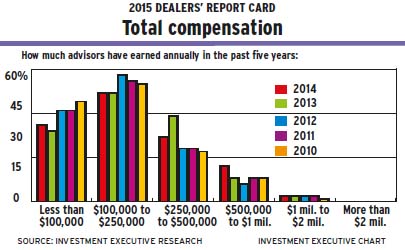

There are increasing levels of happiness among the financial advisors surveyed for this year’s Report Card on Banks and Credit Unions regarding their overall compensation. In general, advisors characterize their firm’s respective pay structure as not only being fair but allowing advisors to serve their clients effectively.

However, advisors feel that the growing demands of their jobs are not always reflected in the overall compensation.

Advisors surveyed for this year’s Report Card gave their firms an average performance rating of 7.8 in the “firm’s total compensation” category, up from 7.5 in 2013.

“I feel valued,” says an advisor in Ontario with Toronto-based Royal Bank of Canada (RBC), expressing his satisfaction with both the bank’s compensation and its rewards and recognition programs. “If you do well, they make sure you know that they know.”

In fact, many advisors pointed to their firms’ rewards and recognition programs, in particular, for causing them to feel appreciated and giving them the sense of belonging to a team.

For example, advisors with Toronto-based TD Canada Trust gave their firm a category-high performance rating of 8.4 in the “firm’s reward/recognition program” but a 7.7 rating in total compensation.

TD offers a merit award program for its top 50 financial planners; a Champion’s Club for its top branch managers and district vice presidents; and formal recognition for its top advisors and financial services representatives.

“[The programs] are very creative and constant,” says a TD advisor in Ontario.

Adds a colleague in Atlantic Canada: “They’ll send people on trips all over the place. There’s always something going on.”

Advisors with Toronto-based Canadian Imperial Bank of Commerce (CIBC) rated their bank’s rewards and recognition programs performance at 8.2, with many describing it as “comprehensive.”

CIBC offers a variety of programs, including Achiever Awards, which are given quarterly and annually across the bank for exceptional performance, and Crystal Awards at the branch level for top performers.

“[The bank] really recognizes effort and when employees go above and beyond,” says a CIBC advisor in Atlantic Canada.

In terms of total compensation, RBC received a performance rating of 8.5. That’s not only up from 8.0 in 2013, it’s the highest rating in the survey. RBC advisors described their pay regime as “competitive and stable.”

RBC’s leadership says that while the bank hasn’t made any changes to its compensation structure, they continually review it to make sure that it remains “more than competitive” among its peers, says Michael Walker, the firm’s vice president and head of branch investments.

In addition, RBC is considering the introduction of new compensation elements, which could include an equity component that would be longer-term in focus, in order to recognize and reward top performers’ service provided to clients. Says Walker: “We’re still going through the due diligence, but it’s something we’re looking at.”

Advisors with St. Catharines, Ont.-based Meridian Credit Union also rated their firm higher in compensation this year, as the financial co-operative received a rating of 8.0 , up from 7.3 last year.

“Meridian has a solid compensation structure,” says an advisor with the credit union in Ontario.

At Meridian, advisors are paid a base salary and variable compensation based on the credit union’s performance and individual targets. For senior wealth advisors, the variable portion is paid quarterly and calculated based on performance in a variety of metrics. The relative weightings of these metrics are reviewed annually.

“We make sure we have the right balance,” says Bill Whyte, senior vice president and chief of member services with Meridian in Toronto.

Despite the strong ratings on compensation for some banks and credit unions, there remains – as in previous surveys – a sizable and stubborn satisfaction gap between the average performance rating (7.8) that advisors gave their compensation relative to the average importance rating (9.0) that advisors gave to the category.

“I’m not making remotely enough for what I’m doing,” says an advisor in Atlantic Canada with Toronto-based Bank of Montreal – echoing, to be sure, a recurring complaint among some advisors at all firms. BMO advisors rated their firm at 7.6 in compensation performance, up from 7.3 last year.

Some advisors also expressed disappointment with the establishment of what they consider to be unattainable targets for bonuses and rewards or the too frequent adjustments to their firm’s compensation structure – particularly if any of those changes result in less take-home pay.

Case in point: advisors with Toronto-based Bank of Nova Scotia, who rated their firm’s performance at 7.1 in compensation, down from 7.4 in 2013 and lowest in the survey, described their compensation targets as being too high to reach and the compensation regime overall as lacklustre.

“You hear rumours about what other people in your position at other banks make, and it’s a lot more than I’m making here,” says a Scotiabank advisor in Alberta. “After a while, it just begins to wear down your positivity.”

Scotiabank, for its part, says that it provides a competitive total compensation package based on salary, incentive pay, pension plan and benefits, and that it reviews individual employees’ salaries on an annual basis, offering increases in line with performance and the competitive marketplace.

© 2014 Investment Executive. All rights reserved.