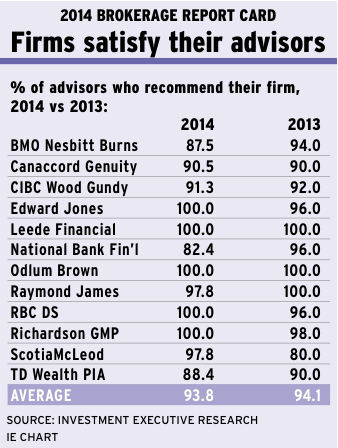

The financial advisors surveyed for Investment Executive‘s 2014 Brokerage Report Card are finding that there’s more than one formula that leads to success. Despite the fact the firms have different business models and different ways of serving their clients, all advisors are seeing unprecedented levels of prosperity. Average books of business have surpassed the $100-million mark for the first time ever in this Report Card.

Yet, for some advisors, finding this formula for success continues to be challenging as some firms raise their production targets and tighten their pay grids – all in the face of substantial regulatory changes that are coming down the pipeline in lockstep with the second phase of the client-relationship model.

This is evident when looking at advisors’ paycheques: record-setting books of business have failed to translate into more take-home pay. For example, the percentage of advisors earning less than $500,000 annually has increased year-over-year while those earning more than that threshold has declined. (See story on page C7.)

“It’s getting more difficult to achieve targets,” says an advisor in Alberta with Toronto-based BMO Nesbitt Burns Inc. “In more than 15 years with this firm, I’ve seen [the firm] push targets back and back.”

But some parts of the formula for success don’t change year-over-year. And, for advisors, these parts are what they hold closest to their hearts year after year – regardless of economic or market conditions: “freedom to make objective product choices,” “firm’s ethics” and “firm’s stability.”

Not only do advisors rate these categories as the most important to their business, the majority of firms meet their advisors’ expectations. However, upon closer analysis, it’s clear that the regional and national independent firms are outperforming their bank-owned counterparts in these three categories. In particular, advisors with the independent brokerages praised their firms for a “bias-free” corporate culture that’s not linked to specific product offerings.

“There’s no pressure to promote in-house products,” says an advisor in British Columbia with Vancouver-based Leede Financial Markets Inc. “And when you work for a bank, there’s a lot of pressure that way.”

Adds an advisor in Alberta with Toronto-based Richardson GMP Ltd.: “We have complete freedom when it comes to product choice. We have no conflicts of interest because we generate almost no in-house products.”

Richardson GMP continues to be rated strongly, not only in these three categories but also in the Report Card overall, with the firm’s advisors lauding the recent acquisition of former Report Card participant Toronto-based Macquarie Private Wealth Inc.

This acquisition was completed this past autumn. Richardson GMP advisors are equity owners in their firm, and many saw the deal as a boost to the firm’s stability and a way to access a deeper pool of profits.

“This deal positions us clearly as the largest independent in Canada,” says a Richardson GMP advisor on the Prairies, “and gives me confidence in the private shares I own.”

Adds a colleague in Ontario: “In the beginning, I didn’t think the Macquarie deal was important to me; but now, I’m so proud of it. It has increased our visibility, our critical mass and the value of my stock.”

Meanwhile, advisors who ply their trade with Toronto-based ScotiaMcLeod Inc. and Vancouver-based Canaccord Genuity Wealth Management also saw big changes this year. The biggest change at both of these firms was the introduction of new leadership at the beginning of the year. Alex Besharat, managing director and head of ScotiaMcLeod, and Stuart Raftus, president of Canaccord, both stepped into their new positions this past January.

ScotiaMcLeod advisors saw a seamless transition, as many were already familiar with Besharat, who has spent almost 30 years with the firm. In Besharat’s former role as regional manager of Western Canada, he was an integral part of the firm’s executive committee and was in daily contact with the former head and managing director, Hamish Angus. This history allows Besharat to continue running the firm with minimal disruption – specifically, to the recent $50-million technology initiative.

“It’s clear we had a deficiency in our technology platform, and it was clear that this deficiency couldn’t be fixed with a small, Band-Aid solution,” says Besharat. “That’s why we went with the scale of investment we made. And, yes, that’s something we had to solve. I think we’re well on our way now.”

Although ScotiaMcLeod still has a long way to go in implementing its new platform, advisors are already seeing results.

“They’ve made enormous progress, enormous strides,” says a ScotiaMcLeod advisor in Ontario. “The incredible amount of people walking me through these new systems is great. I’ve never been more coddled in my life.”

In contrast, Canaccord advisors are a bit more wary of what lies ahead – although some are hoping the change in leadership could be the light at the end of the tunnel. In fact, many advisors cited the departure of John Rothwell, who previously held Raftus’s position, as the reason the firm’s stability rating increased to 7.7 from 7.1 last year.

“There’s been a hell of a lot of changes, but it’s not unstable, it’s constructive,” says a Canaccord advisor in B.C. “It’s a little unsettling, but John had five years to accomplish his goals and he didn’t achieve them.”

For some advisors, a change in leadership leads to positive results down the line. That’s what happened with Mississauga,Ont.-based Edward Jones. David Lane, the firm’s principal and head of Canadian operations, has been in his current role since replacing his predecessor, Gary Reamey, in January 2012.

The firm has seen improvements in advisor satisfaction in the past two years – and that trend continued this year. Ratings were up in 25 of 32 categories in the Report Card, with eight categories garnering significant improvements of half a point or more.

One of the largest increases was in the “firm’s succession program for advisors” category, which rose to 8.6 from 7.6 last year. This improvement is thanks to a new retirement/transition plan that was implemented last year, with the goal, Lane says, to make the transition between a new advisor coming on board and the retiring advisor a smoother process for clients. (For more on succession planning, see story on page C13.)

“This has changed completely,” says an Edward Jones advisor in Alberta. “[My] bottom line has more recognition, dollarwise, for assets and for generated revenue.”

How we did it

When talking with advisors, we want to ensure that we are keeping up with the times. And that means tweaking our survey questions to reflect current issues.

This year, Investment Executive (IE) research journalists Jacob Boon, Geoff Davies and Leah Golob spoke with 494 financial advisors at 12 brokerage firms. And while certain categories remain a constant in the Report Card, there were some marked changes that took place within the past year.

Most notably, the number of firms in this year’s survey has dropped to 12, with Toronto-based Richardson GMP Ltd. acquiring former Report Card participant Macquarie Private Wealth Inc., also of Toronto, this past autumn.

It’s important to note that although the acquisition was completed by the time our research began, IE did not survey Macquarie advisors because of the limited experience they would have had with their new firm and the services it provides. Those advisors will be surveyed in the 2015 Report Card.

In addition to the change in the number of firms surveyed, there are two new questions in the survey. Advisors were asked to rate their firm’s “support for helping to deal with changes in the regulatory environment” to reflect the changing landscape and the implementation of the second phase of the client-relationship model.

Also, the “firm’s total compensation” category was split into two questions to reflect the difference that advisors see between their monetary compensation and the rewards and recognition they receive for a job well done. Thus, advisors were asked to rate the “firm’s reward/recognition program” as a separate category for the first time.

Ratings for all the categories are compiled by asking advisors to provide two ratings for each category in the survey questionnaire: one for their firm’s performance in that category and another to specify the importance of that category to their business.

Both sets of ratings are based on a scale of zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “critically important.”

© 2014 Investment Executive. All rights reserved.