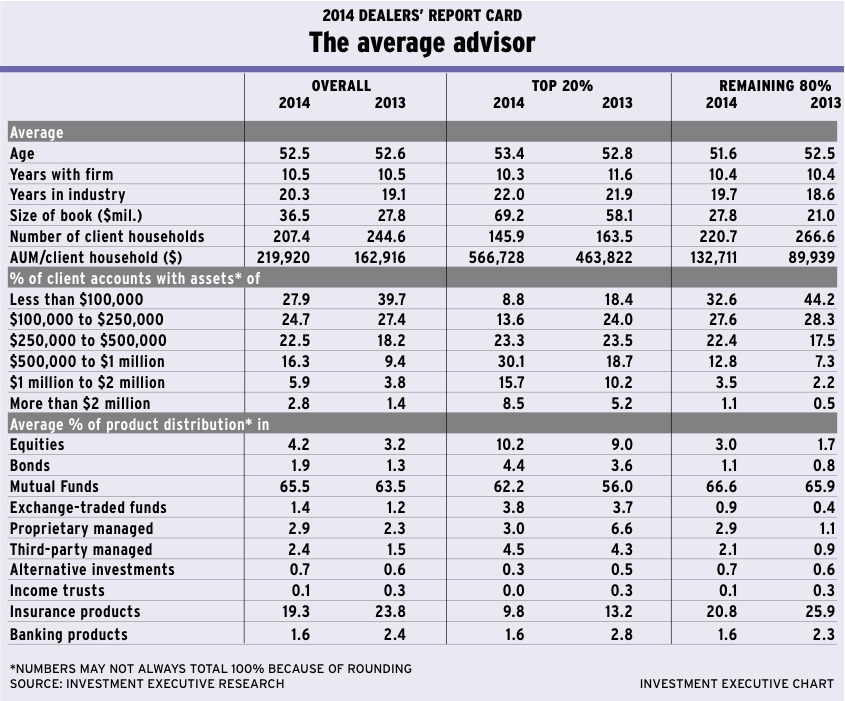

In fact, the average financial advisor in IE’s survey is enjoying notably stronger growth rates than the channel as a whole. Total mutual fund AUM is up by about 20% since the start of 2013, according to data from the Investment Funds Institute of Canada (IFIC). By comparison, the average advisor reports that his or her AUM is up by more than 30% in the past year – to an average of $36.5 million from $27.8 million in 2013.

The gains in advisor AUM are so robust that it appears reps are further rationalizing their books and focusing greater attention on their most valuable clients. Indeed, the average advisor is producing this stellar AUM growth while actually serving about 15% fewer client households this year – 207.4 households vs 244.6 last year.

That advisors appear to be doing more business with fewer clients probably reflects the fact that strong market gains are driving much of the mutual fund AUM growth. The IFIC data show that less than 30% of the gain in overall mutual fund AUM over the past year has been supplied by net sales activity, with the strong rise in AUM mostly attributable to robust investment returns.

So, it appears this rising tide in the equities markets is giving dealers and their reps the latitude to cull some of their smaller, less productive clients. In tougher markets, reps may feel compelled to cling to every client to retain AUM and to add new clients to generate growth. But when markets are powering AUM gains, there’s more room to jettison smaller accounts and put greater emphasis on the clients that provide the biggest return.

This combination of strong average AUM growth and fewer client households being served is generating even more robust productivity gains. The average rep now boasts AUM/client household of $219,920, up by about 35% from $162,916 last year.

For the top 20% of producers, average AUM/client household is far higher – at $566,728; however, their growth rate is notably slower than for the rest of the industry, suggesting that it’s truly the average advisor driving the overall productivity improvement. (IE divides the rep population into top producers, defined as the top 20% of reps as measured by AUM/client household, and the remaining 80% of advisors.)

Looking at these two advisor segments of the dealer channel, it’s clear that although the top 20% hold a huge advantage over the remaining 80% in both average AUM and productivity, that gap has narrowed over the past year. Average AUM for the top 20% is up to $69.2 million, more than double the $27.8 million average AUM for the remaining 80%. And average productivity for the top producers ($566,728) is more than four times that of the remaining 80% ($132,711).

What’s notable is that in 2013, average AUM for the top 20% was almost triple the average AUM for the remaining 80%. And average AUM/household for top producers outpaced the remaining 80% by more than five to one. So, it seems the gap between “have” and “have not” reps has closed considerably over the past year.

For example, average AUM for top producers is up by only about 19.1% from a year ago, whereas average AUM among the remaining 80% is up by 32.4%. And the number of client households served is down by 10.8% for the top reps vs a reduction of 17.2% for the remaining 80%. Although average productivity has grown by 22.2% for the top producers, it’s up by 47.6% for the remaining 80%.

To some extent, these figures highlight the divergent profiles of these two segments of the rep population. The businesses of the top producers, while still growing strongly, are more stable and mature than for the remaining 80% – a fact that’s also reflected in the demographics. On average, top producers are a couple of years older and have a couple more years of experience than the rest of the dealer channel.

Although the top 20% of advisors do have an edge in age and experience, the remaining 80% aren’t exactly novices, with an average of 19.7 years in the industry and an average age of 51.6 years.

Overall, the rep population is relatively old, at an average age of 52.5 years. This is essentially unchanged from last year, indicating that there has been some influx of younger reps and/or retirements among the oldest reps.

Average industry experience has ticked upward to 20.3 years, but average tenure with the current firm remains steady at 10.5 years. This suggests that there has been some movement by reps between firms in the past year – not surprising, as strong markets and robust AUM gains can facilitate a certain amount of movement between firms because reps can be more comfortable jumping ship when organic growth is relatively healthy.

There’s certainly evidence in the account distribution data of reps taking advantage of this healthy growth environment to transform their businesses, whether that involves shifting firms or just rationalizing their books. Case in point: there has been a notable decline in the allocation within the average advisor’s book to accounts worth less than $250,000. In 2013, 67.1% of client accounts fell into the sub-$250,000 category; this year, that’s down to 52.6%.

The biggest drop came in allocations to accounts worth less than $100,000, which remains the single largest account category – but just barely, as its share of accounts has dropped to 27.9% from 39.7%.

Big declines in the allocations to the smallest accounts are evident among all reps. For top producers, their exposure to sub-$100,000 accounts plunged to just 8.8% from 18.4. The rest of the dealer channel still has much higher allocations to this category, at 32.6%, but this also reflects a significant drop from 44.2%.

Among the top 20% of reps, there has been a similarly sharp decline in their share of accounts that fall into the $100,000-$250,000 range, to just 13.6% of the average book from 24%. The same cannot be said for the remaining 80%, though, as allocations to accounts in this range are down only slightly, to 27.6% from 28.3%.

For the dealer channel overall, allocations to every account category above the $250,000 threshold is up from last year. But for top producers, the increased allocations are taking place above the $500,000 mark. For these advisors, there’s virtually no change in allocations to accounts in the $250,000-$500,000 range. Instead, this advisor segment reports that accounts of between $500,000 and $1 million now represent the single largest allocation in their books, at 30.1%, up sharply from 18.7% last year. And accounts worth more than $1 million have jumped to 24.2% from 15.4%.

For the remaining 80% of advisors, allocations to every category above $250,000 are up from last year. The biggest percentage gains are in the $2 million-plus range, but these reps also are enjoying significant increases in accounts in the $500,000-$1 million range.

Again, these shifts probably can be attributed to equities market gains, which have boosted AUM and skewed the account distribution organically toward higher-value accounts. At the same time, the apparent trimming of client rosters suggests that these organic effects are being amplified by the reps’ efforts to boost their own productivity by intensifying their focus on wealthier clients.

© 2014 Investment Executive. All rights reserved.